Abstract:This article aims to outline V5 Forex Global’s problems which were submitted by a compliant addressing the automatic closure issue and the exorbitant commissions imposed, raising questions about the broker's practices.

In the fast-paced world of online trading, traders rely on brokers to provide a secure and fair trading environment. However, a concerning complaint has been brought to WikiFXs attention by a reader regarding their experience trading the AUD/JPY variety with V5 Forex Global.

The trader alleges that their positions were automatically closed, resulting in negative balances, and they were subjected to manipulated commission charges. This article aims to outline the details of the complaint, addressing the automatic closure issue and the exorbitant commissions imposed, raising questions about the broker's practices.

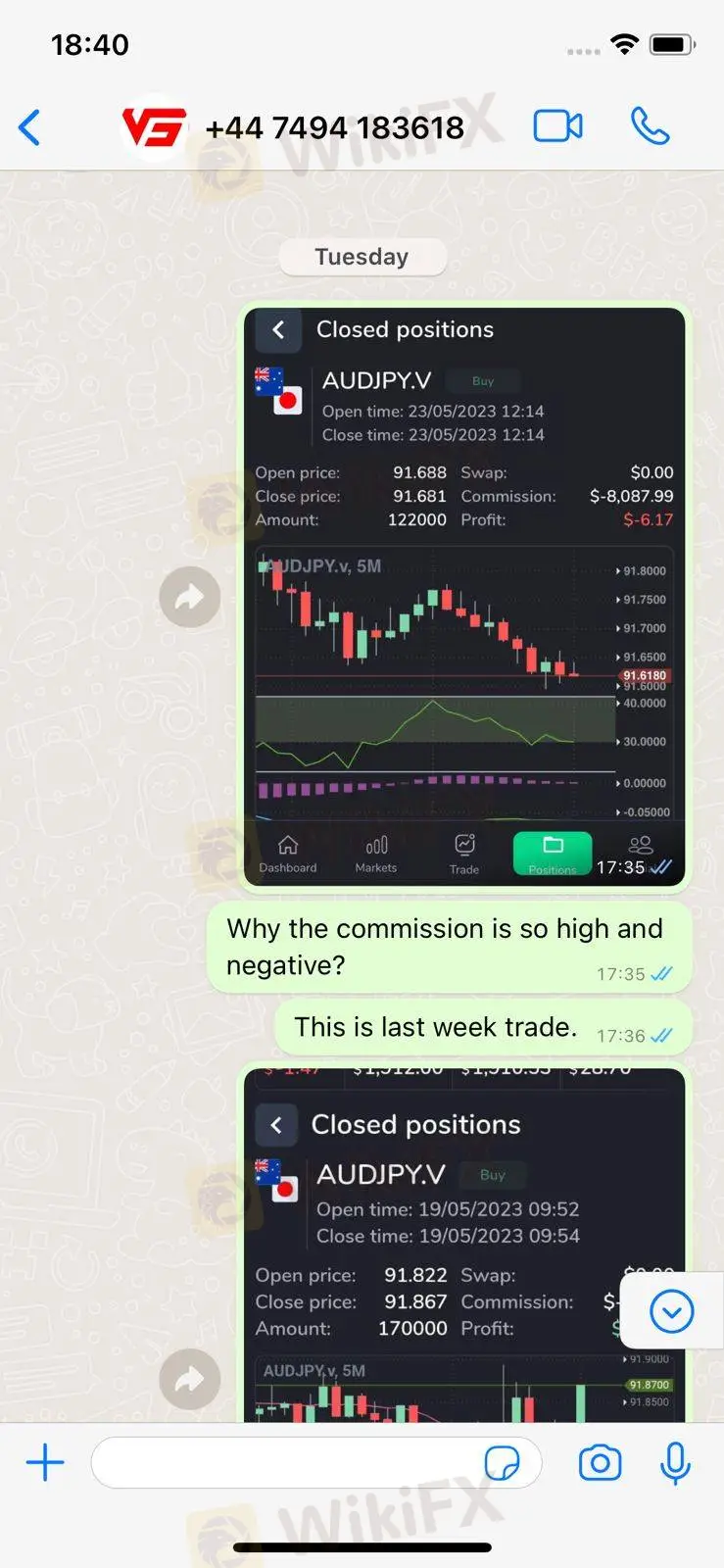

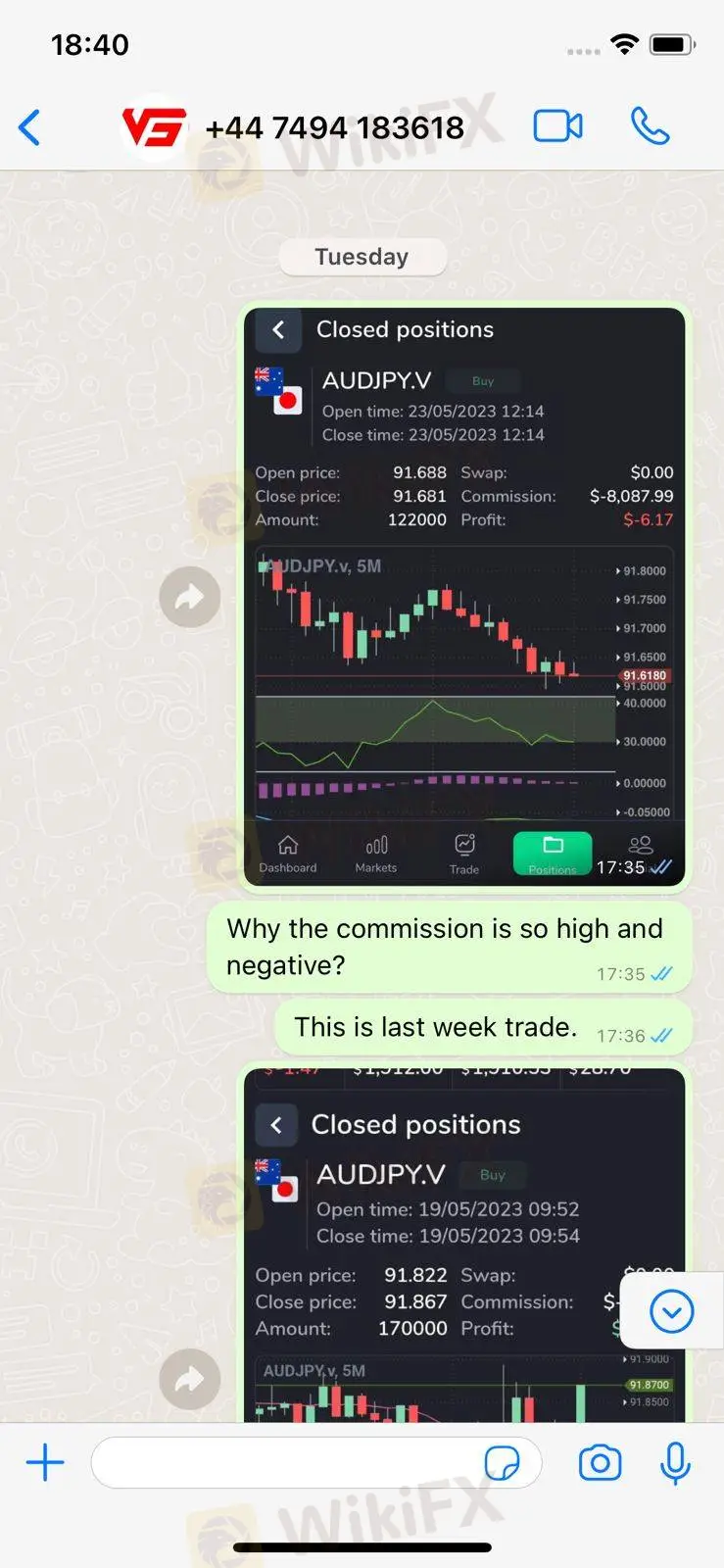

According to the complainant, they and their friends engaged in trading the AUD/JPY variety. However, upon initiating their positions, they were shocked to discover that the trades were automatically closed, leaving them with negative balances. Such an occurrence not only raises concerns about the stability and reliability of the trading platform but also questions the trader's autonomy in managing their trades.

Adding to the distressing experience, the trader alleges that the platform set a manipulated commission structure, which was ten times higher than their original balance. Legitimate brokers are expected to adhere to fair and reasonable commission rates that align with industry standards. The imposition of such outrageous commissions, surpassing the trader's actual balance, is highly irregular and raises suspicions about the broker's integrity.

The complainant states that their personal loss amounted to $830, while some of their friends suffered losses of nearly $2000 or more. According to their account, the broker's explanation for the excessive commissions was that they were generated by handling fees associated with subordinate trading products. These fees were then subjected to commission percentages at different levels. However, despite the high commissions charged, the traders did not receive any rebates in their wallets, further adding to the confusion and dissatisfaction.

The complainant highlights a discrepancy in the commission structure between the recent trades and trades from the previous week. They note that the commission charges for the previous week were considerably lower, indicating an inconsistency in the broker's practices. Such inconsistencies raise doubts about the transparency and fairness of the commission system employed by the broker.

Traders affected by these automatic closures and manipulated commission charges are rightfully seeking answers and resolution. They deserve transparency from the broker regarding the specific reasons behind the automatic closure of trades and the justification for the exorbitant commission charges. Prompt communication and a fair resolution will not only address the losses incurred by the traders but also restore their confidence in the broker's services and commitment to client satisfaction.

In addition, if you have any unresolved disputes with any forex broker, get in touch with us at WikiFX through the following mediums for further assistance:

Alternatively, you can lodge an Exposure on the WikiFX mobile application, which can be downloaded for free on both Google Play and App Store. Follow the instructions below to lodge your complaint: