Abstract:In this article, we will conduct a comprehensive examination of Make Capital, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Make Capital operates as an online brokerage specializing in the trading of CFDs, offering competitive spreads as low as 0.0 pips and fast execution speeds.

Make Capital provides access to over 200 tradable assets, including currency pairs, metals, commodities, global indices, and cryptocurrencies.

Upon reviewing Make Capital's website, it appears the broker does not offer any partnership programs, such as affiliate or introducing broker (IB) programs. Additionally, Make Capital does not provide copy trading services.

It is important to note that, at present, Make Capital does not extend its services to the United States, Israel, New Zealand, Iran, or North Korea (Democratic Peoples Republic of Korea).

Types of Accounts:

Make Capital does not specify the types of accounts it offers on its official website. Therefore, it can be concluded that Make Capital provides only one account type, with spreads as low as 0.0 pips, leverage up to 500x, and a minimum required deposit of $200.

Deposits and Withdrawals:

Make Capital offers various payment options, including Visa, MasterCard, Maestro, Skrill, and Neteller. The company strives not to charge any fees on deposits and processes funds within 1-3 business days.

Trading Platforms:

Make Capital provides two trading platforms:

- The MetaTrader 4 (MT4) trading platform, available on PC, mobile, and web, is widely used in the industry. MetaTrader 4 is an advanced trading platform offering a comprehensive suite of features and tools for precise trading analysis. With one-click trading, quick order execution, VPS hosting, and up to four pending order types along with trailing stops, it provides a highly customizable interface with thousands of online tools to plug in. The platform supports fully customizable and in-depth charts, in-depth trading history, and allows users to build or import Expert Advisors (EAs), enabling the automation of trading strategies.

- The MetaTrader 5 (MT5) trading platform, available on PC, mobile, and web, renowned for its technological sophistication, provides access to a depth of market and various advanced solutions. It offers features such as buy and sell flexibility with six types of pending orders, 80 technical indicators, and 21 timeframes, providing a customizable platform with numerous online tools for integration. Quick order execution, an economic calendar for tracking global macro-economic news, one-click trading, mobile trading capabilities, and an intuitive market search and grouping functionality contribute to the platform's comprehensive and user-friendly trading experience.

Research and Education:

Make Capital offers brief introductory educational resources on both fundamental and technical analysis, as well as an economic calendar.

Customer Service:

Make Capital offers 24/5 customer support in both English and Chinese via the messaging application on its official website. Clients can also contact Make Capital via email at services@makecapital.com or by submitting an inquiry through the broker's online form.

Conclusion:

To summarize, here's WikiFX's final verdict:

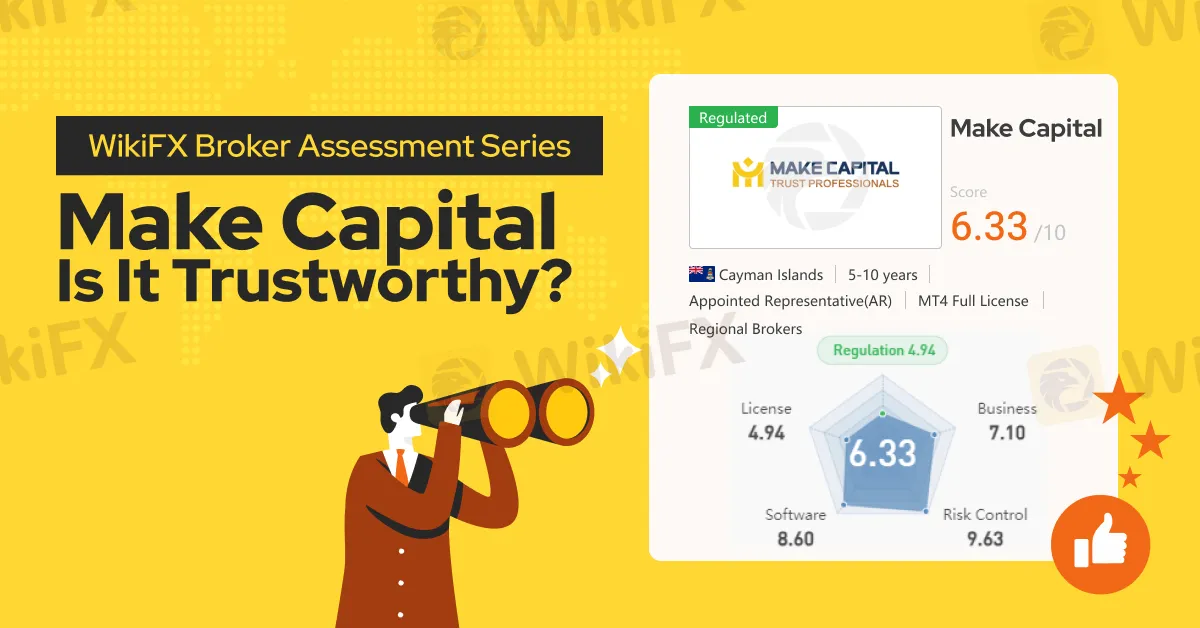

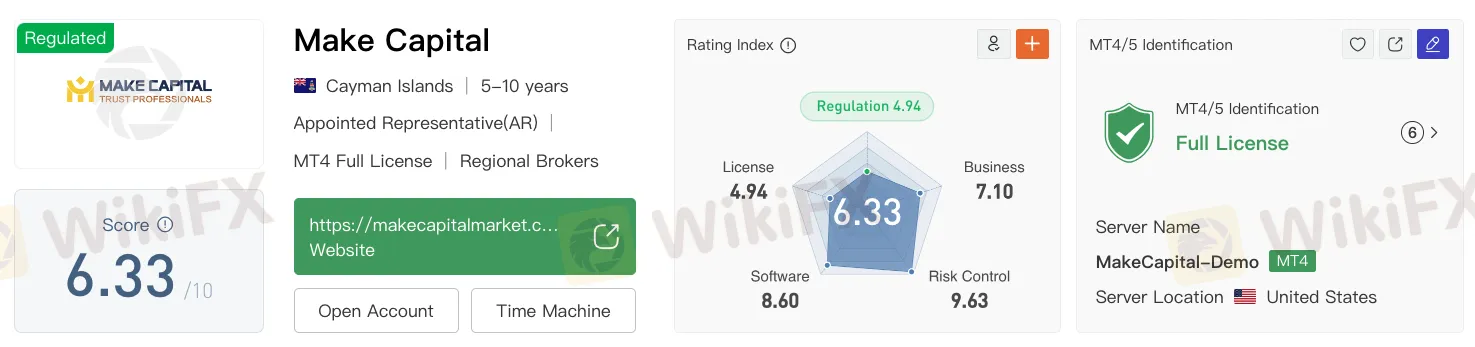

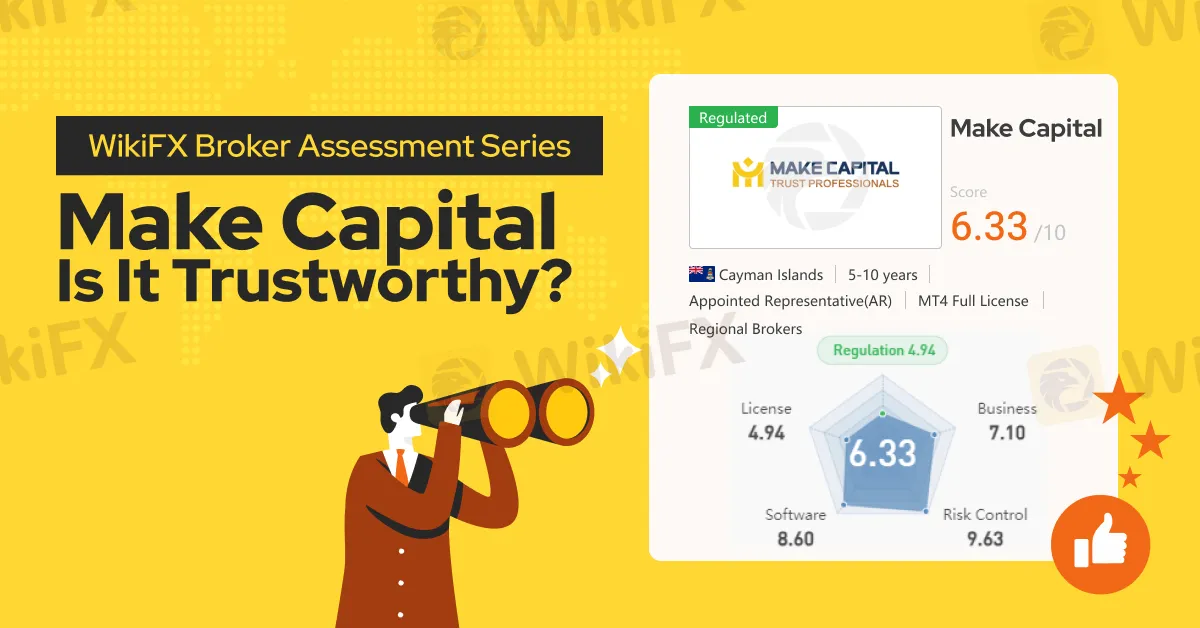

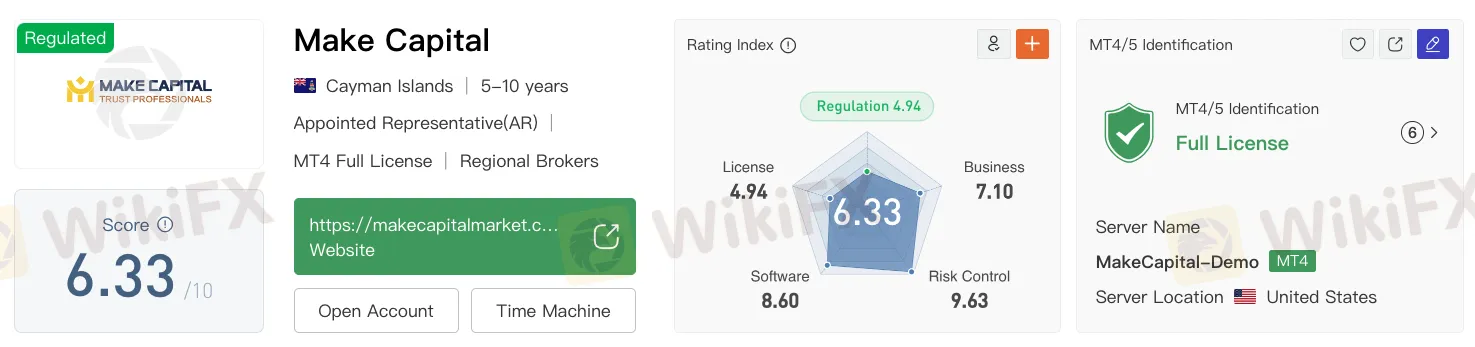

WikiFX, a global forex broker regulatory platform, has assigned Make Capital a WikiScore of 6.33 out of 10.

Upon examining Make Capital‘s licenses, WikiFX found that the broker is regulated by the Australian Securities and Investments Commission (ASIC) and South Africa’s Financial Sector Conduct Authority (FSCA). WikiFX has validated these licenses for the broker.