Abstract:Presidential elections, like Turkey's on May 14, 2023, significantly impact forex trading due to potential policy shifts, causing volatility and uncertainty. Traders need to stay informed and adaptable, turning potential risks into profitable opportunities amidst currency fluctuations for example Turkish Lira (TRY).

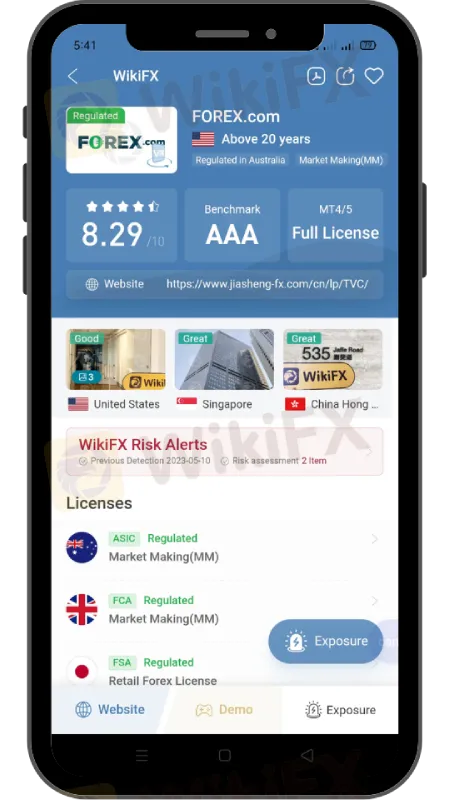

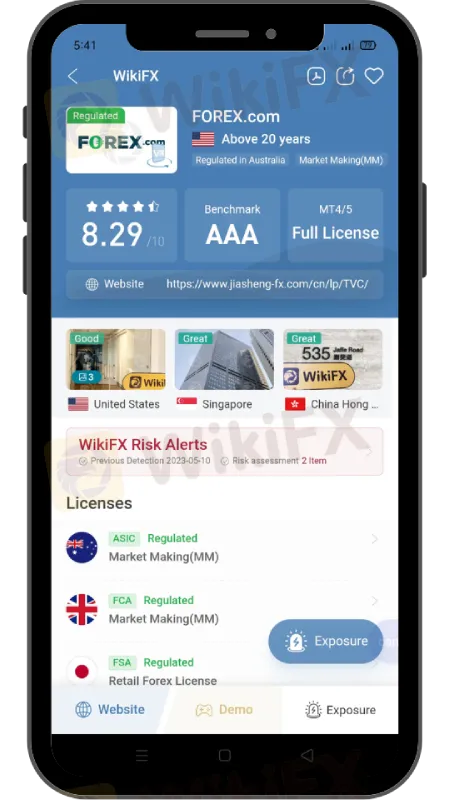

The upcoming Turkish presidential and parliamentary elections, scheduled for May 14, 2023, could have a profound impact on the dynamics of global forex trading, according to a warning issued by FOREX.com Japan, a leading retail Forex and CFD broker. This electoral event underscores a fundamental truth about currency trading: political milestones, such as elections, can trigger significant fluctuations in forex markets.

The broker anticipates that the market open rate on May 15, 2023, could deviate substantially from the closing price on May 12, 2023. The Turkish Lira (TRY), in particular, is expected to experience sudden swings. This forecast raises a broader question: how can a presidential election influence forex trading?

Forex trading operates within the worlds largest financial market, with daily transactions exceeding $6 trillion. It thrives on instability, and few events create greater uncertainty than elections, particularly ones with far-reaching consequences. This is due to the fact that elections may result in changes in government policy, which can then influence economic stability, growth prospects, and investor confidence.

The time leading up to an election may be fraught with uncertainty, which can cause volatility in the FX market. Uncertainty regarding a country's economic policies typically causes traders to become more cautious, resulting in currency value changes. If the election results are likely to result in a shift in economic policy that is viewed as less favorable to the country's economy, the currency may depreciate.

In the event of the Turkish elections, the possibility of a big policy change might cause the TRY to become more volatile. Spreads, the difference between the bid and the asking price, may widen during this period. Liquidity may also decline, leading to transactions occurring at unexpected prices. Further, market fluctuations may cause spreads to widen or price delivery to temporarily halt for other currency pairs.

FOREX.com Japan, in anticipation of these effects, has advised its clients to be aware of sudden fluctuations in swap points and market prices and to manage their positions and funds wisely. It also plans to implement measures such as widening spreads, restricting positions, and raising maintenance margin rates in response to potential market volatility and decreased liquidity.

The aftermath of an election can also influence forex trading. If the results lead to a stable government and promises of business-friendly policies, this can boost investor confidence and strengthen the currency. Conversely, a contentious or unexpected outcome can increase political risk, leading to a fall in currency value.

To navigate this turbulence, forex traders need to stay informed about the political landscape and understand how different election outcomes could impact economic policies. Traders should also be prepared to adjust their strategies in response to changing market conditions.

As the Turkish elections loom, traders across the globe are bracing for potential shifts in the forex market. However, these events also underscore the opportunity inherent in forex trading: volatility, while it can present risks, also opens the door for significant returns for those who can effectively manage and navigate these changes.

In conclusion, while presidential elections can indeed affect forex trading, the impact can be both positive and negative, depending on the outcome. Traders who remain vigilant and adaptable can leverage these fluctuations to their advantage, turning potential risks into profitable opportunities.

Download and install the WikiFX App on your smartphone to stay updated on the latest news.

Download the App here: https://social1.onelink.me/QgET/px2b7i8n