Celebrate the New Year and Usher in a Safer 2026 for All Traders!

As the new year begins, WikiFX extends our sincere gratitude to traders worldwide, our industry partners, and all users who have consistently supported us.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Beware of the challenges faced by OspreyFX users, including account lockouts, login issues, and withdrawal limits, in this insightful article. Learn about the risks of unregulated online trading platforms and discover key steps for safe trading.

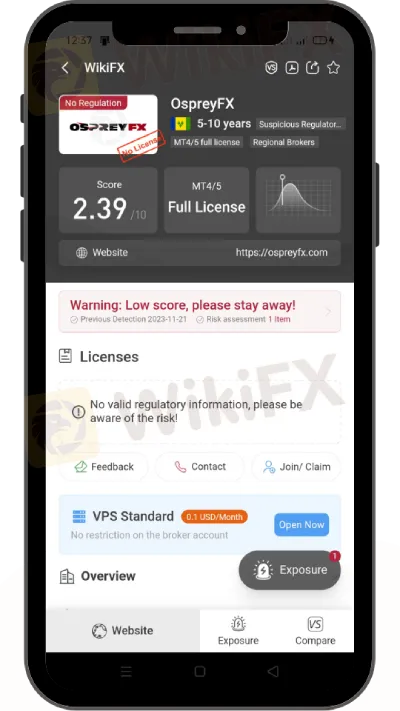

In today's fast-paced financial world, the stability and reliability of online trading platforms are of paramount importance. OspreyFX, an Electronic Communication Network (ECN) broker, has recently come under public scrutiny. Based initially in Saint Vincent and the Grenadines, a locale not known for stringent financial regulations, OspreyFX operates without the oversight typical of regulated entities. This article aims to shed light on the issues arising on social media platforms, particularly Twitter, regarding OspreyFX's practices.

OspreyFX offers traders access to various financial markets through its online platform. The lack of regulatory oversight, however, poses significant risks to its users. These include potential data breaches, unfair trading practices, and operational inconsistencies.

The concerns raised by OspreyFX users on social media platforms are varied and serious:

Unexpected Account Lockouts: Traders report unannounced and inexplicable blockages in accessing their accounts, leading to significant distress and financial uncertainty.

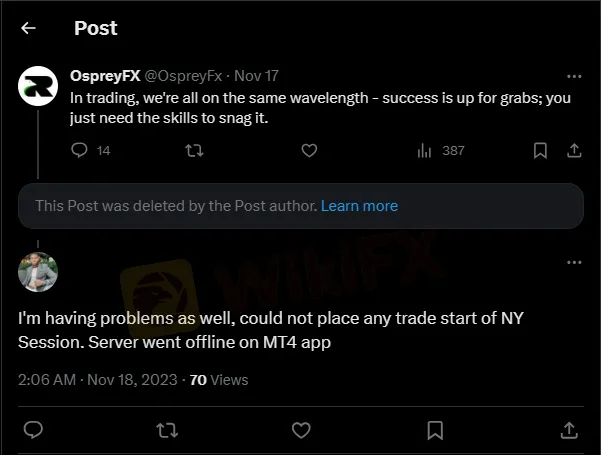

Login Challenges: Instances of users being unable to log into their accounts disrupt trading activities and raise questions about the platform's reliability.

Server Instability: Frequent technical issues and server downtimes have hindered the trading experience, leading to potential financial losses.

Unauthorized Account Migration: Accounts being moved to trade lockers without user consent or prior notification have caused confusion and mistrust among users.

Withdrawal Caps: Restrictions on the amount of funds that can be withdrawn have raised serious concerns about liquidity and financial control.

Images shown below were posted by OspreyFX traders who had experienced such issues.

Image #1

Image #2

Image #3

Image #4

The issues with OspreyFX exemplify the broader risks associated with unregulated online trading platforms. These risks include:

Operational Risks: Without regulatory oversight, operational processes can be inconsistent, leading to issues like those currently faced by OspreyFX users.

Financial Security: The lack of regulation raises questions about the safety of funds and the integrity of financial transactions.

Data Privacy: In the absence of regulatory compliance, there's an increased risk of data breaches and misuse of personal information.

To navigate the complex world of online trading safely, traders should:

Conduct Thorough Research: Before engaging with any trading platform, it's crucial to investigate its regulatory status and reputation.

Read Terms and Conditions Carefully: Understanding the fine print can prevent unexpected issues like unauthorized account changes or withdrawal limits.

Use Secure Connections: Accessing trading accounts through secure, private networks is essential for protecting sensitive information.

Maintain Detailed Records: Keeping comprehensive records of all trading activities and communications can provide crucial evidence in case of disputes.

In response to these issues, it's imperative for OspreyFX to take immediate and transparent action. Addressing user concerns, improving operational reliability, and enhancing communication channels should be top priorities.

The general public must be informed of the complexities of Internet trading, particularly the hazards associated with unregulated platforms. This understanding is critical for making educated judgments and protecting one's financial interests.

The challenges faced by OspreyFX users serve as a reminder of the importance of due diligence in the online trading sector. Understanding and mitigating the risks associated with unregulated platforms are crucial for a secure trading experience. This press release serves not only to inform about the specific issues with OspreyFX but also to educate the public about the broader risks in the online trading world.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

As the new year begins, WikiFX extends our sincere gratitude to traders worldwide, our industry partners, and all users who have consistently supported us.

Dear Forex Traders, When choosing a forex broker, have you ever faced these dilemmas? Dozens of broker advertisements, but unsure which one is truly reliable? Online reviews are either promotional content or outdated/incomplete? Want to learn about real users’ deposit/withdrawal experiences but can’t find firsthand accounts? Now, your experience can help thousands of traders and earn you generous rewards! The campaign is long-term and you can join anytime.

Markets turn cautious as investors await the Fed’s December meeting minutes. The US Dollar stabilizes near 98.10, gold drops sharply from record highs, while GBP/USD, EUR/USD, and USD/JPY react to central bank signals.

In forex trading, a pip is the smallest unit of price movement between two currencies. It’s used to measure changes in exchange rates, calculate profits or losses, and manage trading strategies effectively.