Abstract:For a deeper understanding of why investors make irrational decisions, considering the human brain and its responses to pleasure and pain is enlightening.

The three-layered structure of the human brain

In order to gain a deeper understanding of the reasons behind investors' irrational decision-making, considering the human brain and its responses to pleasure and pain is enlightening.

Our brain has evolved over millions of years and consists of three layers. At its core is the primitive brain, which provides the fight-or-flight instinct necessary for survival. Overlaying this is a more evolved mammalian brain responsible for emotions, memory, and habits, contributing to our decision-making. The highest level of brain function is the neocortex, which aids in thought, reasoning, and self-reflection. This is essentially how our human brain operates.

Signals from our brain's primitive areas prompt us to seek pleasure while avoiding pain. However, these same signals can overwhelm the neocortex, leading to irrational behavior. Human fear of pain far outweighs the enjoyment of pleasure, resulting in muddled reasoning.

In the realm of investing, this can lead to perplexing decisions.

The Loss-Aversion Bias in Action

Here's an example based on the groundbreaking research of behavioral economists Amos Tversky and Daniel Kahneman.

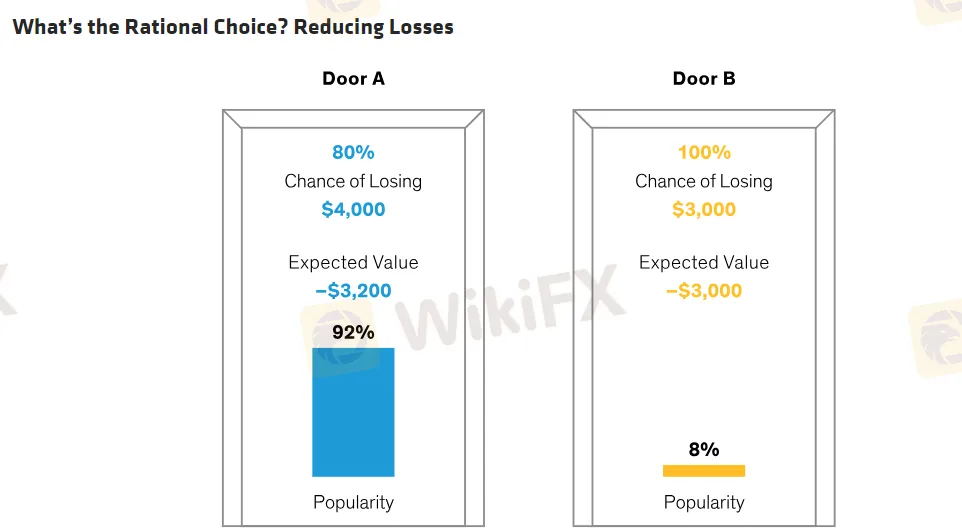

Imagine you have two doors to choose from. You're told that if you open Door A, you have an 80% chance of winning $4,000. (Due to an 80% chance of winning, the expected value is $3,200.) But if you open Door B, you're guaranteed to win but only $3,000. Which one would you choose? Tversky and Kahneman found that most participants would choose Door B. This seems like a rational choice, if not the one that maximizes profit. Why gamble when you can get a certain return? It's best to play it safe.

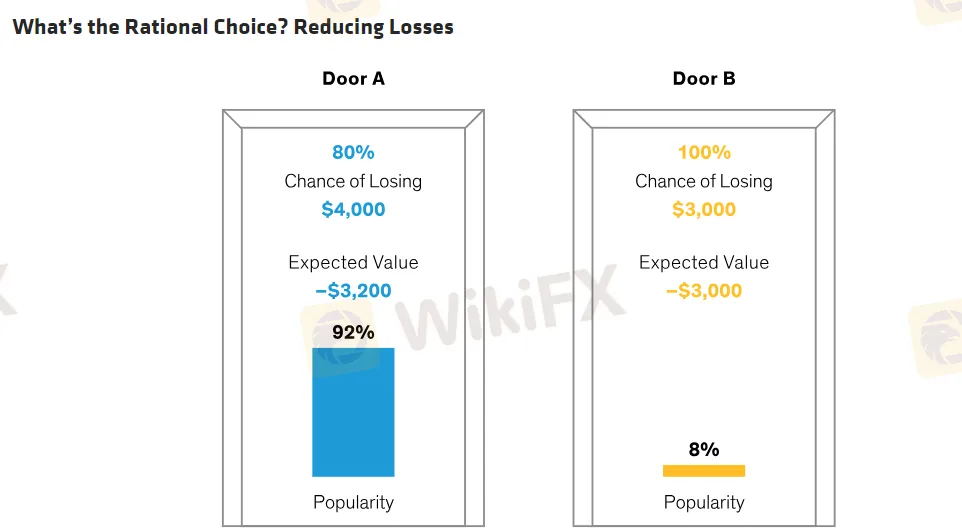

What happens when the situation is reversed? Now, behind Door A, there's an 80% chance of losing $4,000, with the expected value calculated at $3,200, while Door B guarantees a loss of $3,000. The $3,000 loss sets the stage for a downturn, but it turns out that most participants would rather risk a potential $4,000 loss to take a chance on a small probability event that might not incur any loss.

Research consistently shows that people's aversion to loss outweighs their aversion to risk. People are willing to take on more risk to avoid losses than to make gains. Tversky and Kahneman concluded that the pain of losing is two to three times greater than the pleasure of gaining.

Humans feel the pain of loss more intensely than happiness.

This ratio clearly influences investment decisions. Defensive stock strategies provide a pattern of sacrificing some upside in rising markets in exchange for two to three times the downside risk reduction, which may align with human nature. More content on this idea will be forthcoming.

Investors Can Overestimate Their Stock-Picking Prowess

Another bias of human nature is overconfidence. A study in 1999 of nearly 80,000 American households found that, measured by portfolio turnover, households with the lowest trading frequency had an annualized return rate 7 percentage points higher than those with the highest trading frequency. Researchers attributed this difference to investors' overconfidence in their stock-picking abilities — overconfidence leading to lower returns (indicating).

Overconfidence: More trading does not lead to better returns.

Investors are often influenced by behavioral biases such as loss aversion and overconfidence in their investment decisions. Fortunately, there is an investment philosophy that can help overcome overconfidence and risk aversion biases.

Low Turnover Stock Investment Case

Consider a stock investment strategy aimed at limiting downside capture—i.e., exposure to declining markets—while participating in market gains but not fully. This theoretical investment portfolio could capture 90% of market gains during upswings and only 70% of market declines.

How does this 90%/70% defensive strategy help mitigate behavioral biases?

By targeting stocks that strike a balance between offense and defense, low-volatility investments reduce the risk of investors chasing overvalued stocks driven by overconfidence.

However, this strategy does show its mettle in market downturns. If successful, the portfolio's average decline is only 70% of the entire market. This helps mitigate losses, counteracting the bias of loss aversion that might prompt investors to exit the market prematurely. It also helps offset the overconfidence bias of investors in their ability to time the market's turning points, a skill that is almost impossible to consistently replicate. Research shows that missing the best five days of market rebound can have a profound impact on long-term returns.

Trying to Time the Market Can Be Risky

This is because stocks with smaller losses during market downturns require less effort to recover lost ground when prices rebound. Therefore, they can compound from a higher base in subsequent rebounds.

While you might guess that low-volatility strategies would perform poorly over time, history has shown the opposite.

Using data from March 1986 to June 2023, it can be seen that the 90%/70% investment portfolio had an annual return rate 3.1 percentage points higher than the Morgan Stanley Capital International World Index during this period, with lower volatility. We believe the key to building such a portfolio is to focus on stable trading patterns and attractively priced high-quality stocks. Active management with deep fundamental research can be utilized to identify high-quality stocks and better manage volatility. This is crucial in today's environment of rising interest rates, macroeconomic uncertainty, and geopolitical instability.

Humans cannot avoid their human nature. However, by understanding how innate emotional responses become investors' greatest enemy, a low-volatility strategy can be constructed to counteract behavioral biases and provide better investment outcomes over time.

Before making any trades, be sure to search for the broker's rating on WikiFX to preliminarily determine if it's a blacklisted platform.

Looking to invest in US stocks, forex, or futures but afraid of being scammed? The most comprehensive information on brokerage firms is available here.

Before depositing funds, make sure to download the WikiFX APP to safeguard your trading security.