Abstract:In this article, we will conduct a comprehensive examination of GHC. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

This article provides a thorough examination of GHC, equipping readers with essential information to make informed decisions about using this platform.

Identifying potential concerns in online trading is crucial, and GHC presents several notable issues. Marketed as an online broker, GHC lacks a critical element: regulatory authorization. This absence distinguishes GHC from reputable competitors, which operate under the necessary oversight for a trustworthy online trading environment. The lack of regulatory authorization is a significant concern. Regulatory bodies ensure fair practices, set standards, and facilitate issue resolution. Without this oversight, traders face potential risks of unethical practices without proper recourse.

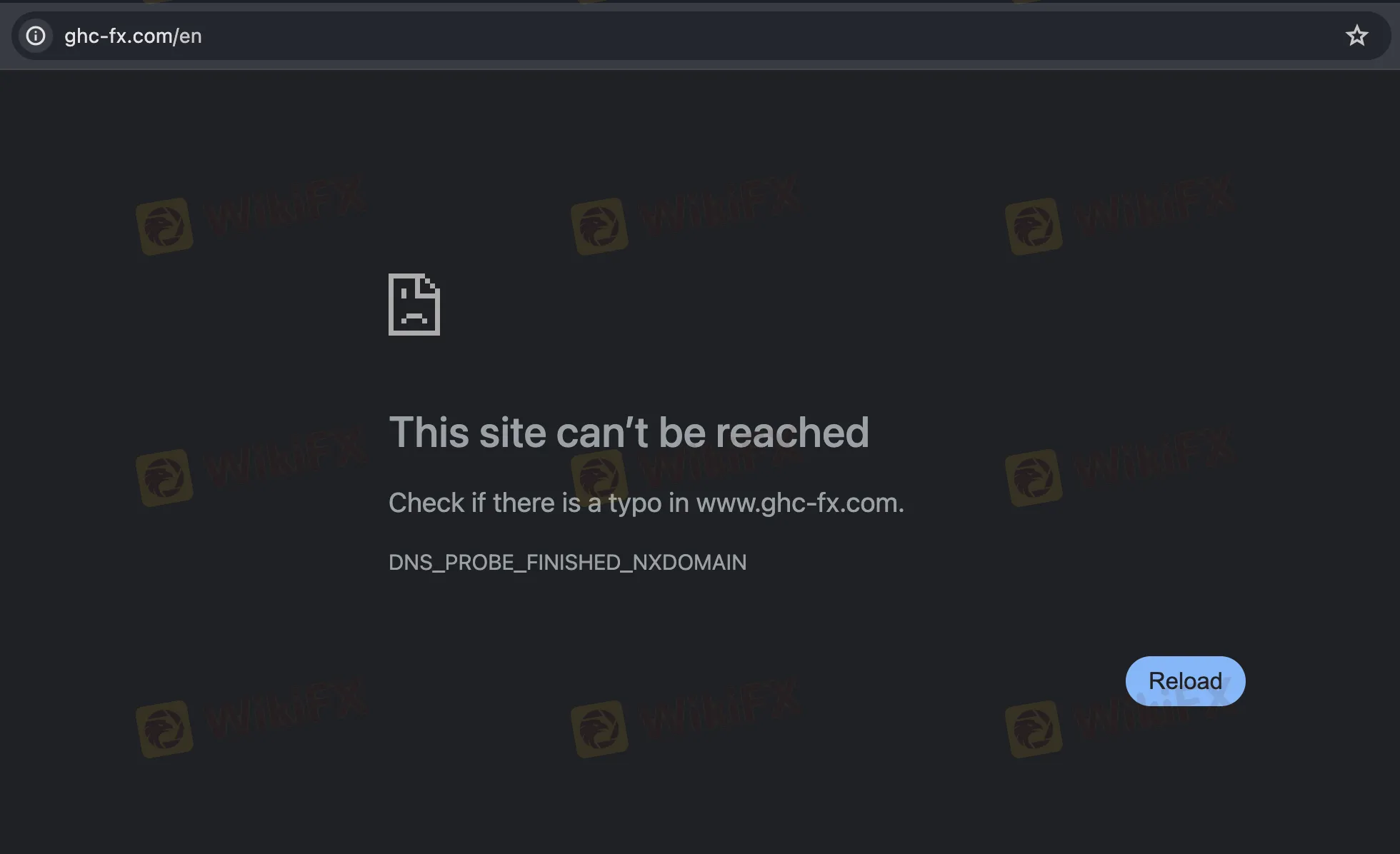

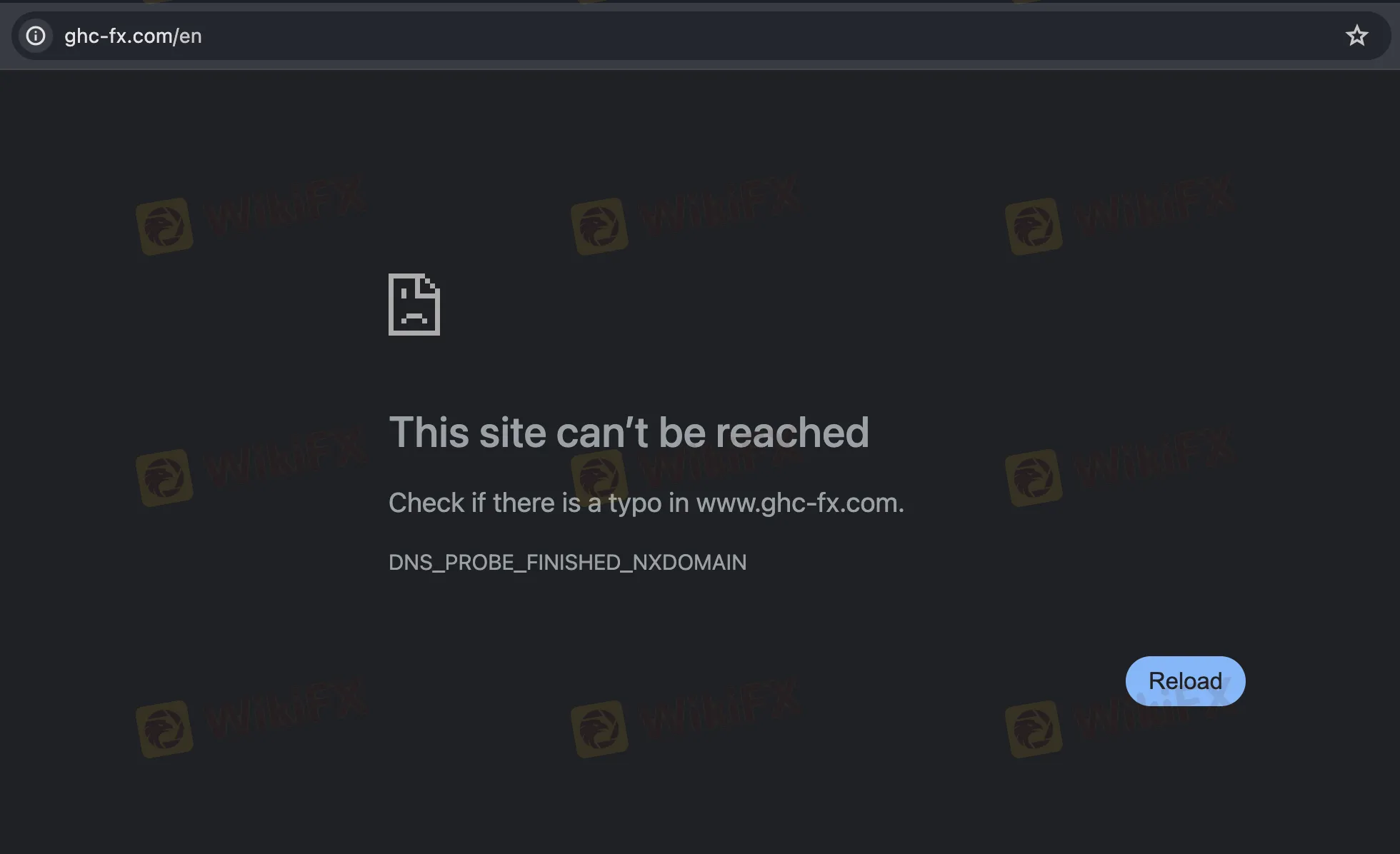

Evaluating the legitimacy of a broker involves examining the accessibility and reliability of its official website. GHC compounds concerns by having its official website, https://www.ghc-fx.com/en, conspicuously unavailable. A reputable broker typically maintains a professional and easily accessible website, providing clients with essential information about services, policies, and regulatory compliance. The unavailability of GHC's website not only prevents potential traders from accessing vital details but also raises significant questions about the transparency of the broker's operations and the safety of clients' funds.

The sudden unavailability of GHC's website raises red flags, deviating from industry norms. Clients rely on brokers to provide a secure and informative online environment, and the absence of GHC's website disrupts this crucial aspect of the client-broker relationship. This unexpected development heightens concerns about the broker's legitimacy, leaving clients uncertain about the safety and whereabouts of their funds. In the competitive forex trading landscape, where trust and transparency are paramount, GHC's missing official website casts doubt on its commitment to maintaining open communication and providing a secure trading environment for its clients.

GHC's status as an unlicensed and non-regulated online forex broker, combined with the sudden unavailability of its website, serves as a clear warning to traders. Caution and thorough research are advised before selecting an online trading platform. In an industry where trust and transparency are critical, GHC's current circumstances underscore the importance of choosing brokers with a solid regulatory foundation and a commitment to clear communication and robust customer support.

Therefore, WikiFX recommends that users exercise caution and consider exploring alternative brokers with verified regulatory status from WikiFX's comprehensive database. Download your free WikiFX mobile app now for more information.