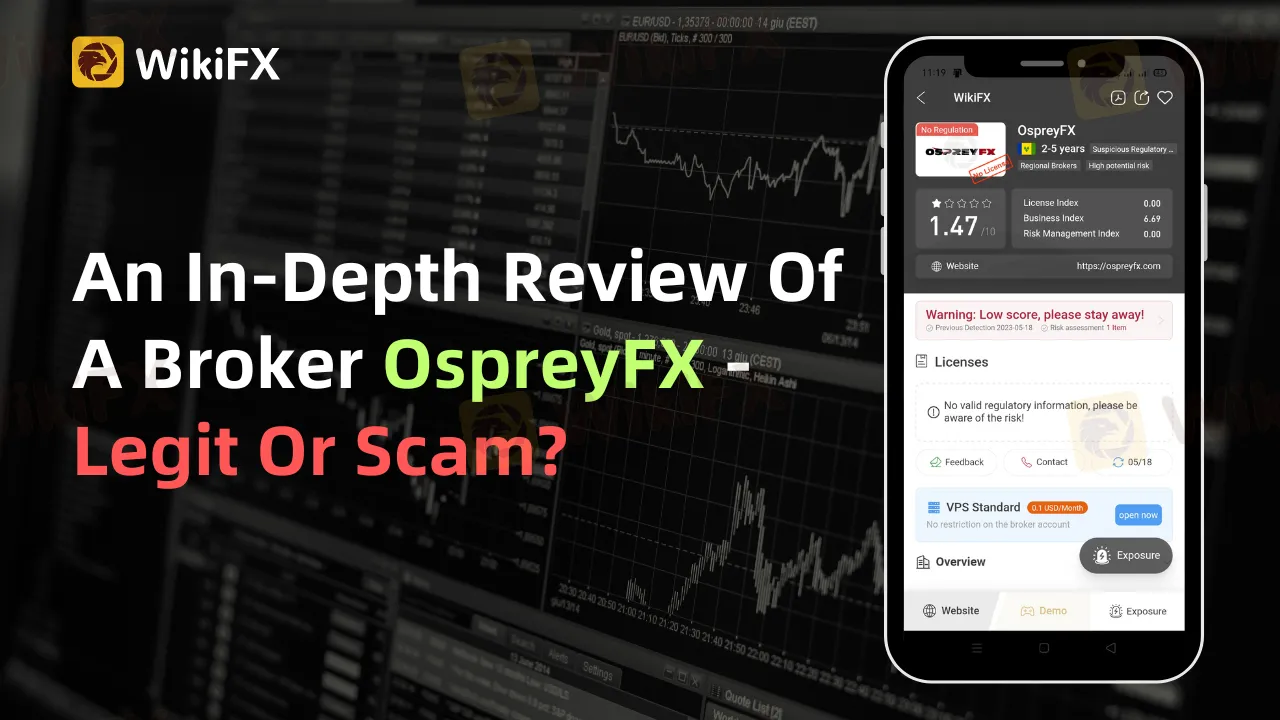

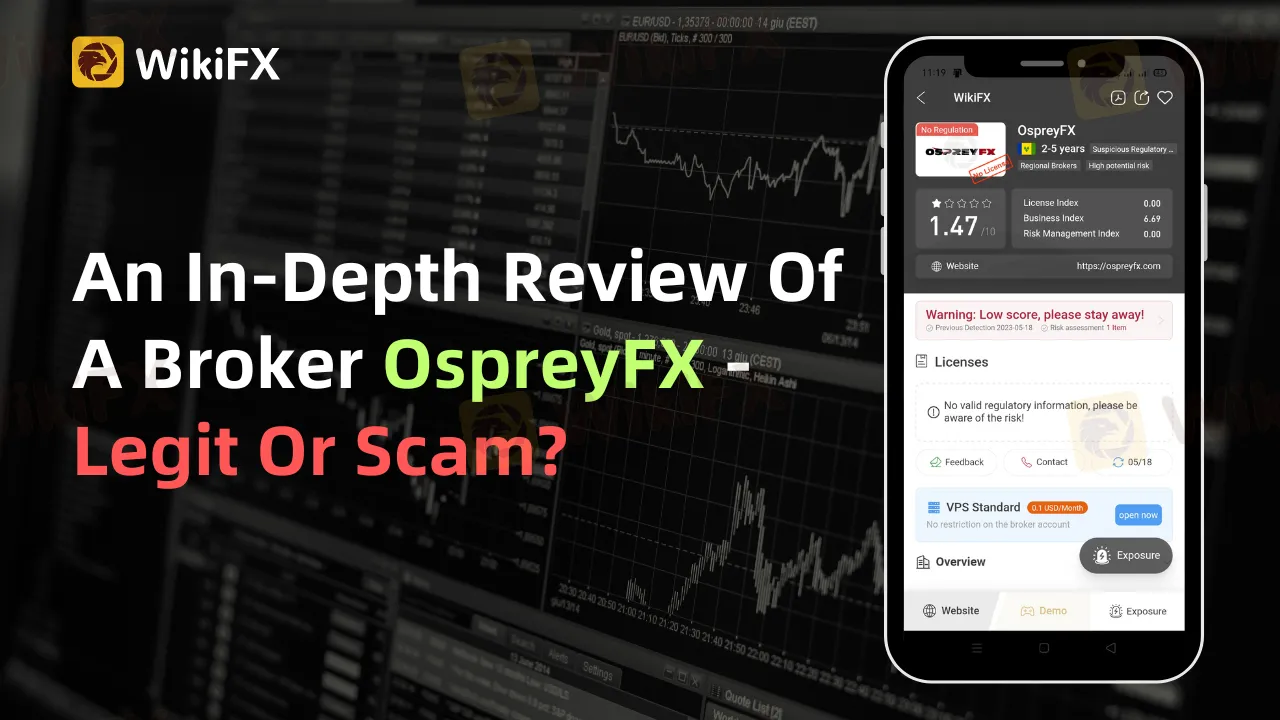

Abstract:OspreyFX, an unregulated online broker offering high-leverage trading, raises significant red flags with its lack of licensing and undisclosed physical location. Investors are urged to partner with regulated brokers and use platforms like WikiFX to verify their credentials for a safer trading experience.

In the world of foreign exchange (forex) trading, the phrase “caveat emptor” – let the buyer beware – resonates more than ever. A multitude of online brokers are vying for your attention and hard-earned capital. In this review, we explore the case of OspreyFX, a platform whose legitimacy is under scrutiny, given its unregulated status and questionable operations.

Upon the initial inspection of the OspreyFX website, it appears to offer a vast array of trading instruments. Forex, cryptocurrencies, commodities, indices, and shares are all part of the menu. The temptation for diversifying one's portfolio could be immense. However, beneath the glossy facade lurks a significant red flag: OspreyFX is unlicensed and unregulated.

About OspreyFX

In the global forex market, regulation is a cornerstone of trader protection. Regulatory bodies such as the US Commodity Futures Trading Commission (CFTC), the UK Financial Conduct Authority (FCA), and the Australian Securities and Investments Commission (ASIC), ensure brokers adhere to strict standards that protect traders from fraud and abuse. On the OspreyFX website, there is a conspicuous absence of any such regulatory affiliations, casting a dark cloud of uncertainty over their operations.

FCA result

NFA result

Adding to the ambiguity, no physical address is provided for OspreyFX. In today's digital age, this might not seem a significant concern, but in the realm of financial trading, it's a massive alarm bell. An absence of a physical location suggests that OspreyFX can disappear without a trace at any moment, taking investors' money along with them.

OspreyFX Leverage

Now, let's delve into OspreyFX's offered leverage of 1:500, a ratio that should make any prudent investor pause. While high leverage can mean high returns, it also dramatically increases the potential for massive losses. It's akin to playing with fire; the higher the leverage, the bigger the potential burn.

Regulated brokers usually offer more modest leverage ratios to protect their clients from significant financial harm. For instance, in the US, the CFTC allows a maximum of 1:50 for major currency pairs. In Europe, under the European Securities and Markets Authority (ESMA), the limit is even lower at 1:30. Such restrictions are in place to protect traders from undue risk, a safeguard noticeably absent from the OspreyFX platform.

Investors Feedbacks

More feedbacks can be seen here: https://www.wikifx.com/en/exposure/exposure/8051861404.html

Avoidance

So, what can traders do to avoid falling prey to potential scams like OspreyFX? It's crucial to only partner with regulated brokers and always verify their credentials. WikiFX, a reliable forex broker inquiry platform, provides a wealth of information to assist traders in making informed decisions. Traders can review the regulation status, licenses, and overall credibility of a vast number of forex brokers.

Using tools like WikiFX can help ensure that your hard-earned capital is not in the hands of unscrupulous operators. Instead, you can be confident that your investments are safeguarded by internationally recognized regulatory standards.

In conclusion, the allure of a seemingly varied trading platform like OspreyFX can be tempting. However, the absence of regulation, undisclosed physical location, and dangerously high leverage offering presents a significant risk. The world of forex trading is not a game of blind luck but of calculated decisions, and part of those calculations should always be the legitimacy and reliability of your chosen broker.

The old adage “If it's too good to be true, it probably isn't” stands tall in the world of forex trading. While some may be lured by the high-risk, high-return promise of OspreyFX, the safer and smarter choice lies with regulated brokers who operate transparently and with accountability. Financial trading should not be a leap of faith into the unknown, but a calculated risk undertaken with a trusted partner.

Navigating the world of online brokers can often feel like traversing a minefield. The high-leverage offer from OspreyFX may seem attractive, but it can also be a trap. In the absence of regulation, the broker can freely extend such potentially destructive offerings. Experienced traders understand that while high leverage can boost profits, it can also lead to devastating losses, possibly wiping out their entire investment.

OspreyFX, with its vast offerings of trading instruments, might appear to be a one-stop-shop for every investor's needs. But without the safeguards and assurances offered by regulatory compliance, you, as an investor, stand to risk more than just your capital. You risk falling prey to unethical practices, and even fraud, which could leave a lasting dent in your financial well-being and confidence.

Partnering with a regulated broker isn't just a sensible choice – it's a fundamental prerequisite for secure trading. Regulatory bodies exist to protect investors, establish fair trading practices, and maintain the integrity of the market. When a broker like OspreyFX operates without any regulatory oversight, they lack accountability, which could leave investors helpless in the face of any malpractice.

Platforms such as WikiFX are invaluable resources for traders, offering a reliable means to verify the regulation status and credibility of a multitude of forex brokers. With WikiFX, traders can make informed decisions and avoid potential scam brokers.

In conclusion, it is always crucial to tread carefully in the forex market and arm yourself with knowledge. An unregulated broker like OspreyFX may present attractive offers, but the underlying risks far outweigh any potential rewards. Prudence, due diligence, and the use of trustworthy platforms like WikiFX to verify broker credibility are essential in ensuring a safe and rewarding trading experience.

Remember, the more informed you are, the safer your investments will be. Don't allow attractive offers to cloud your judgment. Always stick to regulated brokers to secure your capital and peace of mind. Don't let your forex trading journey be tarnished by potential scams. Instead, let it flourish with the right partner, under the protective umbrella of regulation. Your trading future deserves nothing less.

Download and install the WikiFX App on your smartphone to stay updated on the latest news.

Download the App here: https://social1.onelink.me/QgET/px2b7i8n