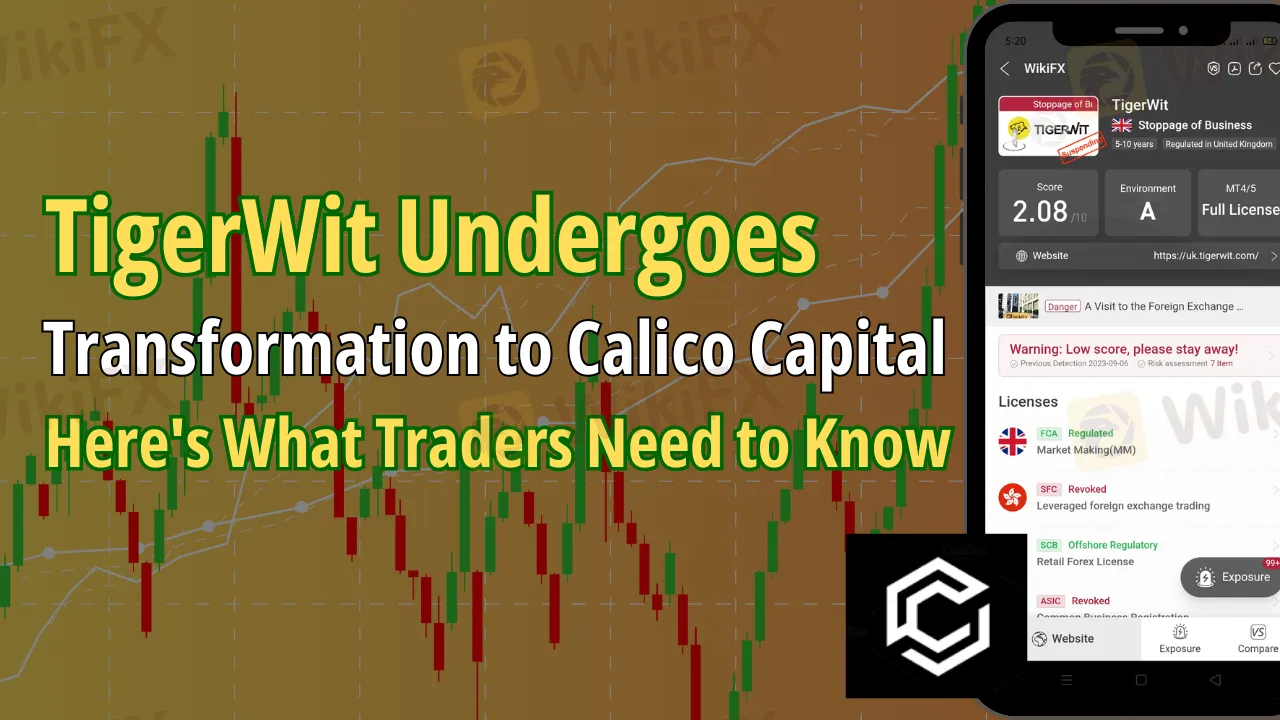

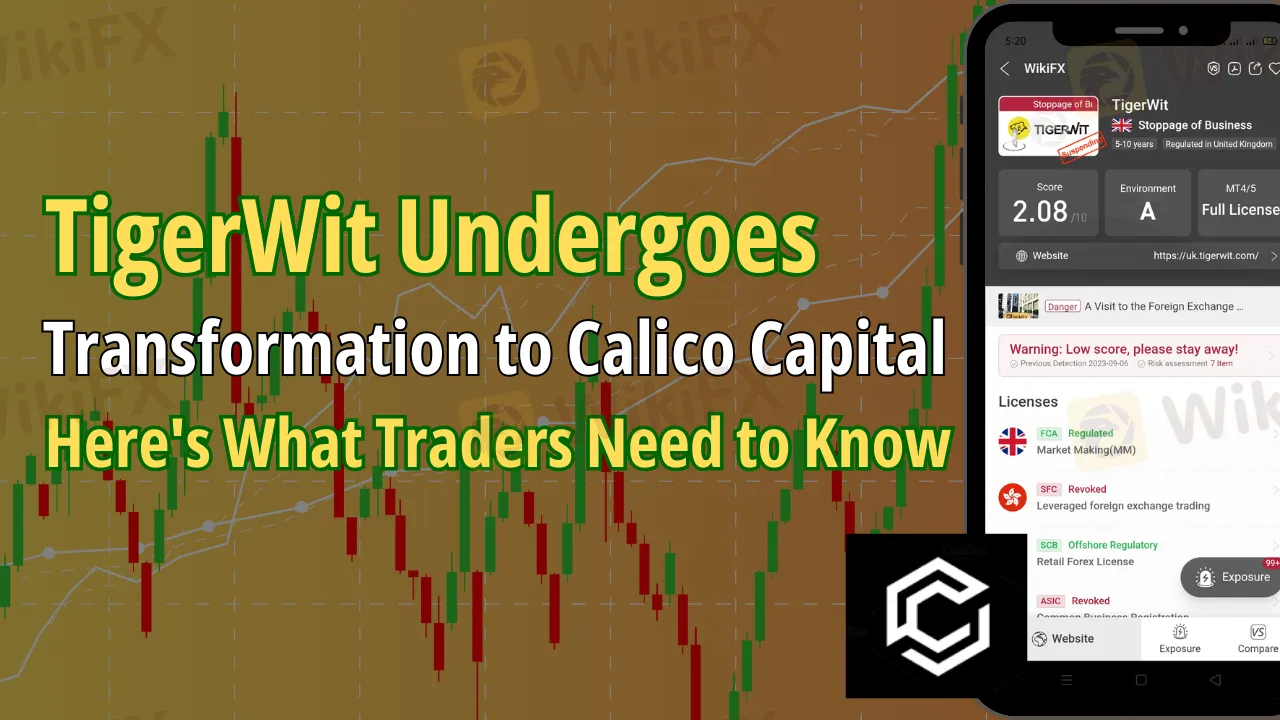

Abstract:London's TigerWit rebrands to Calico Capital post FCA-licensed sale. Traders urged to stay vigilant amid offshore concerns.

London's renowned Retail FX and CFDs broker, TigerWit, is undergoing a significant transformation. The company, licensed by the Financial Conduct Authority (FCA), is gearing up for a rebranding and will soon be known as Calico Capital. This shift in identity follows a series of events, including a botched sale last year, a successful sale this year, and a falling out with its offshore partners.

A Quick Peek at TigerWits Past

About a decade ago, TigerWit was born out of the vision of Chinese entrepreneurs Summer Xu and Weilong Song. The firm mainly catered to clients in China and the Far East. Fast forward to 2016, TigerWit expanded its reach by gaining an FCA license, paving the way for its entry into the UK and European markets. Furthermore, in 2021, they secured an Electronic Money Institution authorization from the FCA.

Challenging Times and New Beginnings

Despite its ambitious start, TigerWit UK's financial performance did not reach anticipated heights. The firm's revenues saw a decline by 2022, leading the then-owner, Tim Hughes, to strike a deal with crypto exchange FTX. However, due to unforeseen circumstances, the deal crumbled.

Come 2023, a fresh opportunity knocked on TigerWit's door. Jim Manczak's investment company, Investor Limited, expressed interest in taking over. Now, with FCA's approval awaited, the company is all set to restart operations as Calico Capital. Their immediate focus will be on serving B2B and professional traders, with plans to cater to the general public by 2024.

A Word of Caution for Traders

The transition hasn't been without challenges. With the takeover, the global operations of TigerWit have ceased. However, traders need to be wary. Reports suggest that TigerWit LLC, the offshore segment previously associated with TigerWit, has been causing concerns for clients trying to withdraw their funds.

In light of this, Jim Manczak and his team have launched a warning for traders via their website, emphasizing the fact that TigerWit Group Limited and its associated entities do not offer any legitimate trading or financial services.Traders with concerns or complaints are being urged to reach out to their local regulatory bodies. Additionally, for any withdrawal requests or concerns related to funds, traders can directly get in touch with the company through support@tigerwitgroup.com.

Stay Alert, Stay Safe

This story highlights the ever-changing landscape of the financial world. As traders, staying updated and ensuring the authenticity of platforms is crucial. If you're associated with TigerWit or considering trading with its successor, Calico Capital, remember to be vigilant and informed.

For more such updates, consider downloading the WikiFX App via the provided link.

Download link: https://www.wikifx.com/en/download.html