FCA Flags Multiple Unauthorised Platforms Offering Financial Services Without Approval

Unlicensed platforms operating across multiple domains and using identical website interfaces to offer financial services.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:UK’s FCA adds Ledger Light FX, fx-alpha.com, RIFA FX, InvestCAN, and NitroPrime to its unauthorised list. Learn the risks of unregulated brokers and how to stay alert.

The UK Financial Conduct Authority (FCA) has published new warnings against five firms suspected of offering financial services without proper authorisation. These entities are not registered with the FCA, meaning they lack the permissions required to provide investment or trading services in the United Kingdom. Engaging with such firms places investors at risk of losing their funds with little or no recourse.

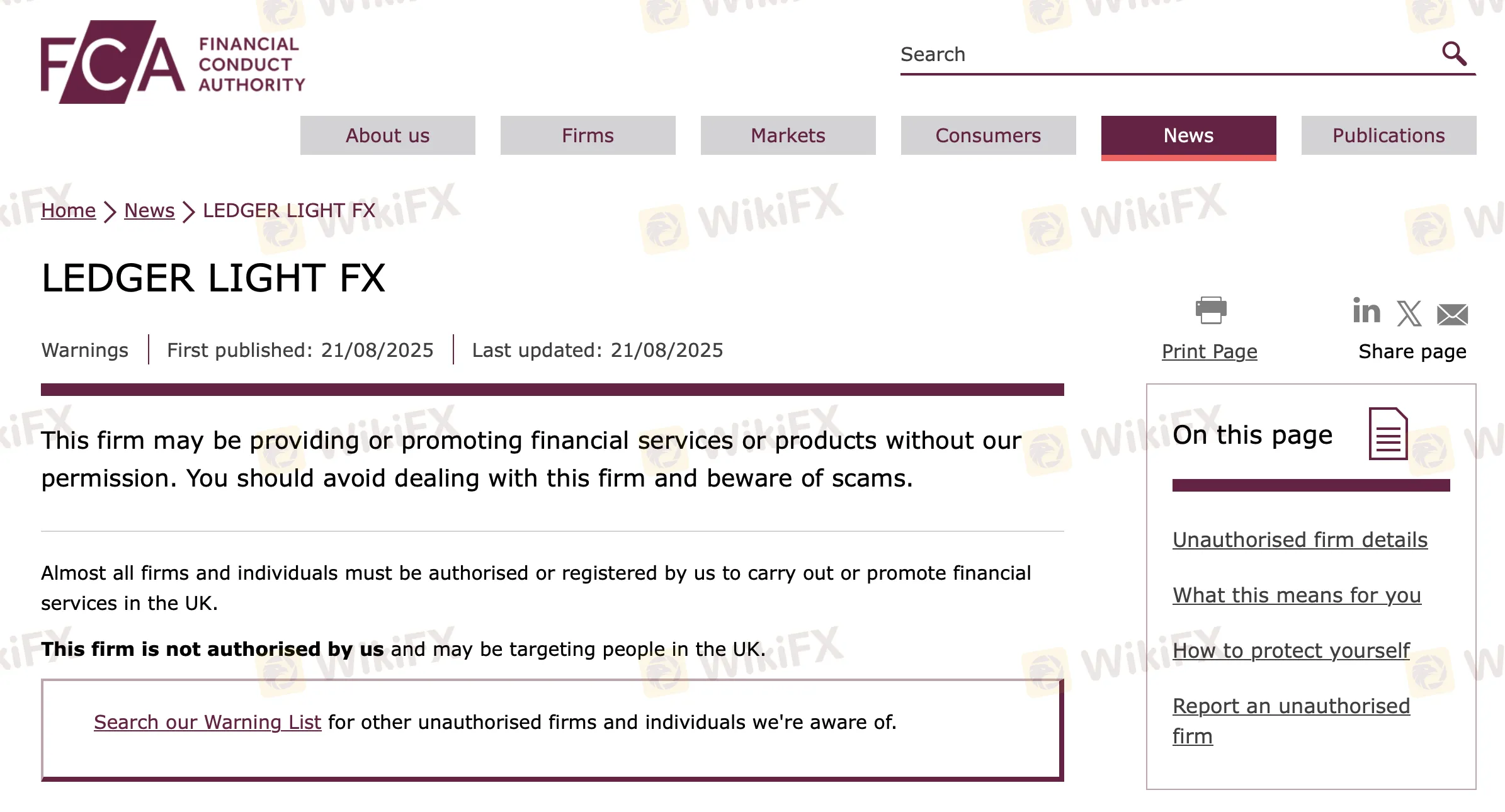

Ledger Light FX has been flagged as operating without FCA approval. Investors are advised to avoid all contact with this entity.

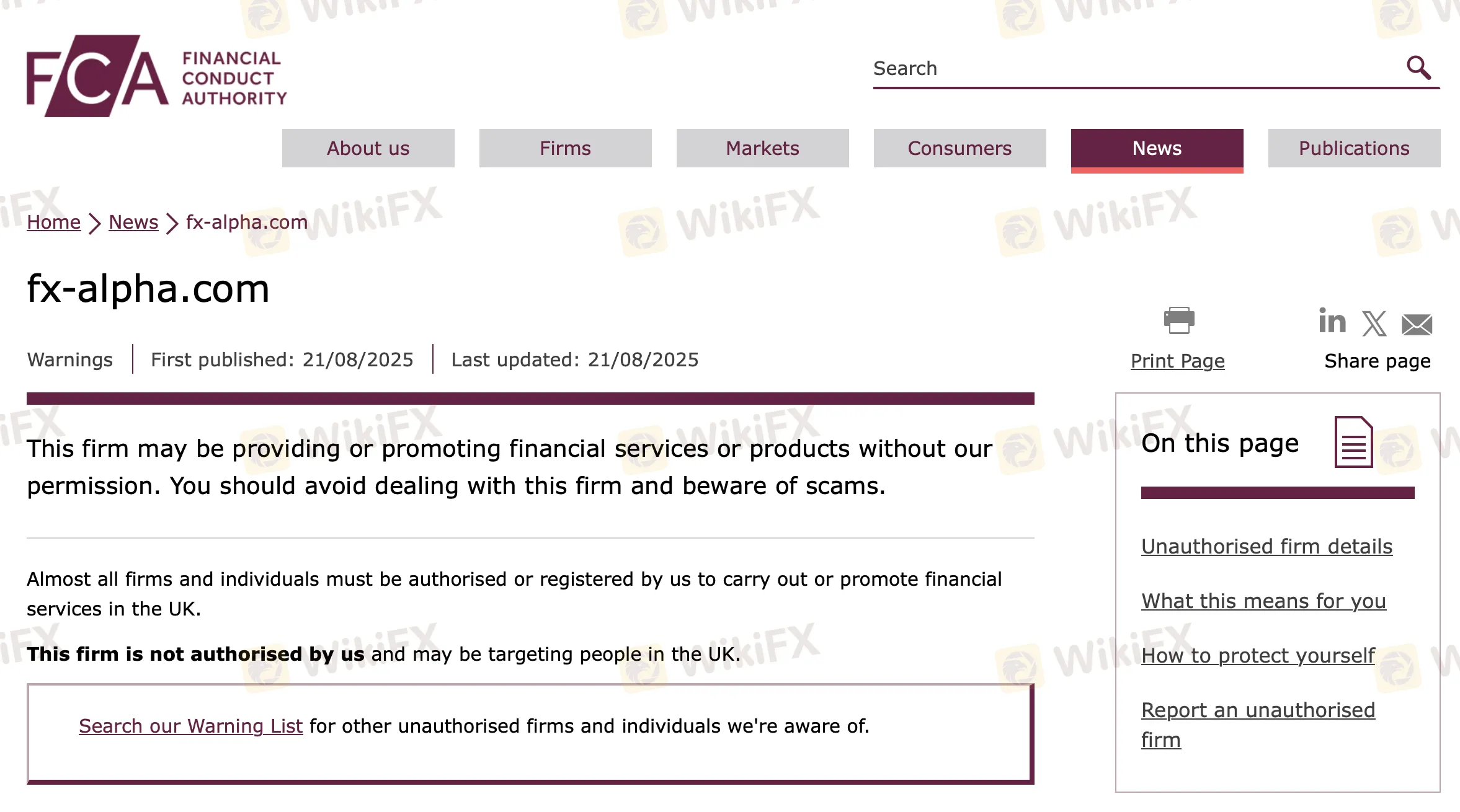

Despite presenting itself as a UK-based trading platform, fx-alpha.com is not authorised to provide investment services.

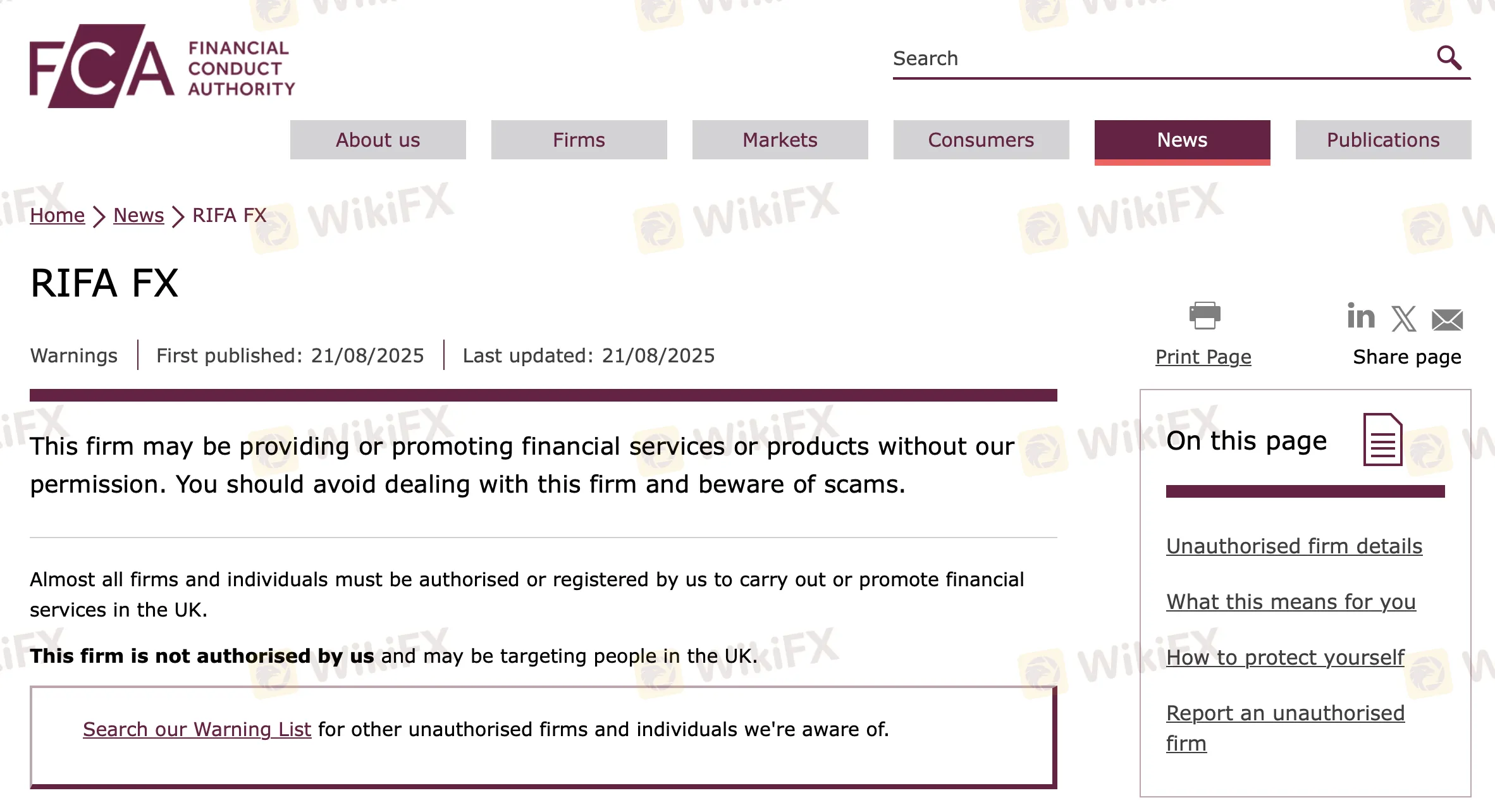

RIFA FX has built a strong online presence through social media platforms, but the FCA has confirmed it holds no authorisation to operate in the UK.

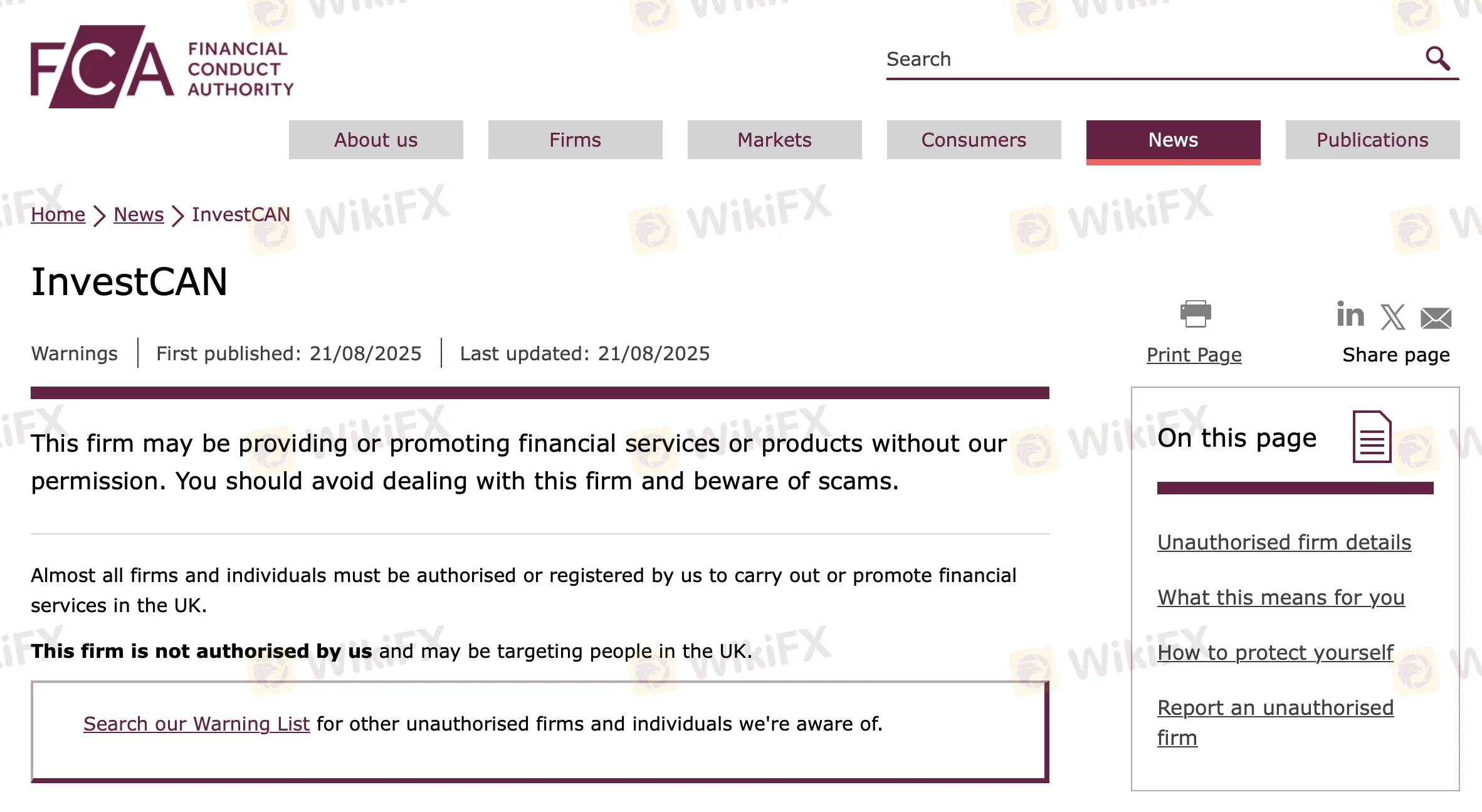

The platform InvestCAN is also named in the latest warning list. No evidence of authorisation was found.

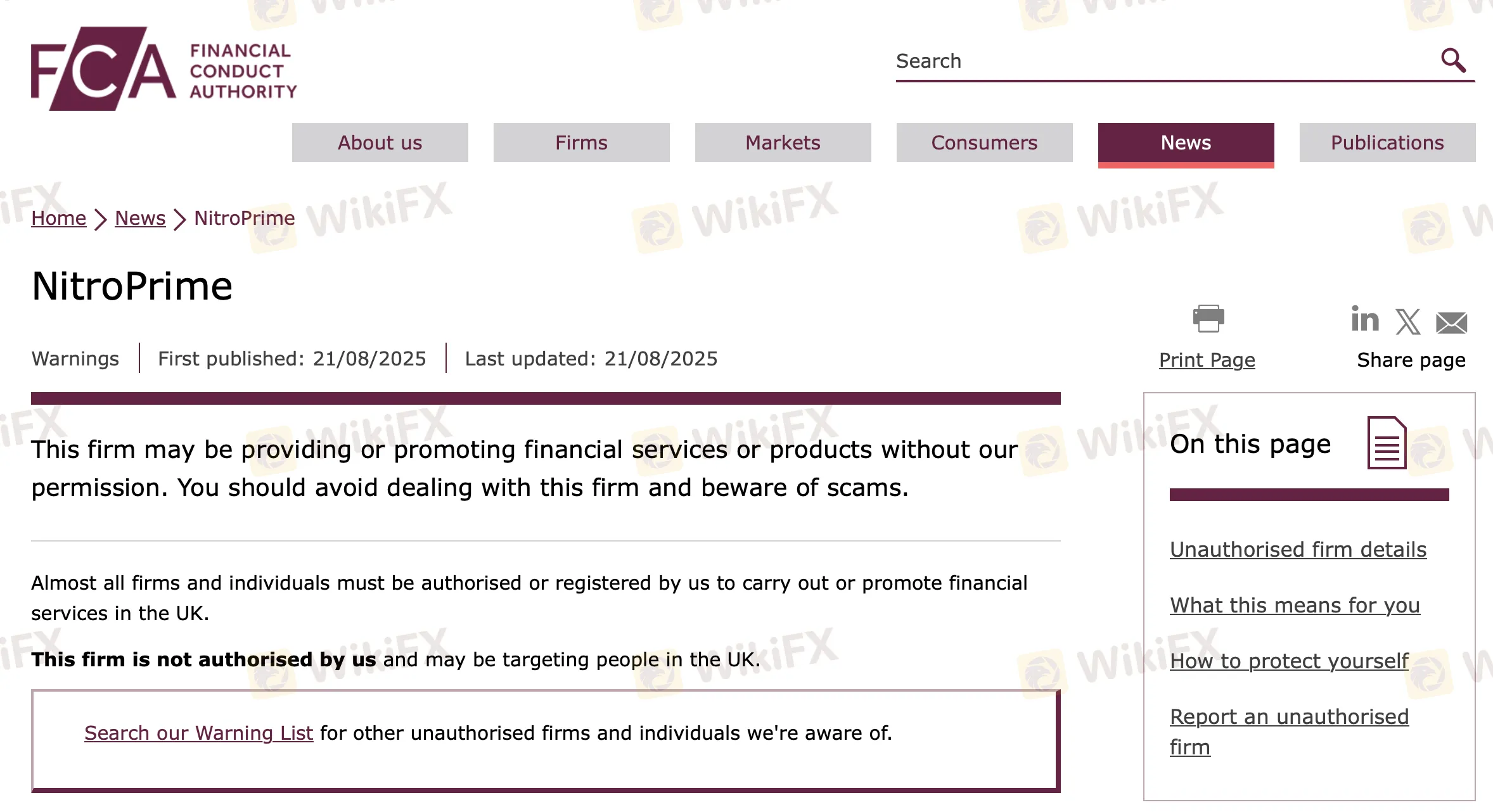

NitroPrime claims to provide capital trading services but is not recognised by the FCA.

The FCA emphasises that dealing with firms not authorised in the UK leaves investors without access to regulatory protections, including the Financial Ombudsman Service or the Financial Services Compensation Scheme (FSCS). If problems arise, recovering funds may be extremely difficult.

Scammers often rely on urgency and professional branding to win trust. The safest step for traders is to confirm licensing before depositing funds and to review independent exposure reports available on WikiFX.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Unlicensed platforms operating across multiple domains and using identical website interfaces to offer financial services.

FCA warnings reveal four unauthorised investment platforms using the same website design, differing only in their logos.

The UK’s Financial Conduct Authority is scrapping its old complaints reporting system. From 2027, brokers face bi-annual filings, the removal of the "Other" category, and strict new mandates on tracking vulnerable traders.

The Financial Conduct Authority (FCA) in the UK has published the FCA Warning List Firms to Avoid:- November 2025, alerting forex traders and investors about unauthorized brokers. These firms are operating without the necessary FCA approval. To safeguard your funds and avoid scams, be sure to check the full warning list below.