Abstract:Liska Investors Beware! Latest News on Platform Shutdown Reveals Forex Trading Risks. Learn How to Spot Scam Brokers & the Myth of 'Guaranteed Profits.' Stay Informed in Online Trading.

Introduction: The Unfolding Story Behind Its Operation

With the rise of digital currencies and online trading platforms, many have sought to capitalize on the trend. Liska, a crypto trading broker, has recently garnered significant attention across various social media platforms. The buzz around it, especially on Facebook, stems from its tantalizing offers of guaranteed profits. Liska's primary pull factor? Their trading signals promise nothing but profit. They even invite potential investors to join their Telegram community chat, giving the illusion of a satisfied and profiting clientele.

However, seasoned investors know that in the Forex Trading world, 'guaranteed profit' is a red flag. The vast majority of brokers that peddle such promises, especially those unregulated, often operate on the periphery of legitimacy, using models eerily similar to the infamous “Ponzi Scheme”. No expert, no matter how skilled, can precisely predict the price movements of cryptocurrencies or forex currencies. This brings to light a simple fact: “guaranteed profit” is a myth.

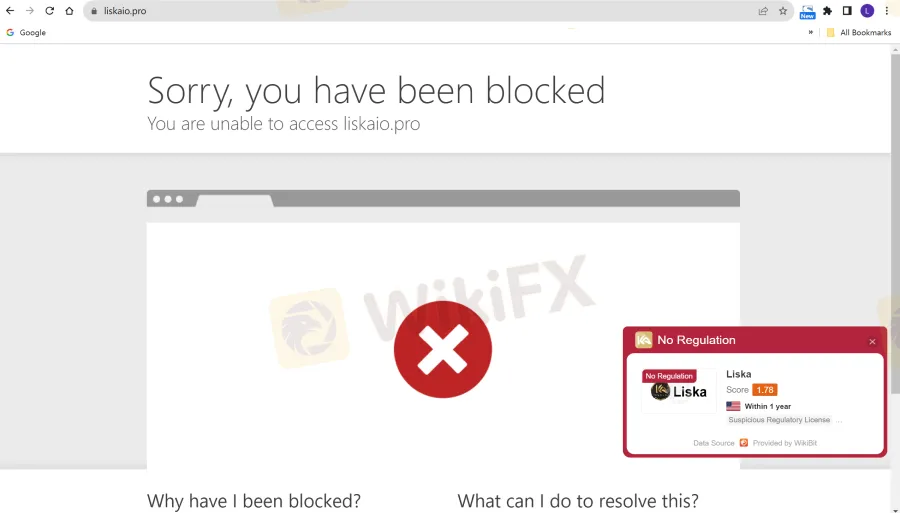

Liska's Operation Shutdown

Lately, Liska's operations seem to have come to an abrupt halt. The platform is mysteriously inaccessible, leaving many investors high and dry. Reports have started flooding Facebook with claims like, “Liska's Gone... No Withdrawal,” showcasing the anxiety and uncertainty that many of Liska's investors now face.

In a comparable incident, V5 Forex, a broker that similarly offered 'too good to be true' Forex trading signals, operated without hitches for nearly a year. Early investors saw consistent, albeit meager, profits, fueling the notion that the platform was legitimate. Yet, the reality was far grimmer. While the broker promised returns of up to 15%, most users only saw profits ranging from 1 to 2% of their investments.

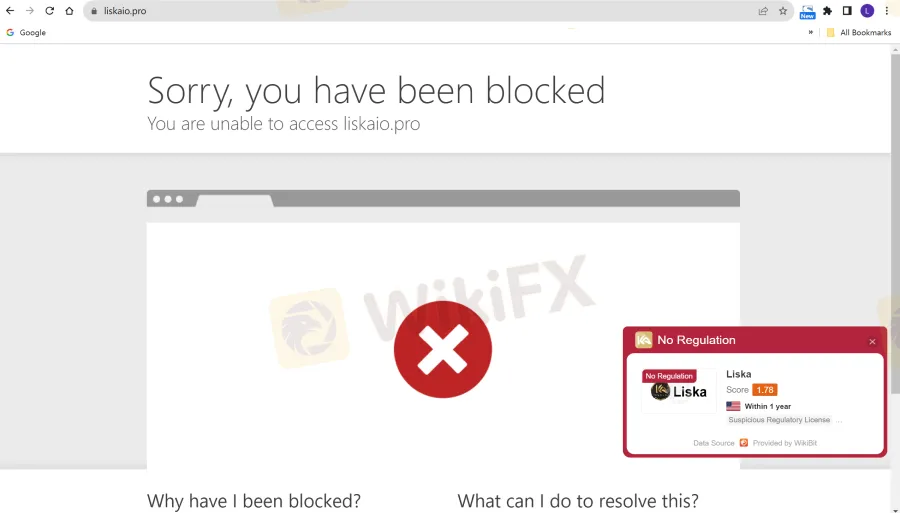

Liska Trading Broker Overview

The inherent risk with unregulated brokers is well documented. These platforms operate without the oversight or regulations imposed on licensed entities, making them a volatile and risky investment. Liska unfortunately falls into this bracket. Without any recognized regulatory oversight, the platform's legitimacy and operation were always on shaky grounds.

For those interested in delving deeper into Liska's operations and its history, a detailed article can be found at the link below.

Red Flags: Recognizing a Scam Broker

Here are common pitches indicative of a potentially fraudulent broker:

- Guaranteed Profits: If it sounds too good to be true, it probably is.

- High Returns with Low Investment: Beware of brokers who promise large returns for minimal investments.

- Pressure to Invest More: Any broker pushing you to deposit more funds should be approached with caution.

- Limited Information: A lack of transparency about the platform's operations, history, or team.

- Difficulty in Withdrawing Funds: Delays or excuses when attempting to withdraw your money.

Awareness: “No Such Thing as Guaranteed Profit in Online Trading”

In the ever-evolving world of online trading, it's vital for investors to remain vigilant. It's tempting to jump onto platforms promising sky-high returns, but one must always remember the inherent risks associated. As reiterated, there's “No Such Thing as Guaranteed Profit in Online Trading”.

Conclusion

In the pursuit of profit, it's easy to get lured by the siren call of guaranteed returns. However, the world of online trading is fraught with risks, and the story of Liska serves as a cautionary tale. Being informed, doing thorough research, and being skeptical of too-good-to-be-true offers are essential in ensuring your investments remain safe.

To stay updated on the latest news, install the WikiFX App on your smartphone and access the latest new even on the go.

Download the App here: https://www.wikifx.com/en/download.html