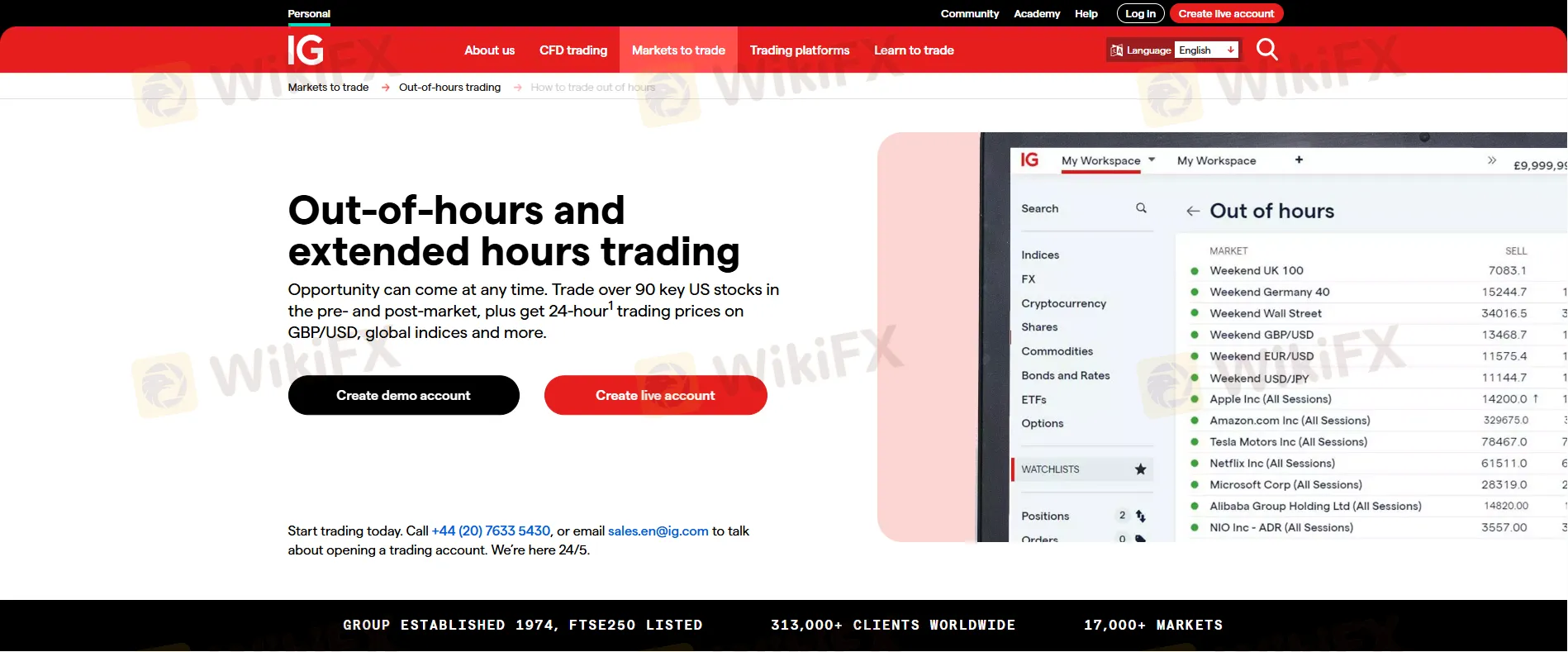

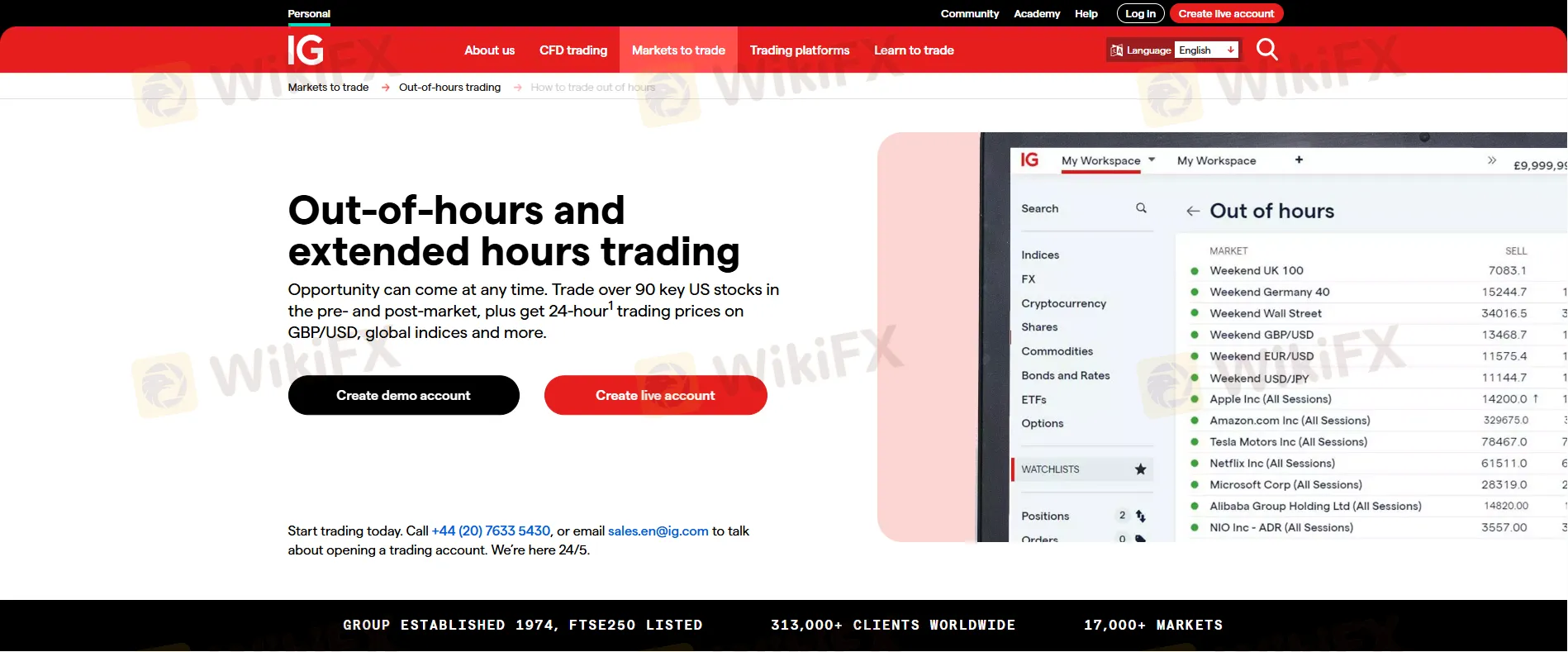

Abstract:IG adds 25 new stocks for extended hours trading, available to UK clients from 9 am to 1 am Monday-Thursday, and 9 am to 10 pm on Fridays.

IG, the global leader in electronic trading, has added 25 more equities to its extended-hours trading platform.

UK customers may now trade these new equities Monday through Thursday from 9 a.m. to 1 a.m., and Friday from 9 a.m. to 10 p.m. This increase enables traders to have access to a greater choice of equities outside of typical market hours, improving their ability to react to market moves quickly.

IG is noted for continually increasing its trading instruments. The firm just launched US-listed options and futures trading for UK customers. This new tool gives users access to over 7,000 underlying options and futures, providing complete depth and liquidity to the US market.

Furthermore, IG's platform allows rapid financing and currency conversion, allowing traders to capitalize on opportunities as soon as they arise. This extensive offering demonstrates IG's dedication to providing customers with a varied and responsive trading experience.

Access IG page at WikiFX to route to the official website.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.