Abstract:One victim, who shared his harrowing experience with WikiFX, sheds light on the dubious practices of Ivision Market, particularly their alarming habit of blocking withdrawal requests.

About Ivision Market

Ivision Market offers a wide range of financial instruments, including forex, stocks, commodities, indices, and cryptocurrencies. Traders have the flexibility to choose from different account types based on their trading preferences and investment size. These accounts provide various benefits such as tight spreads, high-leverage options, and market execution. This broker is regulated right now. the regulatory status of NFA with license number: 0553552 is abnormal, the official regulatory status is unauthorized. Recently, we received a lot of complaints against this broker. Traders need to be aware of the risks.

Case Description

One victim, who shared his harrowing experience with WikiFX, sheds light on the dubious practices of Ivision Market, particularly their alarming habit of blocking withdrawal requests.

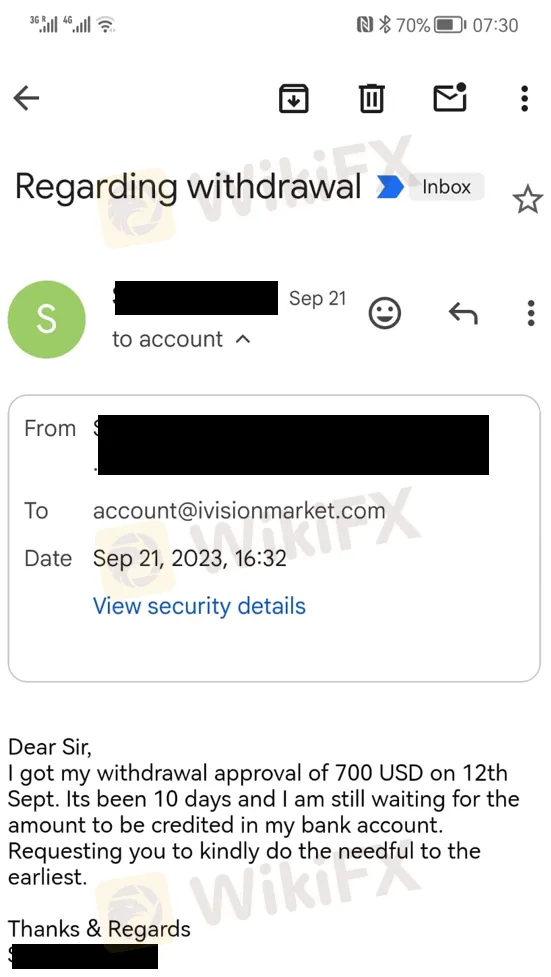

The victim, who wishes to remain anonymous, recounts his ordeal with Ivision Market, stating, “On September 12th, I initiated a withdrawal request of $700 from my account. Despite assurances of a swift transaction within 2-3 days, my funds never materialized.” This initial delay prompted the victim to reach out to Ivision Market, seeking clarity on the matter. However, what followed was a frustrating cycle of empty promises and unfulfilled commitments.

“After 15 days of waiting in vain, I contacted Ivision Market again, only to receive a vague response claiming they were 'stuck somewhere' but would release the funds at the earliest opportunity,” the victim laments. Such evasive responses only served to exacerbate the victim's distress, as months passed without any sign of his hard-earned money.

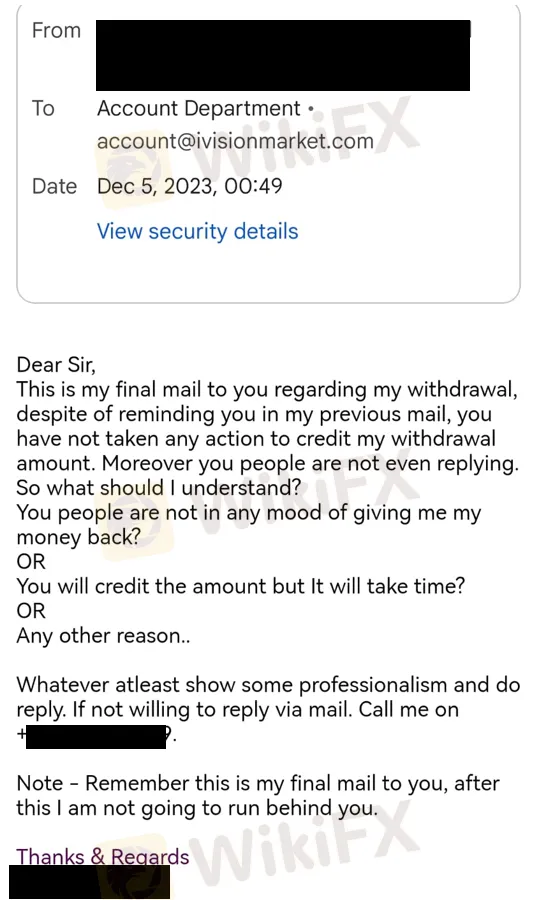

Now, three months later, the victim finds himself in a distressing predicament. “Not only have I not received my funds, but I am met with silence from Ivision Market. My repeated emails go unanswered, leaving me stranded and helpless,” he reveals. Despite numerous reminders, Ivision Market has chosen to ignore his pleas for resolution.

The victim's story underscores a troubling trend within the online trading industry, where unscrupulous brokers like Ivision Market exploit the trust of their clients for personal gain. By blocking withdrawal requests and evading communication, they not only betray the confidence of investors but also jeopardize their financial well-being.

In light of such egregious misconduct, investors must exercise caution and due diligence when choosing a broker. Platforms like Ivision Market serve as cautionary tales, highlighting the importance of thorough research and vigilance in safeguarding one's investments.

As the victim's voice echoes through these revelations, one can only hope that his plight serves as a wake-up call to others navigating the treacherous waters of online trading. Let his experience serve as a beacon, guiding investors away from the clutches of deceitful entities like Ivision Market and towards safer, more transparent avenues for financial transactions. Besides, WikiFX has given this broker a low score, which highlights the risk of investing in this broker.