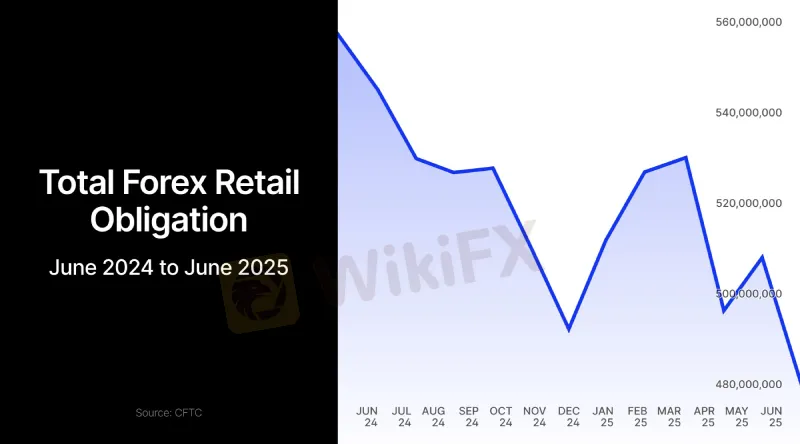

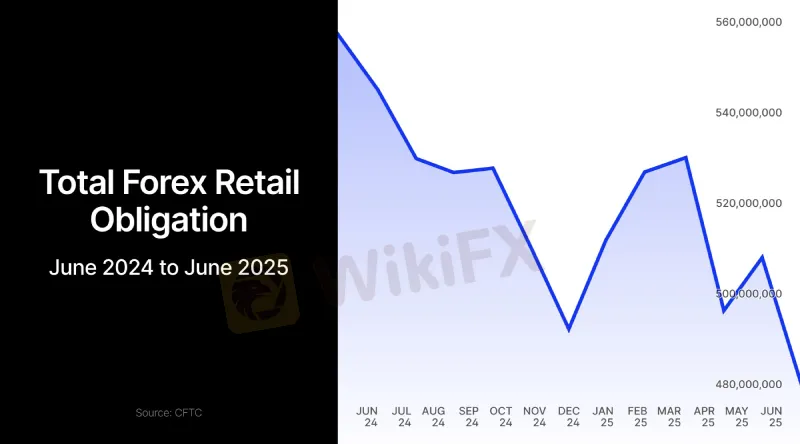

Abstract:US forex deposits drops 5.8% to $479.5M in June as the dollar hit multi-year lows, leaving major brokers facing sharp declines and shifting market flows.

Key Takeaways:

- US forex deposits fell 5.8% month-over-month to $479.5 million in June 2025, the lowest since coverage began in September 2023, as the dollar index tested multi-year lows.

- The CFTCs monthly framework for FCMs and RFEDs underpins deposit reporting and capital oversight across US retail forex platforms.

- Dollar weakness reached three-year lows in late June, intensifying outflows and challenging retail participation dynamics.

Industry Snapshot: June 2025

US forex deposits contracted to $479.5 million in June, marking a 5.8% monthly decline as sustained dollar index weakness weighed on risk appetite and prompted withdrawals across US retail forex platforms. GAIN Capital remained the market leader despite a 5.6% monthly drop to nearly $204 million, reflecting the largest recent monthly retreat for the platform amid softer client engagement. Charles Schwab bucked the trend with a 0.96% rise to $62.1 million, suggesting differentiated strategies among larger retail cohorts during the prolonged USD slump. Interactive Brokers slipped 1.7% to $34.7 million, while tastyfx fell 7.0% to $38.7 million, underscoring how client bases reacted unevenly to extended currency moves.

Macro Backdrop: Dollar Index Weakness Deepens

The June downswing coincided with the US Dollar Index (DXY) probing its lowest levels in more than three years, capping a months-long slide that reshaped positioning and sentiment across FX markets. Throughout late June, multiple market trackers noted the DXY touching multi-year lows as investors priced in rate cut prospects and navigated trade policy uncertainty, reinforcing headwinds for USD exposure. Investment strategy updates during mid-June highlighted the magnitude of the decline and recommended hedging or reducing USD allocations amid a deteriorating macro impulse for the greenback.

Platform Performance and Market Structure

- Broker market share and flows: GAIN Capital‘s deposits fell 5.6% month-over-month to roughly $204 million, maintaining leadership despite sharper attrition, while Schwab’s modest increase to $62.1 million contrasted with declines at Interactive Brokers and tastyfx.

- Smaller platforms: Trading.com Limited declines to 4.1% ($2.3 million), illustrating relative resilience among boutique providers navigating directional volatility rather than short-lived spikes.

- Year-over-year lens: The industrys $479.5 million total represented a 16.3% YoY decline, reflecting broader pressures on US retail forex platforms during sustained dollar weakness and evolving trading patterns.

Regulation and Reporting: CFTC Oversight

Monthly deposit figures derive from mandatory filings by Futures Commission Merchants (FCMs) and Retail Foreign Exchange Dealers (RFEDs) to the Commodity Futures Trading Commission, a process designed to safeguard customer funds and surface early signs of systemic stress. The CFTCs Financial Data for FCMs portal indicates updates are typically posted within roughly 12 business days after firms file reports, reinforcing the cadence and transparency of the reporting regime. Technical guidance clarifies that reported retail forex obligations aggregate money, securities, and property in retail forex accounts, adjusted for realized and unrealized P&L, while firms remain subject to capital and segregation requirements under the rule set.

Whats Driving the Decline?

- Impact of dollar index weakness on forex deposits: Prolonged USD depreciation changed trading behavior, with a sustained directional trend proving less supportive for retail engagement than volatility bursts that often boost activity, contributing to lower deposit levels in June.

- Macro narrative: Newsflow through late June emphasized the DXYs multi-year lows as rate cut bets and policy uncertainty weighed on the currency, adding pressure on risk allocation to USD-linked strategies.

Outlook

If the dollars weakness persists, US retail forex platforms may continue to face uneven deposit flows, with larger institutions and niche brokers potentially diverging based on client profile and hedging strategies. Continued transparency via CFTC monthly forex reports should help market participants monitor broker market share shifts, capital strength, and evolving risk dynamics across US retail forex platforms.

Stay tuned for the latest news on the financial market. Scan the QR code below to download and install the WikiFX app on your smartphone.