Is 9X markets Legit or a Scam? 5 Key Questions Answered (2025)

You are likely here because you are considering trading with 9X markets, but their very recent launch date has you worried about the safety of your funds. You are right to be cautious.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:If you're considering investing your money, you must make a wise decision and not fall prey to fraudulent activities.

CedarFX, an unregulated broker, pretends to be a tempting investment opportunity with its eco-friendly trading and low spreads. Still, it poses a high risk due to the lack of regulatory oversight. At WikiFX, we prioritize transparency and security, so we're here to provide an in-depth analysis of CedarFX. We'll look closer at its potential risks, absence of regulation, and features to help you make an informed decision about your investment journey.

CedarFX - A Quick Overview

CedarFX is an independent brokerage focusing on knowledge-sharing and equipping clients with the necessary tools to succeed in financial markets. It claims to offer a variety of over 170 tradable assets, such as forex, crypto, stocks, indices, and commodities, with no commissions or transaction fees. It also claims that traders can utilize a demo account for practice before investing real funds, and its customer support team is available 24/7 through various channels. According to the broker, CedarFX provides 0% commission accounts to help clients maximize their returns and multiple deposit and withdrawal methods, including cryptocurrency transactions, for speedy and effective fund access.

Is CedarFX Regulated?

According to WikiFX's investigation, CedarFX lacks regulatory oversight, leaving investors' funds potentially unprotected by laws and at higher risk. As its webpage does not display any regulatory status, it is crucial to exercise caution and avoid CedarFX as they may be considered a scam broker.

Clientele Feedback:

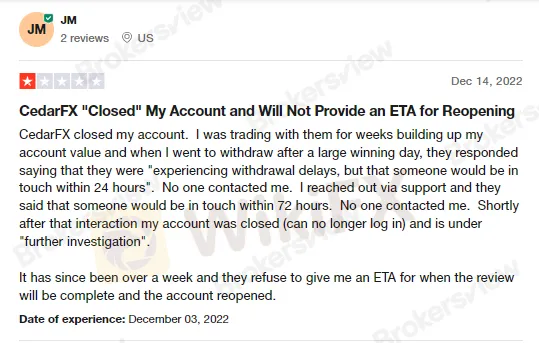

The feedback on CedarFX provided by clients has been predominantly negative, citing problems with withdrawals and significant spread widening. Despite this, some users have noted their appreciation for the broker's partnership with an organization focused on climate change. However, there have been accusations of CedarFX being a scam and having ties to scammers on Instagram. Given these mixed opinions, it is essential to exercise caution when considering CedarFX as a broker.

What Makes CedarFX A Scam Broker?

CedarFX has been accused of being a scam broker due to several factors.

Firstly, the lack of transparency and communication channels raises red flags. They do not provide clients' phone numbers or email addresses, limiting their ability to contact the broker.

Secondly, the absence of regulatory licenses is a cause for concern, as legitimate brokers are typically licensed and regulated by financial authorities.

There have also been instances of account freezing and closure, mainly when clients make significant gains or attempt to withdraw funds.

The clients also reported that CedarFX accused them of using high-frequency trading and refused to return their funds.

The broker's partnership with Eco, a climate change organization, has been criticized as a ploy to lure customers.

Last but not least, CedarFX has been added into CFTC's Registration Deficient List.

Bottom Line:

CedarFX's low spreads and eco-friendly trading campaign may appeal to a diverse range of traders. Still, potential investors should be aware of the numerous negative reviews, including withdrawal problems and spread widening issues. In addition, WikiFX has also flagged CedarFX as an unregulated broker, as it potentially unsafe for investors. Before investing, it is crucial to do thorough research and understand the risks involved. It is essential to exercise caution and carefully consider all aspects before deciding to invest with CedarFX.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

You are likely here because you are considering trading with 9X markets, but their very recent launch date has you worried about the safety of your funds. You are right to be cautious.

Malaysia is facing a sharp escalation in online scam activities, with reported losses reaching RM2.7 billion between January and November, driven by increasingly sophisticated and well-organised fraud schemes. Official data shows a significant rise in cases compared to the previous year, while experts warn that the true economic impact may be far greater due to widespread underreporting.

Global financial markets are closing the year with a stark divergence in asset performance, characterized by a robust "Santa Rally" in traditional equities and precious metals, while speculative digital assets struggle with liquidity constraints.

If you are considering depositing funds with MYFX Markets, you need to pause and read this safety review immediately. While many brokers operate with high standards of transparency, our analysis of the data suggests MYFX Markets poses significant risks to retail investors.