Abstract:Planning to invest in London Capital Group? Take a pause, read this exposure story, and then make a decision whether it's worth your investment.

London Capital Group, a UK-based forex broker, has been operating for the last five to ten years. It has investors, their money, but not their support and appreciation. Such has been the story of this forex broker, which has scammed investors all over using malicious tactics. We have listed four alarming signs with London Capital Group. Read them carefully. It will help you prevent being scammed.

Here are the Alarming Signs for Traders with London Capital Group

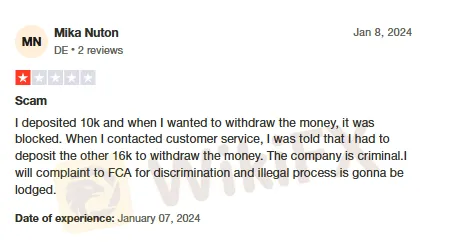

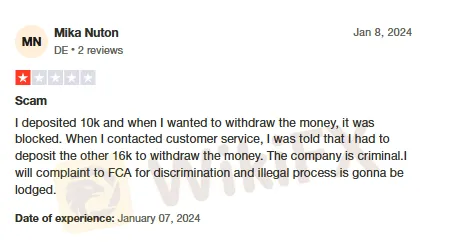

Withdrawal Issue as Usual

As a trader, you deposit to gain and withdraw it to meet your needs. But sadly, its increasingly getting prohibited by London Capital Group. Its officials always deny investors using the withdrawal option. Check the withdrawal complaint raised by one of its investors.

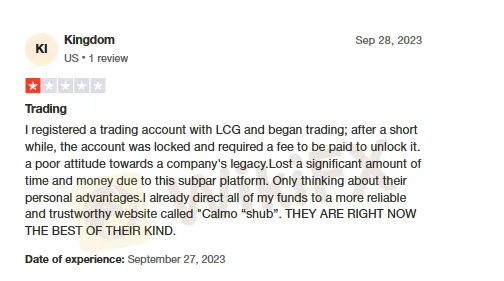

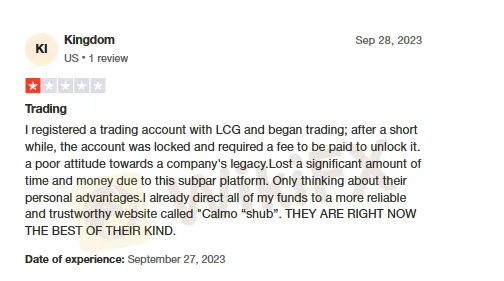

Account Blocking

Investors often see their accounts getting blocked. Sounds unusual, but not for London Capital Group and its investors.

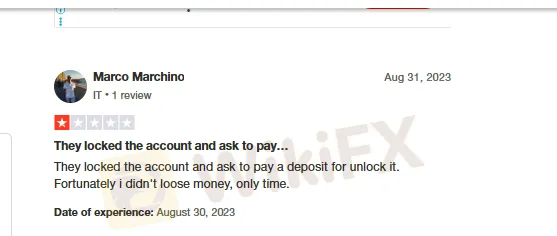

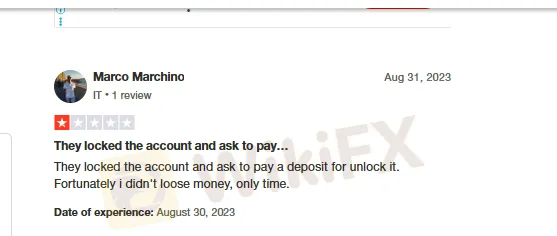

Fee Demand for Account Retrieval

Whats more, this scam forex broker demands an additional fee to unblock your account.

As a result of unfair blocking and its subsequent retrieval by the company upon receipt of additional fees, many customers have faced losses.

Here are snapshots combining the two alarming signs for investors.

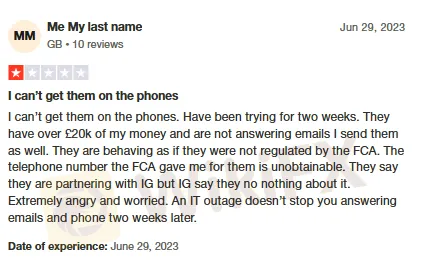

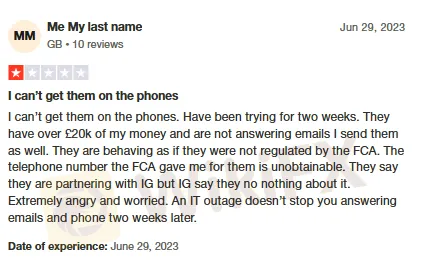

No Response to Customer Queries

Its officials hardly pay attention to customer queries. Their funds are stuck, making them email their queries. But they are not getting answered. Any regulated entity won‘t do this. Here’s the pain of a customer whose emails are constantly getting ignored.

How Does WikiFX Look at London Capital Group?

Not in a great light. Firstly, its not a licensed forex broker despite being in operation for a fairly long period. The overall rating for London Capital Group is merely 1.60 out of 10, not worthy of your precious investments.

Download WikiFX Masterminds to Grab Exciting Cash Prizes. Terms & Conditions Apply.