Abstract:Looking for a 2025 TradersWay broker review? This article reveals its unregulated status, official warnings from Spain and Malaysia, and the real risks facing traders today.

TradersWay presents itself as a flexible forex and CFD broker offering high leverage and easy access. But behind the glossy website lies a darker reality: the broker is unlicensed, flagged by multiple regulators, and carries serious risk for anyone trading through it.

This 2025 review offers verified information, sourced directly from government agencies and public records, to help you make an informed decision.

Official Alert from Malaysias Securities Commission

On January 1, 2023, The Securities Commission Malaysia (SC) issued a formal warning against TradersWay, placing the broker on its Investor Alert List.

The SC stated that TradersWay is carrying on unlicensed capital market activities, including dealing in securities and investment instruments without legal approval.

This designation means the broker is considered unauthorized and poses a threat to investor safety in Malaysia.

Public Warning from Spain‘s CNMV

Spain’s financial regulator, the Comisión Nacional del Mercado de Valores (CNMV), also issued a public warningagainst TradersWay in December 2019.

The CNMV clearly stated that TradersWay is not authorized to offer investment services or forex transactions within Spanish jurisdiction. This includes advisory services, derivatives, and margin-based forex activities.

TradersWay has made no public attempt to resolve or clarify these warnings as of 2025.

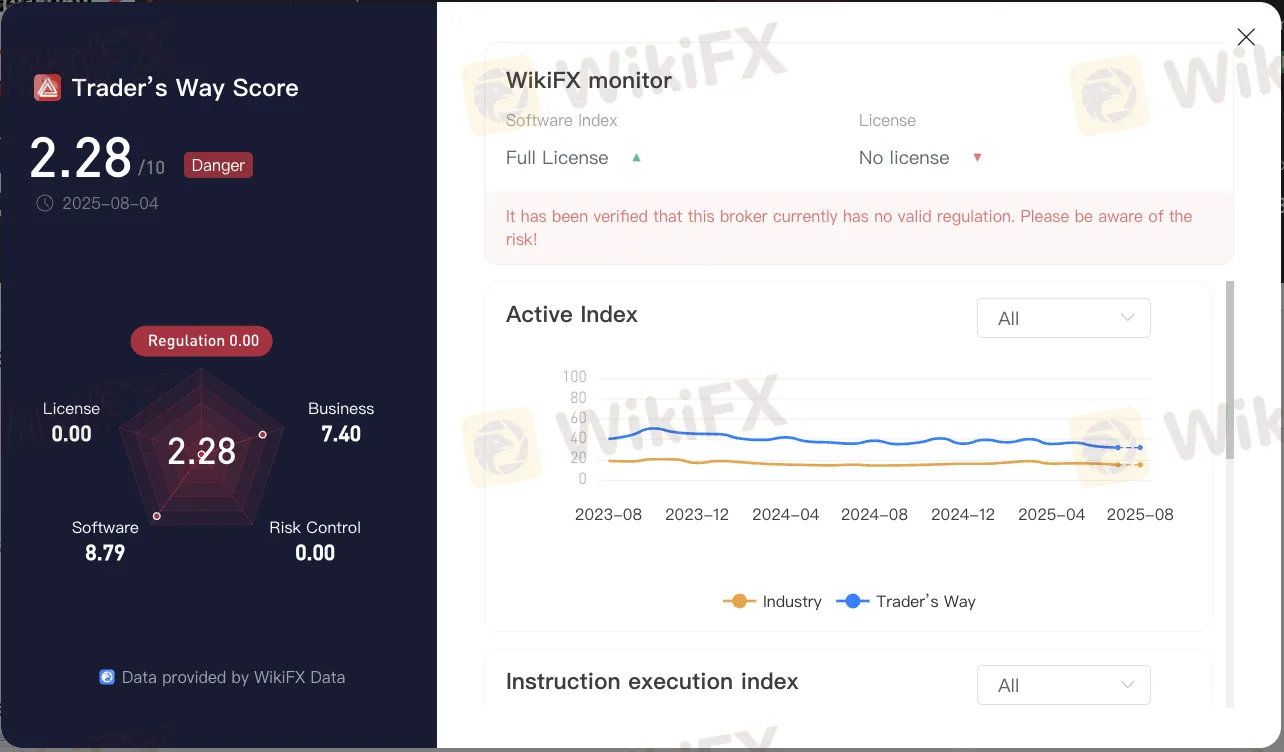

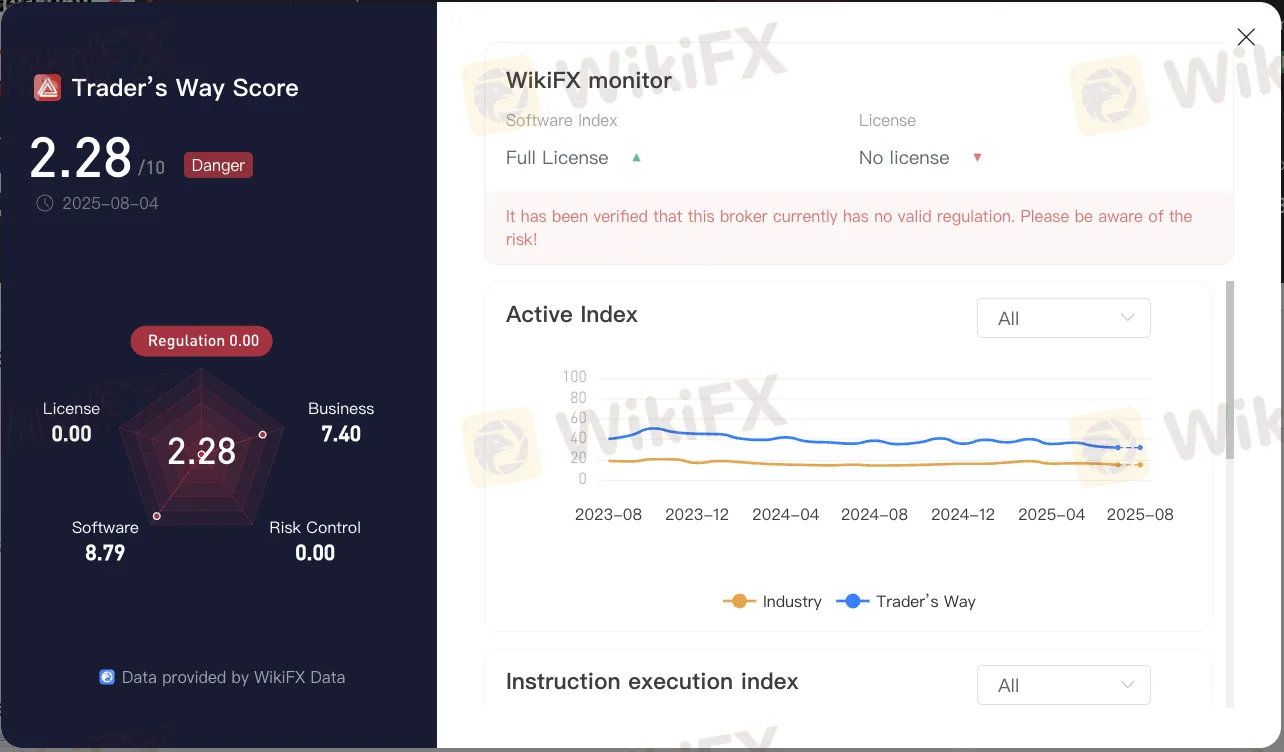

WikiFX Risk Report: 2.28 / 10 Rating

According to WikiFX (August 2025), TradersWays score is just 2.28 out of 10.

Breakdown highlights include:

- License: 0.00

- Regulation: 0.00

- Risk Control: 0.00

- Only Software & Business Indexes scored above average

This score reflects severe risk due to:

- No regulatory oversight

- No financial protection mechanisms

- No dispute arbitration channels

Traders trading with this broker do so entirely at their own risk.

Whats Missing: No License, No Oversight

TradersWay is not licensed by any top-tier authority. It is not listed by:

- FCA (UK)

- BaFin (Germany)

- CySEC (Cyprus)

- ASIC (Australia)

It also lacks registration with global platforms like the CFTC or NFA. In other words, it operates outside any recognized financial framework.

With no headquarters transparency, no complaints resolution channel, and no investor protection scheme, the risk of fund mismanagement or platform collapse is high.

Red Flags Summarized

- Multiple global warnings from financial regulators

- 0.00 regulatory score on WikiFX

- No verifiable license or jurisdiction disclosure

- Opaque operational entity (TW Corp.)

- High-leverage offerings with no risk control transparency

Conclusion

TradersWays unregulated status and repeated regulatory warnings make it a high-risk platform for any trader.

In 2025, where financial compliance and transparency are more important than ever, entrusting funds to an unlicensed offshore entity is a gamble with little upside and massive downside.

Before choosing a broker, verify its regulatory background—and prioritize safety over convenience.

FAQ

Q: Is TradersWay a regulated broker?

A: No. TradersWay has no valid financial license and is listed as unauthorized in multiple countries.

Q: Which regulators have warned about TradersWay?

A: The Securities Commission Malaysia and Spains CNMV have both issued public warnings against the broker.

Q: Can TradersWay legally offer forex services?

A: Without a license, it cannot legally operate in regulated markets. Users have no legal protection in case of disputes.

Q: What does WikiFX say about TradersWay?

A: It rates TradersWay at 2.28/10, with 0.00 in both regulatory and risk control indices.

Q: Are there safer alternatives?

A: Yes. Consider brokers licensed by FCA, BaFin, or CySEC. Use verification tools like WikiFX before opening an account.