Abstract:eToro adds 94 UCITS ETFs to its platform, offering zero commission and new data insights. Learn more about the benefits of investing in these ETFs and how to access them on eToro.

Online broker eToro has announced that it has added 94 UCITS ETFs to its list of investment instruments, giving its users more options to diversify their portfolios.

UCITS ETFs are exchange-traded funds that comply with the Undertakings for Collective Investment in Transferable Securities (UCITS) directive, a set of rules that regulate mutual funds and other investment products in the European Union. UCITS ETFs offer investors exposure to various asset classes, sectors, regions, and themes while ensuring high standards of investor protection, liquidity, and transparency.

The list of new additions includes ETFs like: $IQQQ.DE, $IQQI.DE, $IS3R.DE, $XUTC.DE, $ICGB.DE, $MDAXEX.DE, $IS04.DE, $2B78.DE $ICGA.DE, $VVSM.DE, $QDVH.DE, $G2X.DE, $GC40.DE, $IQQK.DE, $ZPDH.DE, $INDUEX.DE, and $PCOM.DE. These ETFs cover various categories such as technology, healthcare, sustainability, emerging markets, and more.

Zero commission applies to the newly added stocks and ETFs for users where the zero commission policy is offered. Zero Commission means that no additional fees will be charged or added to the raw market spread on your stocks & ETF positions. Also, there are no limits on commission-free positions, and you can buy fractional shares.

The brokerage has recently announced three new data resources that are on all ETF pages on its platform. These data points give traders a load of valuable information and help simplify the world of ETFs.

The three new data insights are Expense Ratio, Prospectus Link, and Annualized Return Chart. These three points are visible on the Stats tab of any ETF.

- Expense Ratio: This shows how much an ETF charges in annual fees as a percentage of its total assets. A lower expense ratio means lower costs for investors.

- Prospectus Link: This provides a direct link to the official document that contains detailed information about an ETFs objectives, strategies, risks, fees, and performance.

- Annualized Return Chart: This displays the historical returns of an ETF over different time periods (1 year, 3 years, 5 years), as well as the average annual return since inception.

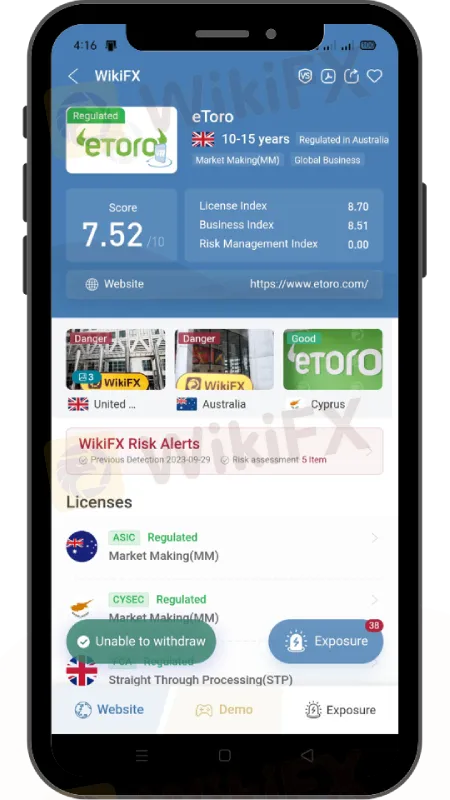

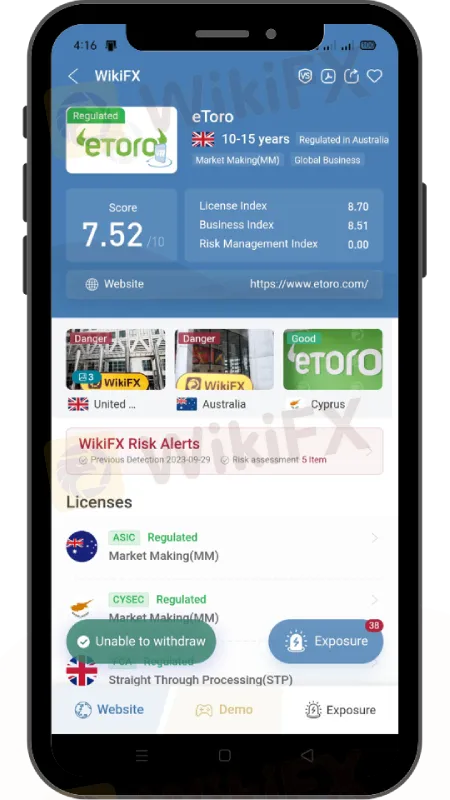

About eToro

eToro is a well-known online trading platform that allows users to trade a wide range of financial assets, including stocks, cryptocurrencies, commodities, and more. It is well-known for its user-friendly design and social trading features, which let users observe and copy the actions of expert investors.

In terms of regulatory status, eToro takes its regulatory duties seriously in order to provide its customers with a safe and secure trading environment. It is regulated by multiple authorities, including:

- Financial Conduct Authority (FCA): eToros operations in the United Kingdom are regulated by the FCA, one of the most reputable financial regulatory bodies globally. This regulation ensures that eToro adheres to strict standards of conduct and transparency.

- Cyprus Securities and Exchange Commission (CySEC): eToros operations in Europe are regulated by CySEC, which oversees the investment services market in Cyprus and the European Economic Area. This regulation ensures that eToro complies with the Markets in Financial Instruments Directive (MiFID) and other relevant laws.

- Australian Securities and Investments Commission (ASIC): eToros operations in Australia are regulated by ASIC, which is responsible for enforcing and regulating company and financial services laws in Australia. This regulation ensures that eToro meets the requirements of the Corporations Act and other relevant legislation.

eToro also operates under other licenses in various jurisdictions around the world. For more information about eToros regulations and licenses, please visit their website.

eToro is constantly striving to improve its platform and offer more choices and opportunities to its users. By adding 94 UCITS ETFs to its list of investment instruments with zero commission, eToro has once again demonstrated its commitment to providing a diverse and accessible trading experience for everyone.

Stay updated on the latest news on eToro, install WikiFX App on your smartphone.

Download link: https://www.wikifx.com/en/download.html