Abstract:Saxo Bank has made several improvements to its trading platform including adding an "Underlying price" column, an "Orders" field, new transaction and portfolio reports, a new Portfolio tab in SaxoTraderGO platform, and a new marketing portal. The changes aim to enhance the user experience and transparency for clients and partners.

A multi-asset financial expert, Saxo Bank, recently revealed several improvements to its trading systems. On all of Saxo's platforms, a new section titled “Underlying price” has been added, which is one of the noticeable alterations. This section shows the actual price of the asset being exchanged, which is useful for dealers who are dealing with options.

The addition of a “Orders” section to Saxo's trade and end account tickets is another enhancement to the trading tools. This section shows whether an order has already been placed for the chosen asset, giving dealers more insight into and control over their transactions.

New transaction and stock records from Saxo are also being made available; they were supposed to be available in April but were postponed until the end of May. These studies are meant to give customers more in-depth, practical knowledge about their business and stock assets.

Saxo has also revealed that it will be adding a new Portfolio option to its SaxoTraderGO platform in June 2023, in addition to these upgrades. The current Account option will be replaced by this new one, which will give customers a more logical and user-friendly experience when examining their accounts and assets.

In April 2023, Saxo will also introduce a brand-new marketing platform within SaxoPartnerConnect. All associate workers will have access to new content as well as pertinent content from the current site through this portal, and the current marketing portal will be shut down.

Saxo's improvements to its trading tools are generally meant to enhance the customer experience and give them more clarity and control over their transactions. The “Underlying price” section, the “Orders” area, and the new transaction and account summaries are all additions made by Saxo to give dealers more tools to make wise investment choices. Clients and partners equally should benefit from the new Portfolio page and marketing portal's more simplified and user-friendly interface.

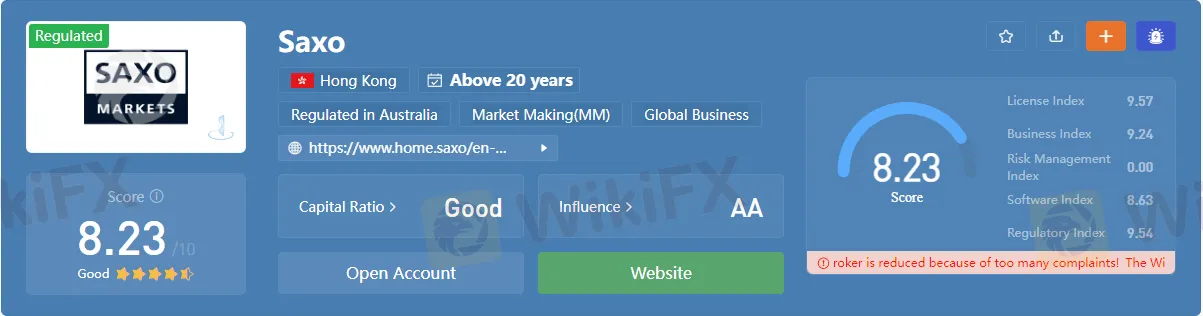

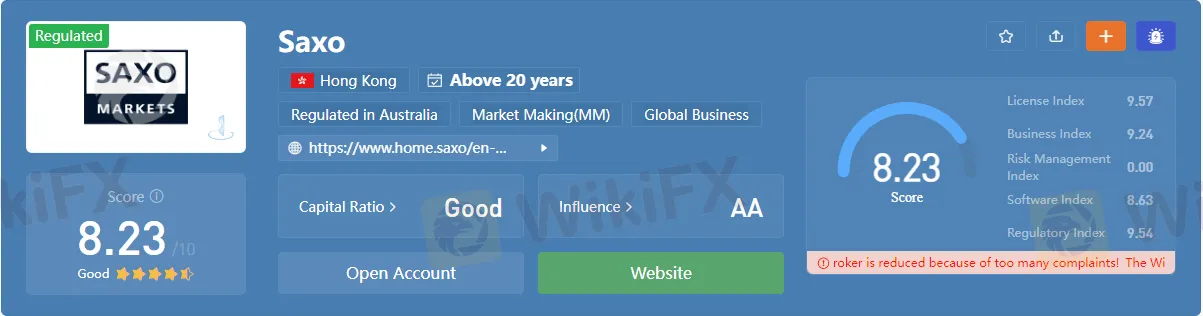

About Saxo Bank

Saxo Bank is a multi-asset bank founded in Copenhagen in 1992 that offers clients a variety of funding and investing choices. Customers can use its internet banking portal to purchase and trade equities, commodities, currencies, options, and futures with clear pricing, cutting-edge monitoring tools, and user-friendly displays. Customers can access emerging markets and unconventional assets through the bank's branches and local support teams in over 100 countries. Saxo Bank is committed to innovation, with a research and development team constantly working to improve the bank's financial systems and services, culminating in the development of cutting-edge trading tools such as a social trading platform and an artificial intelligence-powered trading helper.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download the App: https://social1.onelink.me/QgET/px2b7i8n