Abstract:Malaysian traders using OctaFX Malaysia should take note of a significant update affecting their accounts. As of 18 August 2025, the broker has disabled deposits via Ethereum (ETH) and Bitcoin (BTC) for clients in Malaysia.

Malaysian traders using OctaFX Malaysia should take note of a significant update affecting their accounts. As of 18 August 2025, the broker has disabled deposits via Ethereum (ETH) and Bitcoin (BTC) for clients in Malaysia. This restriction applies only to deposits, while withdrawals in these cryptocurrencies will continue as usual.

At first glance, OctaFX presents itself as a long-established, professional broker with a strong international presence. Its sleek website, diverse range of trading instruments, and claims of regulatory oversight often reassure traders. However, a closer OctaFX review conducted by WikiFX reveals a different story.

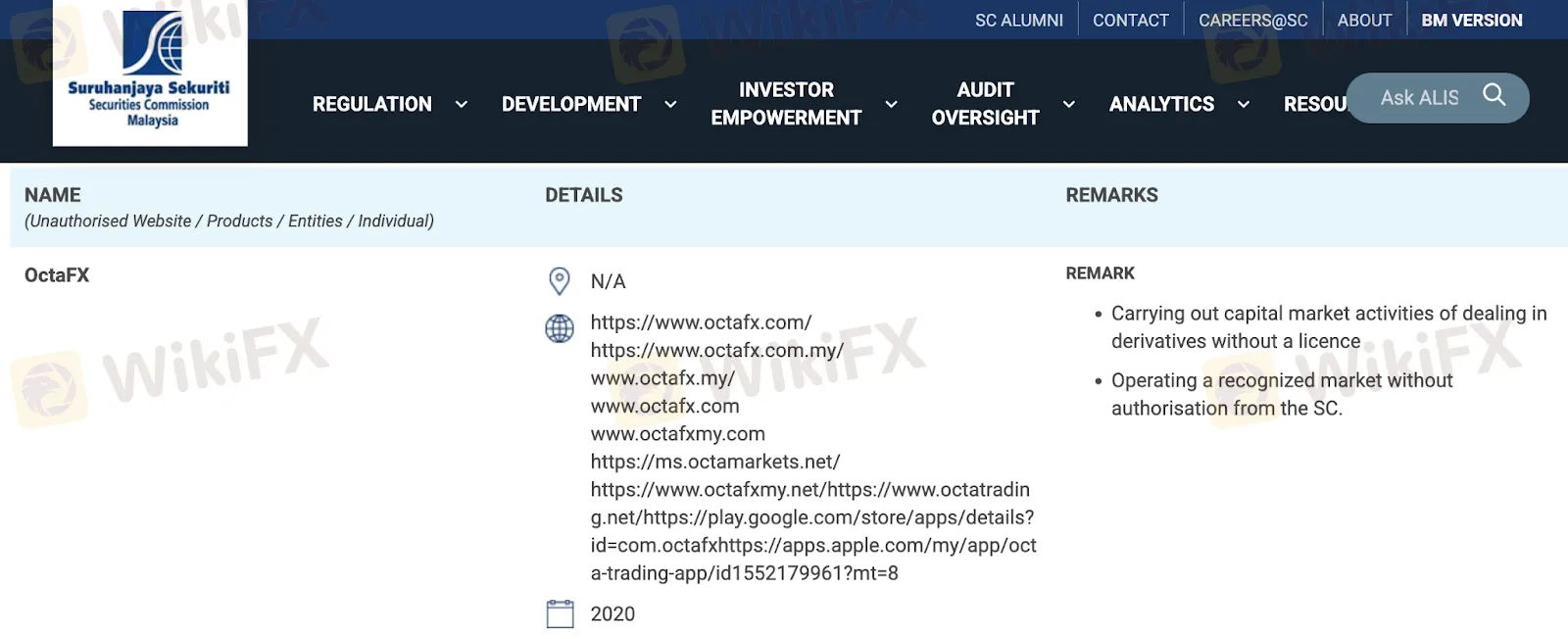

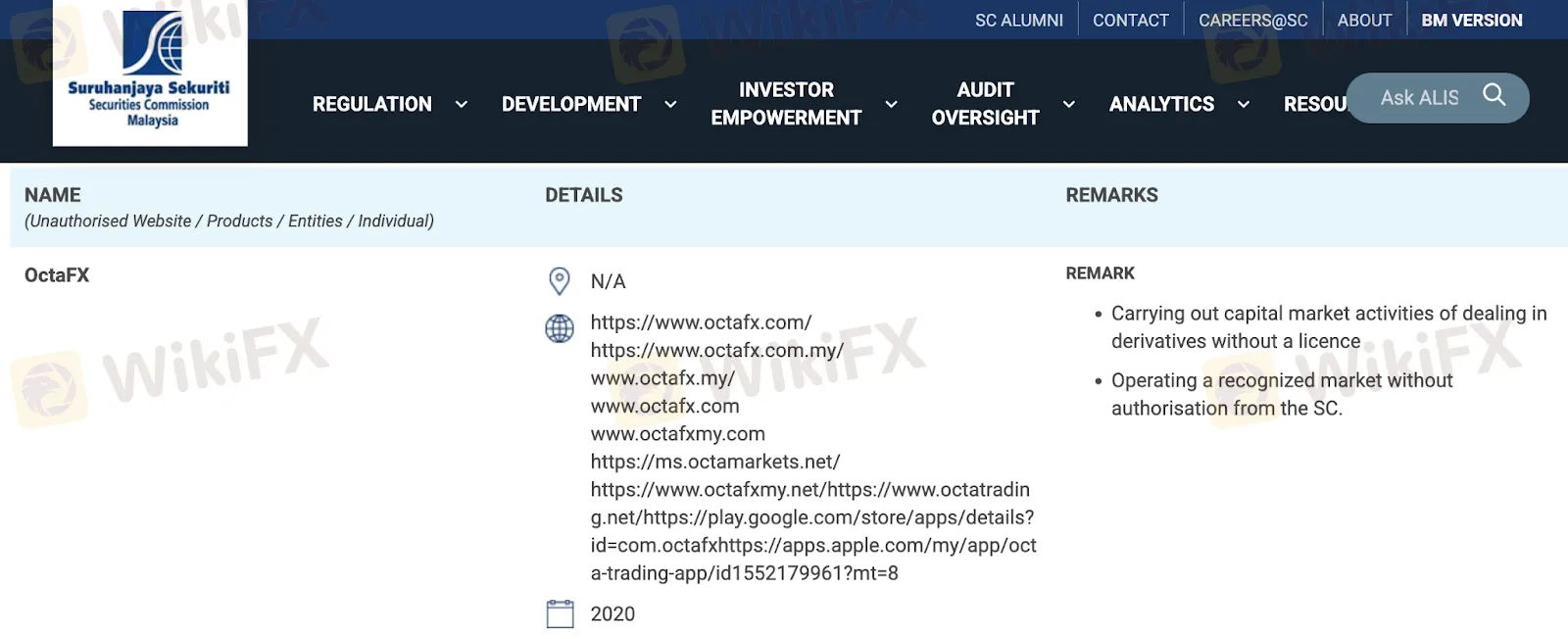

The Securities Commission of Malaysia (SC) has officially placed OctaFX on its Investor Alert List. The regulators notice states that OctaFX has been conducting derivative trading activities without a valid licence and operating a recognised market without authorisation. This means that, despite its global reputation, OctaFX is currently operating in Malaysia without proper approval from the SC.

Globally, OctaFX does hold a licence with the Cyprus Securities and Exchange Commission (CySEC) under licence number 372/18, registered as a market maker. While this offers a degree of legitimacy in Europe, it does not cover operations in Malaysia. This is where many investors misunderstand the concept of regulation. Being licensed in one jurisdiction does not automatically mean a broker is authorised everywhere.

For Malaysian traders, this distinction is crucial. A brokers regulation is only effective in the regions where it is recognised. In the case of OctaFX Malaysia, clients lack the local protections that come with dealing through an SC-approved broker. This exposes traders to risks such as limited recourse in cases of disputes, delayed fund recovery, or potential malpractice.

In every circumstance, investors should not only verify whether a broker is regulated, but also ensure that it is authorised specifically within Malaysias legal framework.