Abstract:In this article, we will conduct a comprehensive examination of ePlanet Brokers LTD, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Founded in 2023, ePlanet Brokers LTD (ePlanet) operates as an online brokerage specializing in the trading of exchanged CFDs. It is registered and regulated in Fomboni, on the Island of Mohéli, in the Comoros Union.

ePlanet provides a diverse range of over 200 tradable assets, covering currency pairs, share CFDs, cryptocurrency CFDs, commodities, energies, metals, and global indices.

Meanwhile, ePlanet features an introducing broker (IB) program, enabling individuals and businesses to earn commissions by referring new clients to the company.

It is important to note that, at present, ePlanet does not extend its services to United States, Turkey, Hong Kong and Australia.

Types of Accounts:

ePlanet offers four account options: the Standard Account, the ECN Account, the Gold Special Account, and the ECN Pro Account. Kindly refer to the attached image below for more detailed information on each corresponding account.

Deposits and Withdrawals:

ePlanet does not provide much information on the deposit and withdrawal methods it offers, other than briefly mentioning that it accepts cryptocurrencies, Perfect Money, or credit card transactions.

Meanwhile, ePlanet claims that its clients trading accounts are insured up to $50,000, protecting their capital against financial losses resulting from errors, negligence, or fraud. However, there is no further information or evidence provided to verify this claim.

Trading Platforms:

ePlanet offers two distinct trading platforms, namely MetaTrader 5 and cTrader.

MetaTrader 5 (MT5) is recognized for its sophisticated features including advanced charts, intelligent tools, and rapid execution. Engineered to simplify and enhance the trading experience, MT5 provides traders with a variety of features for seamless trading. Accessible on Android, Mac OS, Windows, iOS, and Web platforms, MT5 allows traders to trade across multiple devices, offering convenience and flexibility.

On the other hand, cTrader is known for its user-friendly interface and innovative trading solutions. With intuitive navigation, advanced charting tools, and efficient order execution, cTrader provides traders with a streamlined trading experience. Available on Android, Windows, iOS, and Web platforms, cTrader ensures ease of access and seamless trading across various devices.

Research and Education:

ePlanet's official website claims to offer blog and magazine articles, real-time economic news, as well as weekly newsletters aimed at helping trading clients gain a better understanding of the financial markets. However, it appears that these resources are only accessible to registered trading clients.

The tools provided include a margin calculator, lot size calculator, profit and loss calculator, pip value calculator, as well as a win rate calculator.

Customer Service:

The customer service offerings of ePlanet are available 24/7 from Monday to Friday. Moreover, support is also provided from 12:00 AM to 20:00 PM on both Saturdays and Sundays. Clients can seek help by contacting the support team via phone at +35924928518 or by emailing compliance@eplanetbrokers.com.

Conclusion:

To summarize, here's WikiFX's final verdict:

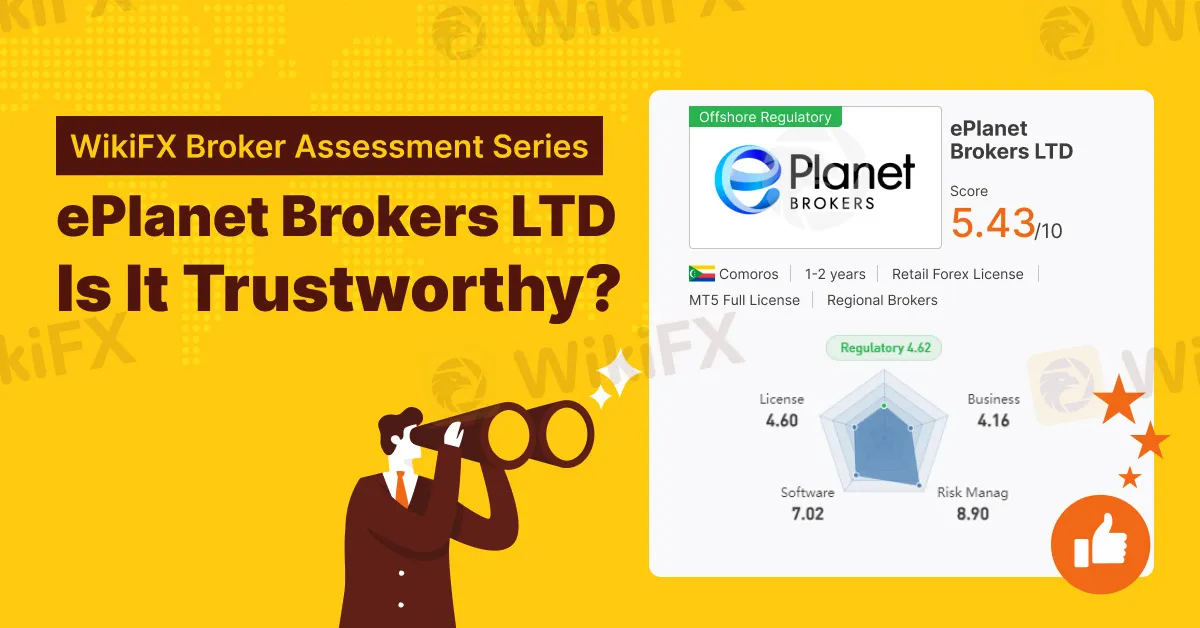

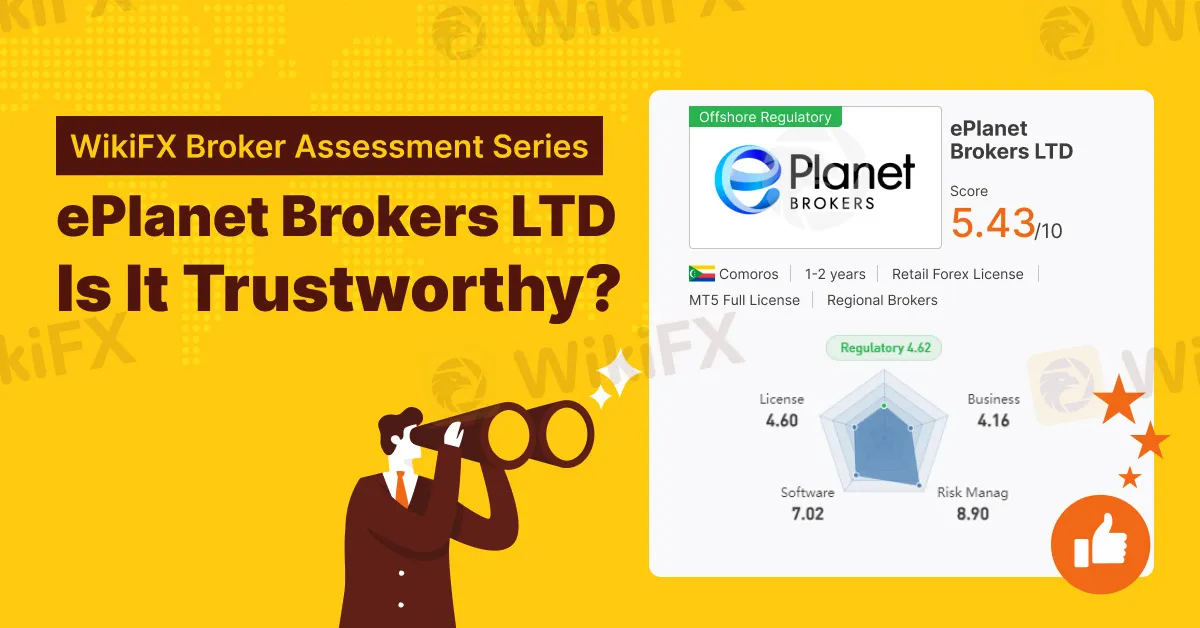

WikiFX, a global forex broker regulatory platform, has assigned ePlanet a WikiScore of 5.44 out of 10.

Upon examining ePlanet's license, WikiFX found that the broker is regulated by the Mwali International Services Authority in Comoros. WikiFX has also validated the legitimacy of the said license.

WikiFX would like to remind our users that a reputable forex broker typically maintains a professional and easily accessible website, providing clients with a centralized platform for crucial information about services, policies, and regulatory compliance. The lack of important information on ePlanet's official website not only hinders potential traders from accessing vital details but also raises significant questions about the transparency of the broker's operations, which could potentially compromise the safety of clients' funds.

Additionally, it is worth noting that the company holds an offshore regulatory license, which some may perceive as less stringent and potentially compromised. As a result, users might consider selecting a broker with a Tier-1 regulatory license that has also withstood the test of time in terms of global reputation and operational history to ensure a higher level of protection. Download the free WikiFX mobile application or visit www.wikifx.com to gain access to our comprehensive database and find your trusted broker now!