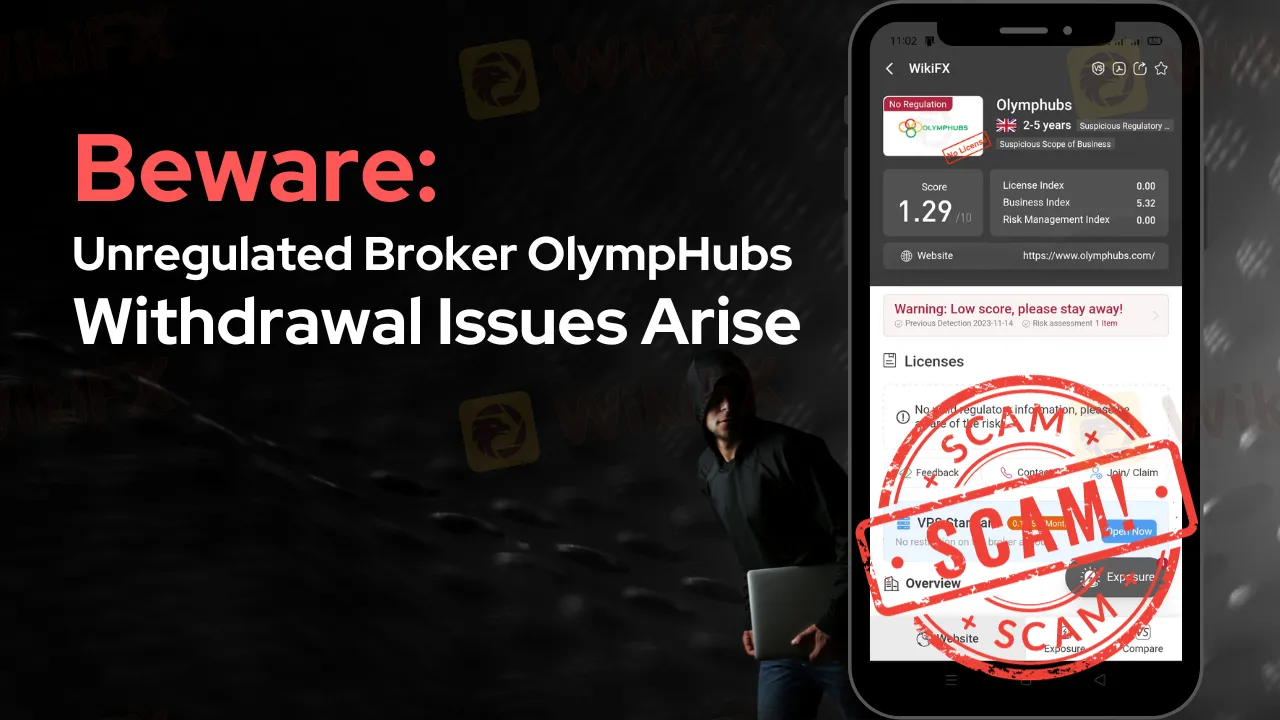

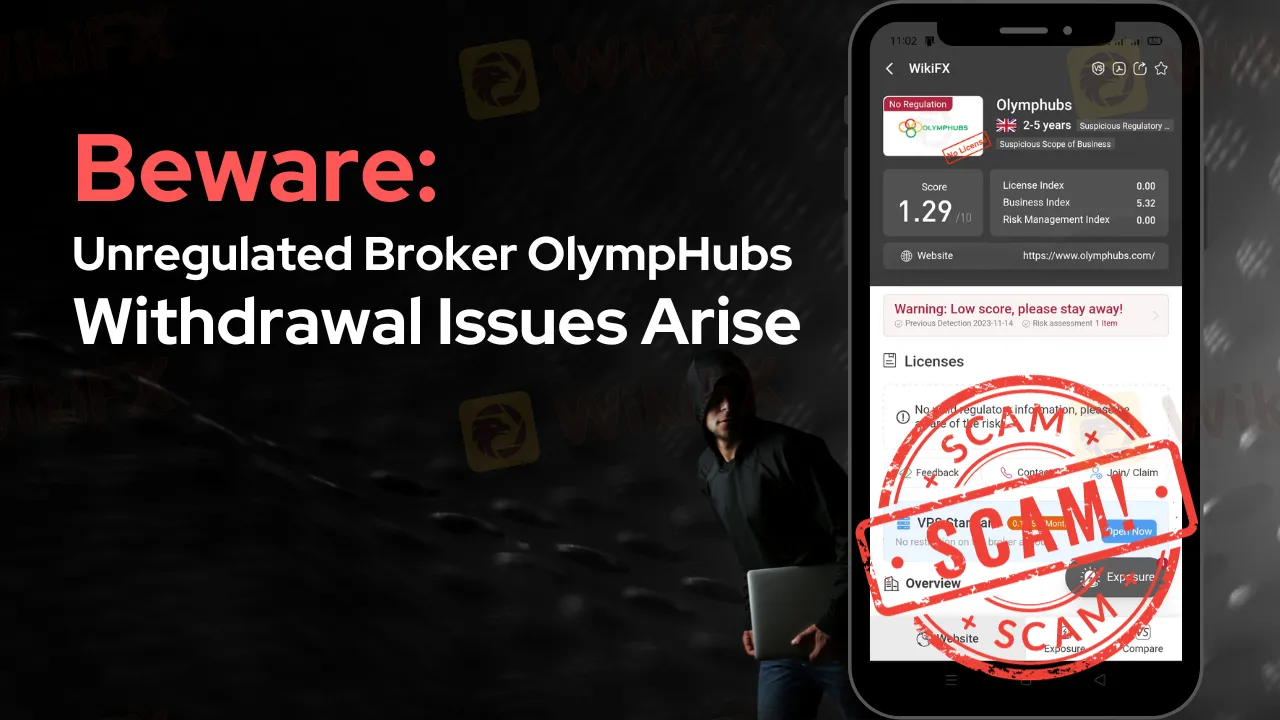

Abstract:Uncover the truth about OlympHubs, an unregulated broker with escalating withdrawal problems and questionable practices. Learn how to safeguard your investments in online trading.

Introduction

In today's fast-paced financial world, the allure of online trading platforms has become irresistible to many. However, the rise of such platforms has also paved the way for questionable practices by some brokers. A glaring example of this is OlympHubs, an online trading broker currently mired in controversy due to its unregulated status and escalating withdrawal issues. This article aims to shed light on the recent challenges faced by traders using OlympHubs and the importance of regulation in online trading.

Latest Case

A disturbing incident involving OlympHubs was recently reported to WikiFX by an anonymous trader. This individual experienced significant hurdles when attempting to withdraw funds. Despite assurances from OlympHubs that withdrawal was possible, the trader was unexpectedly required to deposit additional funds as a “withdrawal fee.” Surprisingly, the broker did not deduct this fee from the existing account balance but demanded an extra deposit. Following this deposit, OlympHubs then requested another, previously unmentioned fee, raising serious questions about its intentions and business practices.

Victim's statement

“Even though I have paid all of the withdrawal fees they asked for, my money is still with them. After a period of inactivity, they gave me a message informing me that I would need to wait for an announcement from them.”

OlympHubs Withdrawal Issues

Complaints about withdrawal issues with OlympHubs have been increasing, as reported to WikiFX. These issues are directly linked to the broker's regulatory status. Being unregulated, OlympHubs operates without the oversight and accountability mandated for licensed brokers. This lack of regulation significantly increases the risk for traders, who may find themselves vulnerable to unethical practices, including refusal of withdrawals or unexpected fee demands.

The Perils of Unregulated Brokers

The case of OlympHubs serves as a cautionary tale for those venturing into online trading. Unregulated brokers operate in a high-risk environment, often without guaranteeing revenue or security for their clients' investments. This situation creates an opportunity for such entities to engage in scams, potentially resulting in the loss of the entire capital invested by traders.

The Importance of Regulatory Bodies

Regulatory bodies play a crucial role in safeguarding traders' investments. They ensure that brokers adhere to strict financial standards and ethical practices, providing a safety net for investors. In cases of unlawful activities by a broker, regulated entities are more likely to see the return of their funds, unlike unregulated brokers like OlympHubs.

Overview of OlympHubs

OlympHubs offers trading opportunities in Forex, Stocks, Bonds, and Cryptocurrency. Despite its London-based office at 20-22 Wenlock Road, the broker's official website lacks crucial information. It neither states its regulatory status nor provides a license or registration number, further confirming its unregulated nature.

Bottom Line

The troubles surrounding OlympHubs underscore the paramount importance of choosing a regulated broker for online trading. Traders must exercise due diligence in verifying the regulatory status of any trading platform to safeguard their investments. The OlympHubs saga is a stark reminder of the risks involved with unregulated brokers and the need for vigilant investment practices.