Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

Investment platforms and financial apps operating without authorisation and using unconventional channels to reach users.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Investors are constantly seeking opportunities to grow their wealth. Unfortunately, not every venture turns out to be as lucrative as expected. One such case has recently surfaced involving VOCO CAPITAL MARKET, where a victim named Sanjeev claims to have lost a staggering 7,000 USD. In this article, we delve into Sanjeev's unfortunate experience and explore whether VOCO CAPITAL MARKET is a legitimate platform or a potential scam.

Investors are constantly seeking opportunities to grow their wealth. Unfortunately, not every venture turns out to be as lucrative as expected. One such case has recently surfaced involving VOCO CAPITAL MARKET, where a victim named Sanjeev claims to have lost a staggering 7,000 USD. In this article, we delve into Sanjeev's unfortunate experience and explore whether VOCO CAPITAL MARKET is a legitimate platform or a potential scam.

About VOCO CAPITAL MARKET

VOCO MARKETS is a young broker registered in Comoros. This broker does not hold a legitimate license, which means this broker is unregulated. WikiFX has given this broker a low score of 1.07/10.

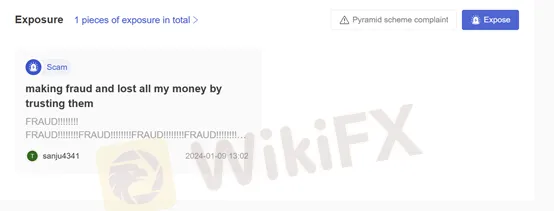

Complaints

Case in Detail

Sanjeev, a 30-year-old individual from the UAE, shares his disheartening story of falling victim to what he believes is a scam orchestrated by VOCO CAPITAL MARKET. According to him, his friend Harshika persuaded him to open an account with the broker. Upon Harshika's recommendation, Sanjeev registered with VOCO CAPITAL MARKET and proceeded to deposit 7,000 USD into his trading account.

Sanjeev states that he engaged in trading activities based on the advice provided by VOCO CAPITAL MARKET's financial advisor Ali. Following Ali's recommendations, Sanjeev executed trades that unfortunately resulted in the complete loss of his 7,000 USD investment. Distressed and frustrated, Sanjeev is now seeking assistance for the refund of his entire investment.

Conclusion

To determine the legitimacy of Sanjeev's claims, it is essential to conduct a thorough investigation into VOCO CAPITAL MARKET. Various factors need to be considered, including the broker's regulatory status, customer reviews, and any history of regulatory actions or warnings.

Investors should exercise caution and conduct due diligence before engaging with any online trading platform to protect themselves from potential scams.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Investment platforms and financial apps operating without authorisation and using unconventional channels to reach users.

OneRoyal has been around since 2006 and has a complicated setup when it comes to regulation. They have licenses from different places around the world - Europe, Australia, and the Caribbean. This setup can give them global reach and different trading options, but it also means you need to look closely at what protection you actually get. This article will break down OneRoyal Regulation step by step. We will look at its top licenses like CySEC and ASIC, check out its offshore companies, and explain what this complex setup really means for your capital's safety. Our goal is to give you clear, honest information so that you can make a smart choice.

When traders ask, "Is OneRoyal legit or a scam?" The answer isn't simply yes or no. OneRoyal is a trading company that has been running for almost twenty years and has important licenses from top financial authorities. This background puts it far away from typical quick scam operations. However, questions about whether it's trustworthy are reasonable and often come from its complicated business structure, the use of overseas companies, and a pattern of specific, serious complaints from users. This article aims to go beyond marketing claims and provide a fact-based analysis of OneRoyal's trustworthiness.

OneRoyal began in 2006 and has been a trading broker for almost 20 years. The company operates globally, from Australia to the Middle East. It is part of Royal Group Holdings and serves several traders by offering various account options and thousands of trading instruments. However, just because a broker has been around for a long time and offers many products doesn't tell the whole story. The most important questions for any serious trader are: Is my capital safe? Are the costs fair? And most importantly, can I trust the broker to execute my trades properly? This OneRoyal Review will give you an honest insight into every aspect of this broker. We'll examine how it's regulated, compare its trading costs, and look carefully at what real users say about their experiences. Our goal is to answer the key question: Is OneRoyal a trustworthy partner for your trading capital? Let's start with a summary of what we found.