Abstract:Learn what a Cent Account is, how it works in Forex trading, and why it's an ideal option for beginners. Compare Cent Accounts with Standard and Micro accounts.

If you‘re eager to dive into Forex trading but hesitant about risking a bundle, Cent Accounts could be your perfect stepping stone. Designed with newcomers in mind, these accounts deliver all the excitement of real trading minus the intimidating financial stakes. But what exactly makes a Cent Account such a great choice for beginners, and how do they stack up against standard and micro trading accounts? Let’s explore everything you need to know in a fresh, approachable way.

How Cent Accounts Work in Forex Trading

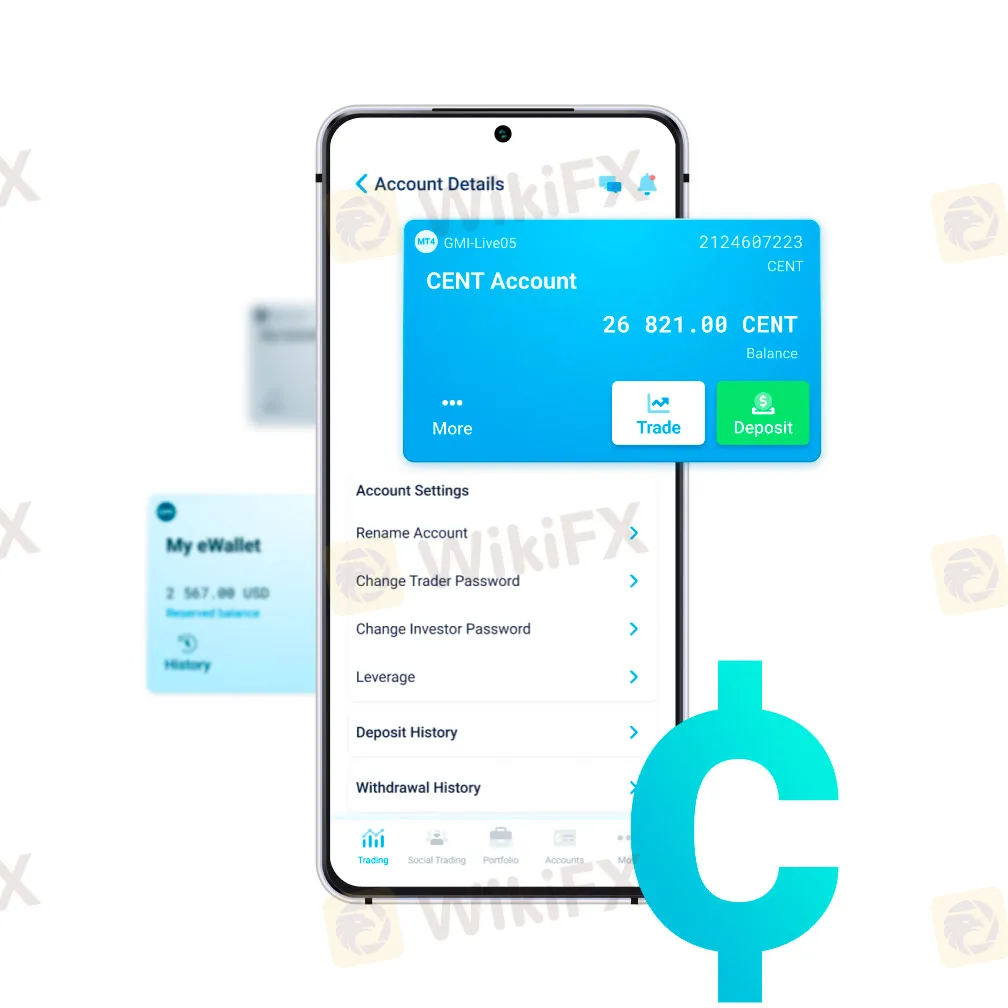

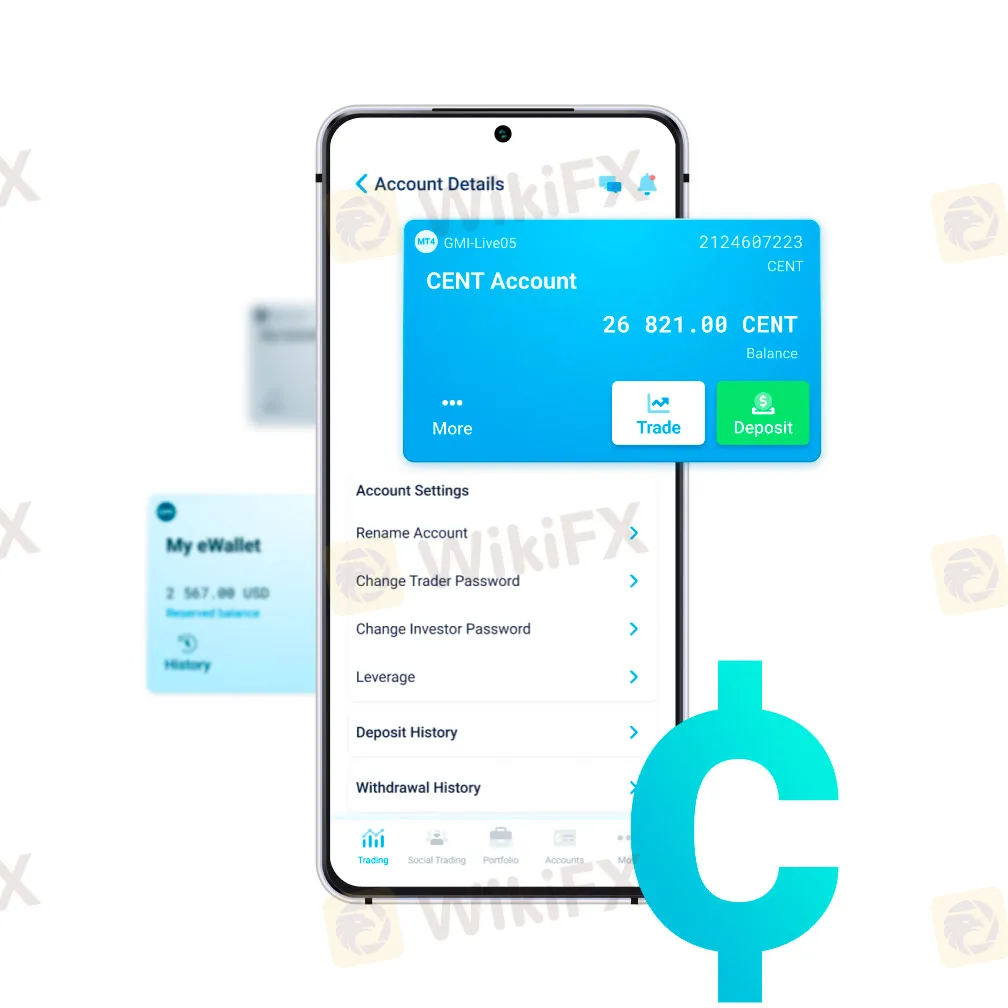

At its core, a Cent Account is just like any other Forex trading account – with one big difference: your balance is shown in cents, not dollars. So, a deposit of $100 appears as 10,000 cents in your account. This shift isnt just cosmetic; it gives you the freedom to experiment with smaller amounts, letting you dip your toes into real market action without high-stakes pressure.

The process is straightforward. You use the same trading tools, charts, and strategies as you would with a standard account. The major perk? A much lower barrier to entry. Most Cent Accounts require only a tiny minimum deposit, making them accessible even if you're trading on a tight budget.

Trading on a Cent Account means every market move has a proportionally smaller impact on your bottom line. That safety net allows you to make – and learn from – rookie mistakes with far less worry of wiping out your bankroll.

Advantages of Using a Cent Account for Beginners

Taking your first steps in Forex can feel daunting. There‘s a whole world of charts to analyze and strategies to decode. Here’s why Cent Accounts takes a lot of the early jitters out of learning the ropes:

- Start Small, Risk Less: Who says you need deep pockets to learn Forex? With just $1 to $10, you can open a Cent Account and start gaining real-world experience. Learning with low stakes means losing a trade stings less – and teaches more.

- Mistakes Wont Break the Bank: Every new trader makes errors. In a Cent Account, each pip (the tiniest price movement) means only cents are on the line, not dollars. That way, early missteps become valuable lessons instead of financial disasters.

- Trade Without Tension: The fear of losing money can cloud your judgment. Cent Accounts keep things low-pressure, so you can try out strategies, test the waters, and build your trading confidence without sweating every trade.

- Experience the Real Market: Practice makes perfect—and Cent Accounts let you practice in real market conditions, not just on a demo. You'll get used to actual volatility and hone your trading instincts using live market data.

- Leverage Without Big Risk: Leverage lets you control positions larger than your account balance. In a Cent Account, you can try leveraged trading while keeping your risks small, learning how it really works before you scale up.

Comparing Cent Accounts to Standard and Micro Accounts

Not sure which account type fits you best? Heres a quick side-by-side to help you decide:

- Cent vs. Standard Account: Standard accounts need a much larger deposit and expose you to higher risk – better suited to pros who can handle bigger swings. Cent Accounts, on the other hand, let you control your exposure and learn the ropes with less on the line.

- Cent vs. Micro Account: Micro accounts are a middle step: slightly higher deposits and transaction sizes than Cent Accounts, but with less risk than standard accounts. They‘re great if you’ve got some practice and want to scale up, but arent ready for standard-level risks.

Choosing the Right Account for Your Journey

If you‘re a Forex rookie, a Cent Account gives you everything needed to train and grow—real market experience, genuine trading tools, and a safety net for your mistakes. Once you’ve sharpened your skills, you might step up to a micro account as your confidence (and trading bank) grows. And if you become truly seasoned, a standard account may be your next leap.

Wrapping Up: Why Cent Accounts Are the Perfect Place to Start

Cent Accounts open the door to Forex trading without forcing you to risk large sums or sacrifice practical experience. With their low deposit requirements and gentle learning curve, theyre an excellent platform for building skills, experimenting with strategies, and gaining confidence before moving up the trading ladder.

Remember: the key to long-term success in trading is continuous learning. Cent Accounts encourage you to do just that—test ideas, make mistakes, and refine your approach—without putting your wallet in jeopardy. For anyone ready to begin their Forex journey with minimal risk and maximum opportunity to grow, Cent Accounts are a brilliant first step.