Abstract:In the vast landscape of online trading, the promise of financial prosperity often lures individuals seeking to secure their financial future. However, amidst the plethora of brokerage firms, some entities operate not with integrity, but with deceit and betrayal. One such entity is WingoMarket, a broker whose actions have left a trail of shattered dreams and broken trust.

In the vast landscape of online trading, the promise of financial prosperity often lures individuals seeking to secure their financial future. However, amidst the plethora of brokerage firms, some entities operate not with integrity, but with deceit and betrayal. One such entity is WingoMarket, a broker whose actions have left a trail of shattered dreams and broken trust.

In the vast landscape of online trading, the promise of financial prosperity often lures individuals seeking to secure their financial future. However, amidst the plethora of brokerage firms, some entities operate not with integrity, but with deceit and betrayal. One such entity is WingoMarket, a broker whose actions have left a trail of shattered dreams and broken trust.

Alexander, a 35-year-old trader from Germany, found himself ensnared in the web of WingoMarket. With hopes of capitalizing on the lucrative opportunities presented by the financial markets, Eichler deposited $450 into his account, eager to kickstart his trading journey. Little did he know, this decision would lead to a harrowing ordeal that would strip him of both his hard-earned profits and his faith in the integrity of online brokers.

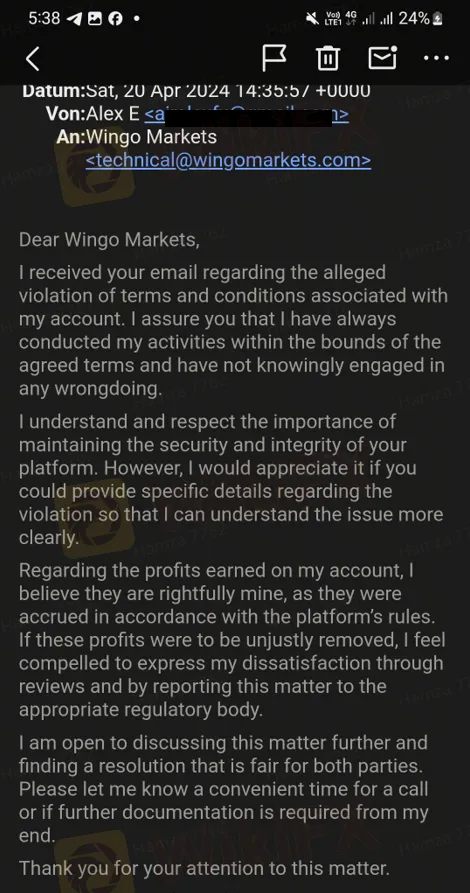

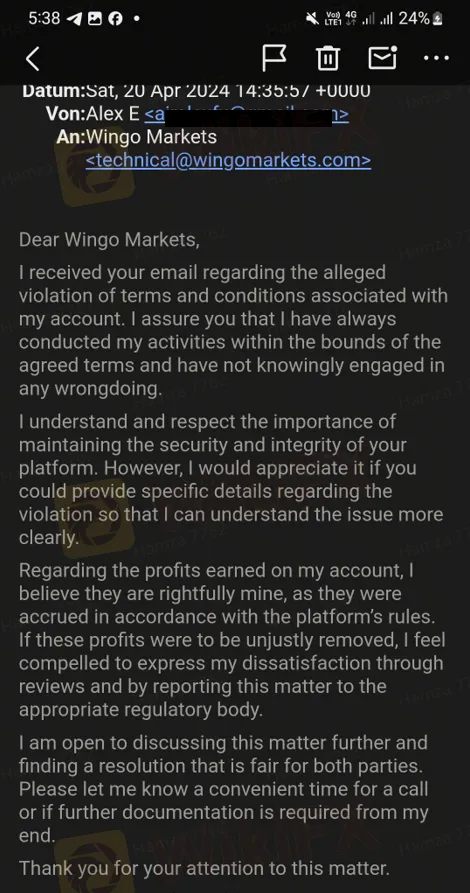

Eichler's initial experience with WingoMarket seemed promising. He diligently executed trades, leveraging his knowledge and expertise to generate a profit of $1200. However, his moment of triumph quickly turned into despair when WingoMarket arbitrarily wiped out his earnings without providing any substantiated reason or evidence. In a cold and impersonal email, WingoMarket cited a vague violation of their terms and conditions as justification for their egregious actions.

The email, devoid of empathy or transparency, reeked of deception. WingoMarket's assertion that Eichler may not have thoroughly read their terms and conditions is not only patronizing but also misleading. Even if Eichler had inadvertently violated a term, the magnitude of the punishment—complete erasure of profits—far outweighs any conceivable transgression.

Worse still, WingoMarket's offer to allow Eichler to withdraw his initial deposit before deactivating his account is a thinly veiled attempt to absolve themselves of accountability. By returning the principal amount, WingoMarket seeks to portray itself as benevolent, masking its malevolent actions behind a facade of faux generosity.

Eichler's plight serves as a cautionary tale for aspiring traders worldwide. The allure of quick profits must not blind individuals to the inherent risks associated with online trading. Moreover, it underscores the urgent need for regulatory oversight to reign in unscrupulous brokers like WingoMarket, who operate with impunity, preying on unsuspecting investors with impunity.

In light of these revelations, it is imperative that the trading community unite to expose WingoMarket's egregious practices and hold them accountable for their actions. Platforms such as WikiFX serve as vital conduits for amplifying the voices of victims like Eichler, providing them with a platform to share their stories and seek justice.

To those who have fallen victim to WingoMarket's deception, know that you are not alone. By standing together and raising awareness of WingoMarket's nefarious activities, we can safeguard others from suffering a similar fate. Let us not allow greed and dishonesty to taint the noble pursuit of financial freedom. Together, we can ensure that brokers like WingoMarket are consigned to the annals of history, where they rightfully belong.