Abstract:Are you facing withdrawal issues with JAFX? Are its executives asking you to pay a fee to get withdrawals? Accepted withdrawals failing to hit your wallet? You are virtually scammed by the company. Explore this story containing a wide range of issues investors face at JAFX.

Are you facing withdrawal issues with JAFX? Are its executives asking you to pay a fee to get withdrawals? Accepted withdrawals failing to hit your wallet? You are virtually scammed by the company. It has been scamming many investors, and some of them have outrightly exposed the Saint Vincent and the Grenadines-based forex broker on several review platforms. With an operational period of five to ten years, this was not expected from the forex broker. We will highlight pressing issues and customer complaints to support our criticism of this scam broker. Lets start investigating!

A Wide-Ranging List of Investor Issues with JAFX

As pointed out, JAFX is crowded with not only investors but also their raging concerns that dont find immediate fixes. Here are some issues investors face with JAFX.

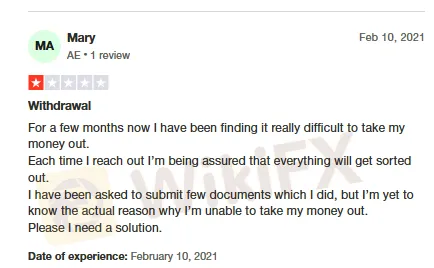

Only Assurances, No Execution

JAFX executives, while responding to customer queries regarding withdrawals and other issues, assure them of a speedy fix. But the reality is different! The issue has remained unresolved for months. One particular customer even submitted documents that were requested by the company executives. Even then, the situation remains at a standstill. In the era of consumerism, this goes down as one serious offence being committed by JAFX. Here is the actual complaint made live by the customer. Take a look!

Oh! Withdrawals Not Going to the Wallet Despite Being Approved

A delay in withdrawal is so rampant at JAFX that investors have taken it as an everyday kind of thing. But when the withdrawal sum requested does not come to their wallet, their frustration over the state of affairs is legitimate and should be taken seriously by JAFX. Unfortunately, the company lets this chaos stay so that they can use these funds for their own advantage. Here is that complaint that got us noticing.

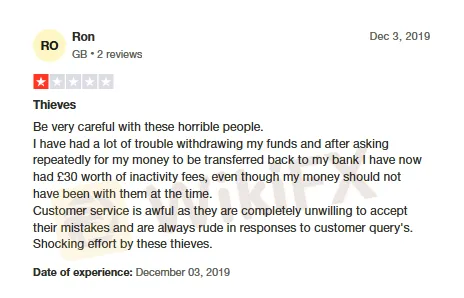

JAFX Officials Don‘t Own Their Mistakes

Mistakes happen everywhere and even with the BEST in the business! However, realizing it and making amends is what converts a company into a BRAND. A brand that inspires with creativity, empathy, and promptness to resolve issues. Sadly, things are exactly the opposite at JAFX. Here, traders are paying for the mistakes committed by the company officials. What further spoils investors’ mood is how rudely these officials behave with them. It calls for strict action by the regulatory authority. The complaint below elucidates our point.

How Does WikiFX View JAFX?

WikiFX, a leading broker regulation inquiry app, has an idea of the wobbles investors experience when trading through JAFX. The fact that it is not licensed by the competent authority is the biggest red flag for investors. This is precisely the reason why its investors face so many issues. Looking at how they have gone about their business, WikiFX has understandably given it a poor rating of 1.56 out of 10.

Something new for you? WikiFX Masterminds - where you can earn exciting cash rewards. Download it now to know how you can earn them.