Abstract:A broker may appear legitimate at first glance, yet still operate beyond the limits of its regulatory permissions. Every year, traders lose money not because of bad strategies, but because they trusted a broker without fully understanding its regulatory standing. Today, WikiFX turns its spotlight on CBCX, a broker licensed in two different jurisdictions. Keep reading to learn more about this broker

In the fast-moving world of online trading, danger often hides in plain sight, including behind official-looking licences, persuasive marketing, and polished websites. A broker may appear legitimate at first glance, yet still operate beyond the limits of its regulatory permissions. Every year, traders lose money not because of bad strategies, but because they trusted a broker without fully understanding its regulatory standing.

Today, WikiFX turns its spotlight on CBCX, a broker licensed in two different jurisdictions. On the surface, it appears to be a regulated and stable trading platform. But beneath that polished image, there are critical details every trader should examine before investing.

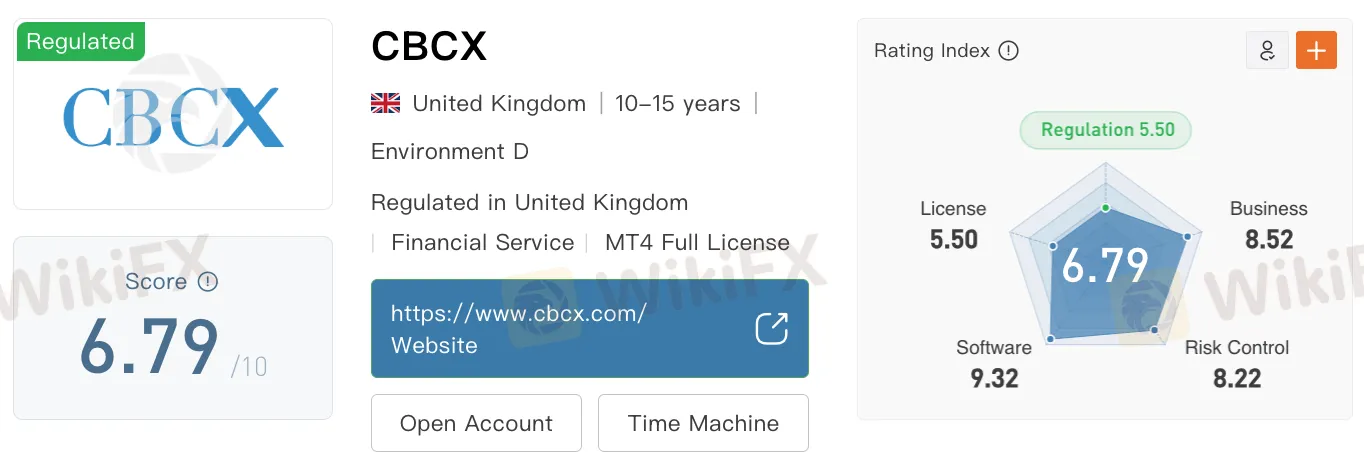

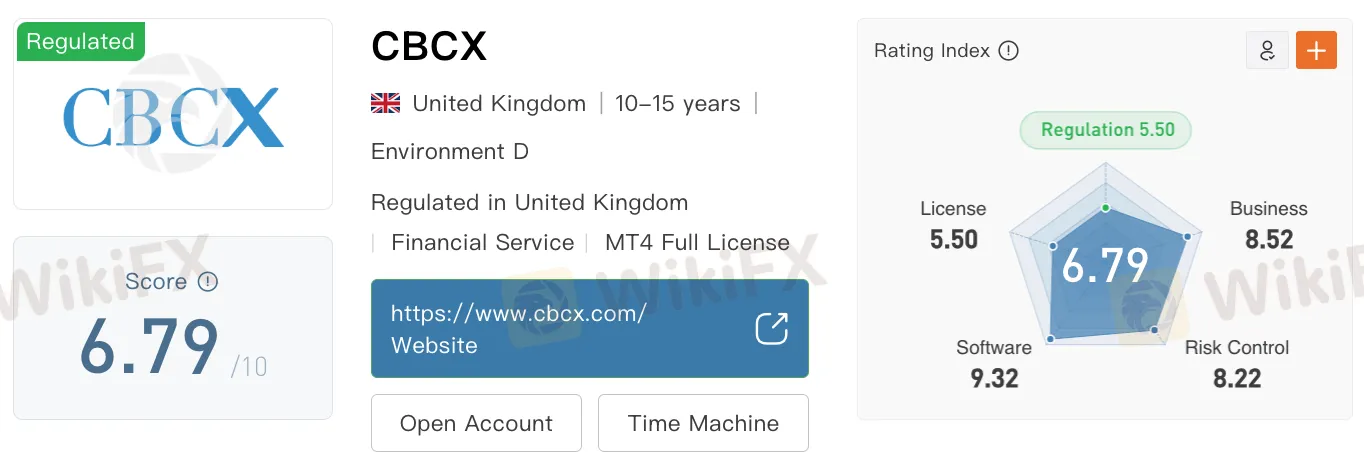

According to WikiFX, CBCX holds a WikiScore of 6.79 out of 10, which is a rating that suggests a generally stable regulatory framework and active operations. However, it also signals areas worth closer scrutiny, particularly since the broker operates across multiple jurisdictions with varying levels of regulatory coverage.

One of CBCXs strongest credentials comes from the Financial Conduct Authority (FCA) in the United Kingdom, under licence number 572911. The FCA is widely regarded as one of the toughest and most respected regulators in the world. Any firm under its supervision must comply with strict rules on transparency, client fund segregation, and fair market practices. An FCA licence is often a strong mark of credibility, but only when the broker operates fully within the rules.

CBCX also holds a registration with the Financial Sector Conduct Authority (FSCA) in South Africa, under licence number 49700. The FSCA oversees market conduct across financial institutions and ensures customers are treated fairly. While that sounds reassuring, here‘s where the red flag appears: CBCX’s FSCA registration is categorised as a non-forex financial services licence. This means that although the broker is officially listed with the FSCA, it may be offering services outside the permissions granted by that licence.

For traders, this is a crucial point. A broker providing products not fully covered by its regulatory permissions is operating in risky territory, and if something goes wrong, those activities may fall outside the regulators protection. Many traders mistake “having a licence” for a blanket guarantee of safety, but the scope of that licence matters just as much as its existence.

This is why professional traders never skip due diligence, and why they use WikiFX before committing a single dollar. WikiFX‘s database lets you instantly verify a broker’s licensing status, check the scope of its permissions, identify regulatory warnings, and read real trader reviews. All of this is free on the WikiFX website and mobile app. Fully utilize WikiFXs free tools to spot risks before they become costly mistakes.

In online trading, it‘s not enough to know whether a broker is licensed. You must know how it’s licensed, where it‘s licensed, and what that licence actually covers. Whether it’s CBCX or any other platform, taking five minutes to check them on WikiFX could be the difference between safe investing and financial regret.