Abstract:MetaQuotes, the developer behind the popular MT4 and MT5 trading apps, has reached an agreement with Apple, and the apps are now available for download on the Apple App Store.

MetaQuotes, the developer behind the popular MT4 and MT5 trading apps, has reached an agreement with Apple, and the apps are now available for download on the Apple App Store. This comes after the apps were removed from the store in September 2022, sparking much speculation on various FX industry news sites. While some incorrectly suggested that the ban was due to MetaQuotes' connections to Russia, the real reason was the increasing number of complaints from users of offshore and unlicensed brokers that offer to trade on the platforms. MetaQuotes' founders are indeed from Russia, but the company is based in Cyprus.

The complaints had little to do directly with MetaQuotes, as many of those brokers had no direct business link with the company. Instead, they rented an MT4/MT5 solution from third parties that offer turnkey MetaTrader White Label solutions to smaller brokers and those who want to start a new brokerage, without having to pay expensive MetaTrader license fees, hosting maintenance, and other costs. MetaQuotes had also halted the processing of all new MT4/MT5 White Labels.

Some top Forex brokers who are using both MT4 and MT5 as their trading platforms

XM Group

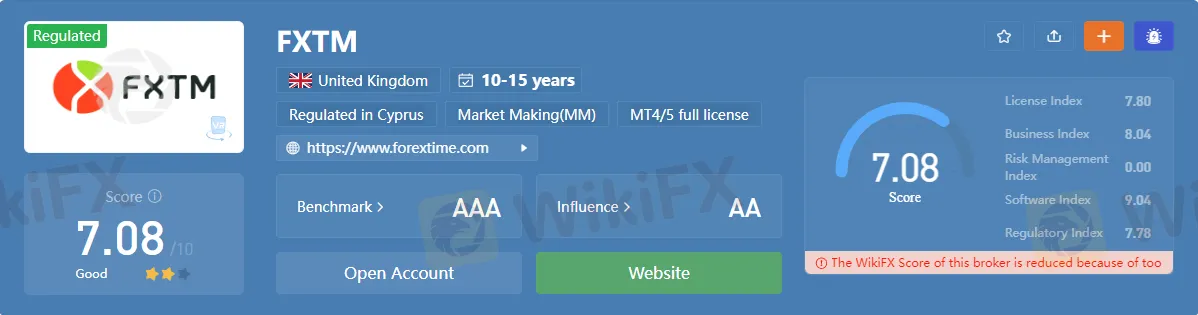

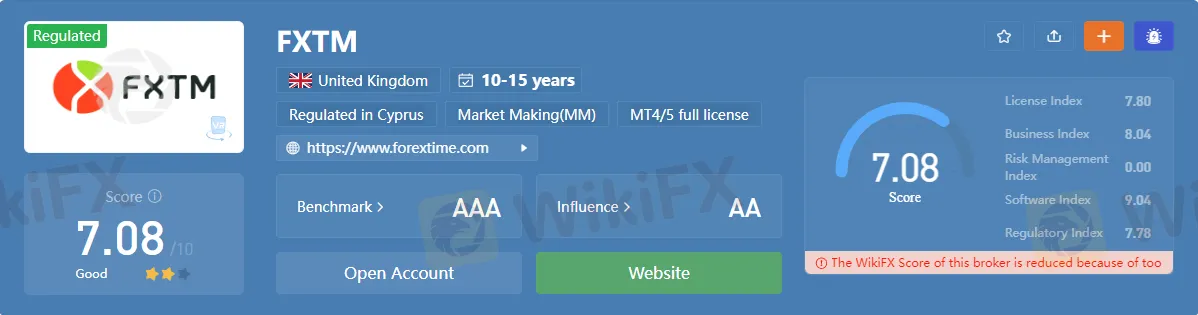

FXTM

Pepperstone

HotForex

Admiral Markets

IC Markets

FxPro

OctaFX

RoboForex

Exness

Over the past five-plus months, MetaQuotes has been in discussions with Apple, demonstrating to the company and the App Store that it will more closely scrutinize which brokers can offer its apps. This means no more offshore or unlicensed brokers, who are infamous for mistreating retail clients and withholding client funds.

During the five and a half months that the apps were unavailable on the App Store, a number of MetaQuotes' smaller competitors sought to offer brokers an MT4 alternative for their Apple iOS device users. An entire sub-industry had been built up around offering turnkey MT4/MT5 White Label solutions, as noted above, which quickly pivoted to offering MT4/MT5 alternatives to brokers and those who wanted to start new brokerage brands.

MT4 and MT5 have remained the dominant trading platform for retail CFD traders, but the ban has changed the industry and led many brokers to look for alternative platforms, not keeping all their eggs in the MetaTrader basket.

Final words

The availability of the MT4 and MT5 trading apps on the Apple App Store once again is good news for users and for MetaQuotes. The company has demonstrated its commitment to making sure its apps are only available to brokers who treat retail clients fairly and who do not withhold client funds. Meanwhile, the ban has led to increased competition in the industry and has prompted brokers to look for alternative platforms, which can only be good for traders, who will benefit from greater choice and innovation in the marketplace.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download link: https://www.wikifx.com/en/download.html?source=fma3