Abstract:You must take any scam alert seriously, as they are warnings issued by reputable financial regulators. Recently, Spanish regulator, the National Securities Market Commission (CNMV), exposed scam brokers who are operating illegally in the forex market

You must take any scam alert seriously, as they are warnings issued by reputable financial regulators. Recently, the Spanish regulator, the National Securities Market Commission (CNMV), exposed scam brokers who are operating illegally in the forex market and swindling peoples money.

Unregulated firms

1. Nexus Trade / Nexus Trade Company

2. Wealth Xandorin

3. Aurum Finanzas

4. Aventus Consualtancy LTD

5. WTRADERS / WTRADERS LLC

What did the Authority Say?

According to the regulator, the brokers listed by the Commission were not legally allowed to offer financial services in the country. So, investors should check CNMV warnings carefully before making any investment decision, or they might fall for an investment scam.

Read this Important Article- www.wikifx.com/en/newsdetail/202507308894988373.html

Why CNMV Warning Matters?

A CNMV warning is a serious alert that a broker or financial service is operating without proper authorization. The CNMV is one of the most respected financial regulators, and its role is to protect investors from fraud, scams, and unethical practices.

If the CNMV issues a warning against any firm, it means:

1. The broker is not licensed or regulated by this reputable authority.

2. It is not allowed to offer financial services.

3. Your funds are not protected.

4. You have no legal recourse if the broker disappears or refuses withdrawals.

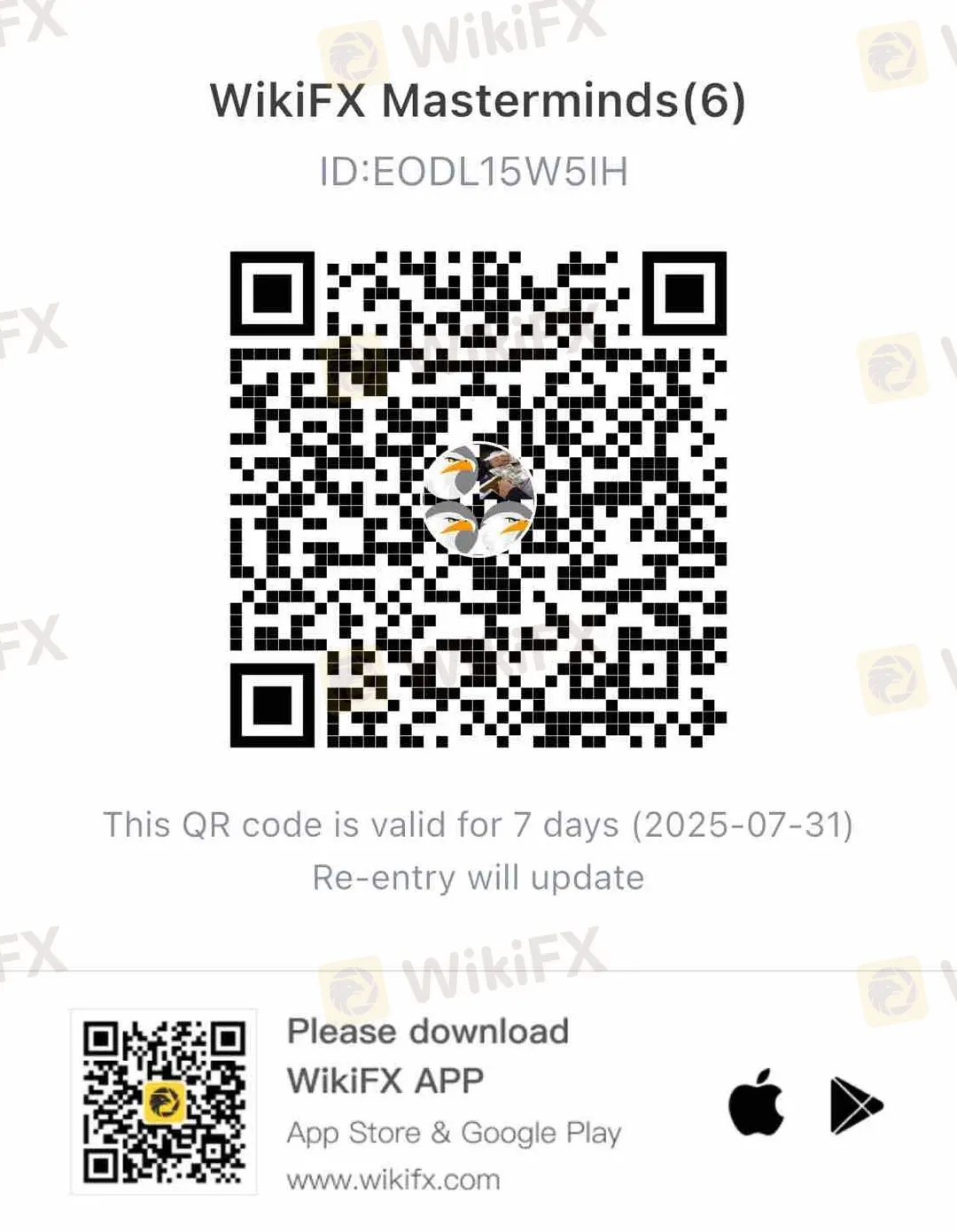

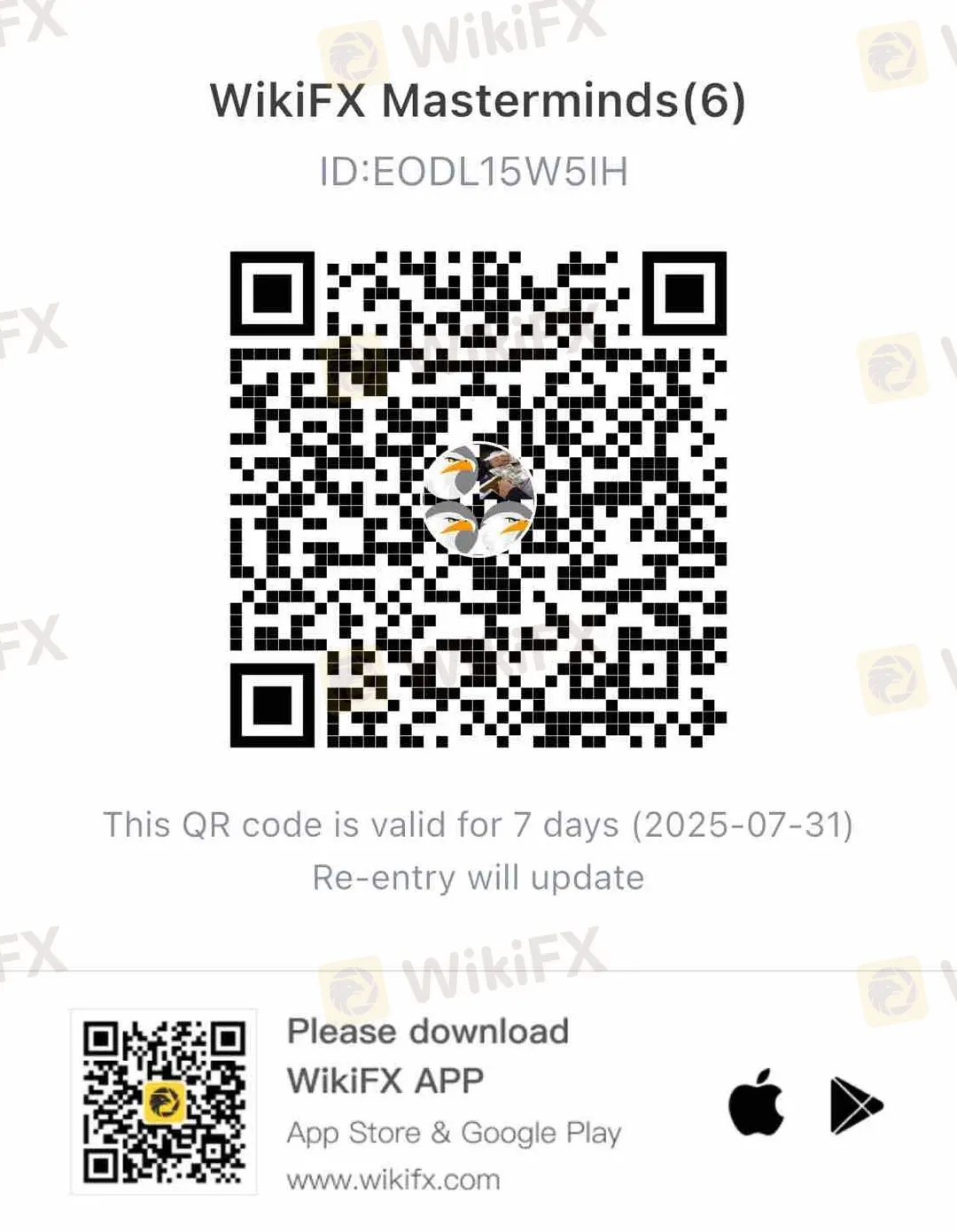

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!