Smart People, Costly Scams: Education Isn’t Enough

Sundramoorthy said investment scams continued to ensnare victims from all walks of life, including highly educated professionals accustomed to analytical and evidence-based thinking

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:As FTX, the cryptocurrency exchange, initiates the opening of its claim window amidst insolvency, it finds itself embroiled in controversy, facing user discontent over the alleged undervaluation of major crypto assets and triggering discussions about legal ramifications and financial restitution.

In the latest developments surrounding the once-prominent cryptocurrency exchange FTX, now undergoing insolvency proceedings, the platform has initiated the claims process for creditors seeking to recover their digital assets. However, FTX finds itself under scrutiny on social media, with users expressing discontent over the perceived undervaluation of major crypto assets in comparison to their current market prices.

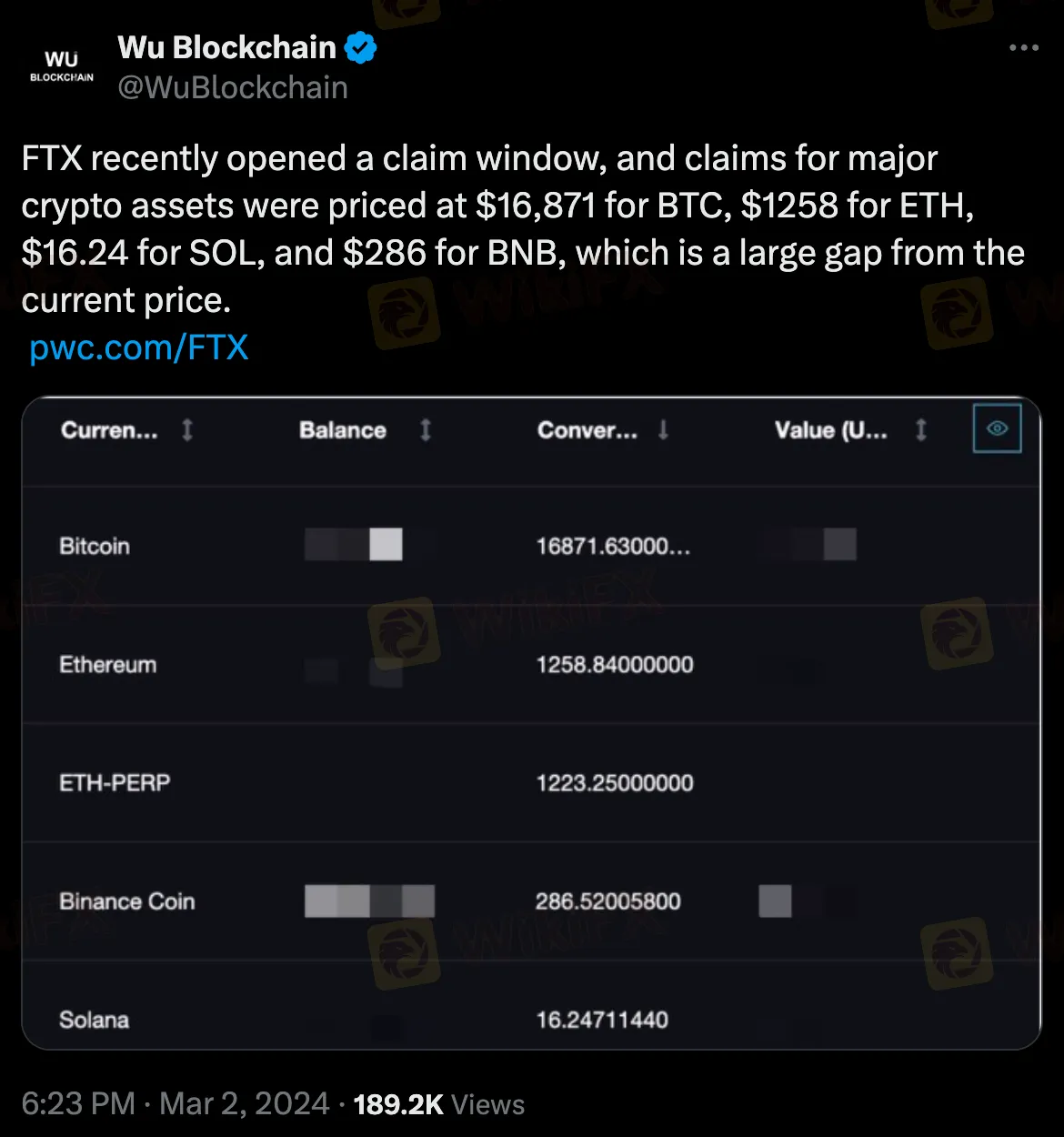

As reported by crypto journalist Colin Wu on March 2nd, FTX's claim window pricing has been set at $16,871 for BTC, $1,258 for ETH, $16.24 for SOL, and $286 for BNB.

These figures, notably below prevailing market rates, have sparked criticism and concerns among affected users, with accusations of wealth appropriation and calls for legal action against what some perceive as a scam.

FTX's bankruptcy plan is designed to reimburse customers based on crypto prices at the time of the exchange's filing for bankruptcy in November 2022. While FTX contends that U.S. bankruptcy law dictates claims to be valued using the filing date, dissenting voices argue that this approach undervalues cryptocurrencies that have experienced substantial appreciation since the market's low point in 2022.

PwC Partners, the court-appointed liquidators for FTX assets, issued an official statement addressing the situation. FTX Digital Markets is undergoing a Chapter 11 settlement with FTX Trading and related debtors, with the primary objective being the consolidation of assets from the estates of both entities. Creditors have been instructed to submit electronic claims by May 15, with an anticipated initial interim distribution through a claims portal managed by PwC expected in late 2024 or early 2025, with all eligible claims denominated in U.S. dollars. PwC has faced scrutiny from various quarters, with critics contending that the firm emerges as the primary beneficiary amid the prevailing tumult within FTX.

In response to growing concerns, FTX issued a precautionary statement regarding its authorized investment manager, cautioning against unauthorized third parties attempting to bid on behalf of FTX Debtors. The exchange clarified that the sale of Digital Assets, mandated by a bankruptcy court order, falls solely under the jurisdiction of Galaxy Asset Management, the court-appointed investment manager. FTX emphasized that only Galaxy Asset Management holds the authorization to manage selling offers or buying requests.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Sundramoorthy said investment scams continued to ensnare victims from all walks of life, including highly educated professionals accustomed to analytical and evidence-based thinking

Police busted 97 online scam cases and seized more than RM5 million, in a series of integrated operations conducted in the capital throughout last year.

When traders ask, "Is OneRoyal legit or a scam?" The answer isn't simply yes or no. OneRoyal is a trading company that has been running for almost twenty years and has important licenses from top financial authorities. This background puts it far away from typical quick scam operations. However, questions about whether it's trustworthy are reasonable and often come from its complicated business structure, the use of overseas companies, and a pattern of specific, serious complaints from users. This article aims to go beyond marketing claims and provide a fact-based analysis of OneRoyal's trustworthiness.

A global crypto transparency era begins as 48 countries enforce CARF rules; data-sharing to combat tax evasion expands worldwide by 2029.