Abstract:Inflation is the rate at which the general price level of goods and services in an economy rises over time. In this article, we will discuss the role of inflation in forex trading.

Forex trading, or foreign exchange trading, is the buying and selling of currencies in the global financial market. One of the most significant factors that affect forex trading is inflation. Inflation is the rate at which the general price level of goods and services in an economy rises over time. In this article, we will discuss the role of inflation in forex trading.

Inflation affects forex trading in two primary ways: it influences the value of a currency in the global market, and it affects the monetary policy of a country. Let's take a closer look at each of these factors.

First, inflation affects the value of a currency in the global market. A country with a high inflation rate typically has a currency that is weaker relative to other currencies. This is because when there is a high inflation rate, the purchasing power of that currency decreases. For example, if a country's inflation rate is 10%, then the cost of goods and services in that country will increase by 10% each year. As a result, the currency's value decreases, and the exchange rate between that currency and other currencies will be affected.

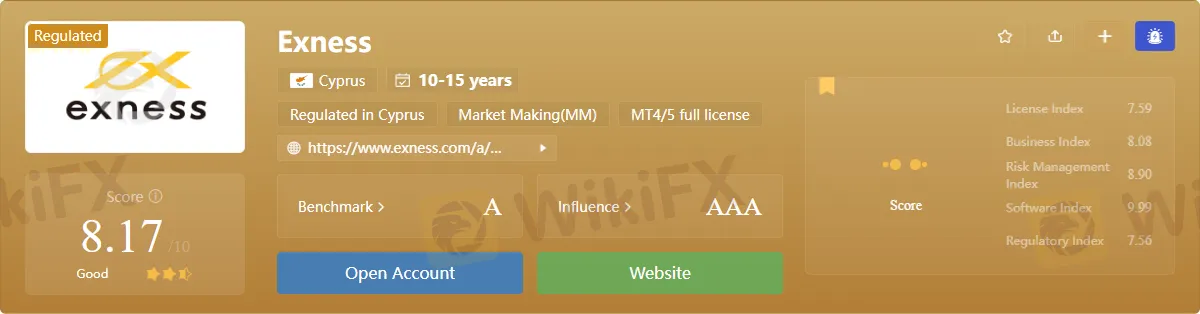

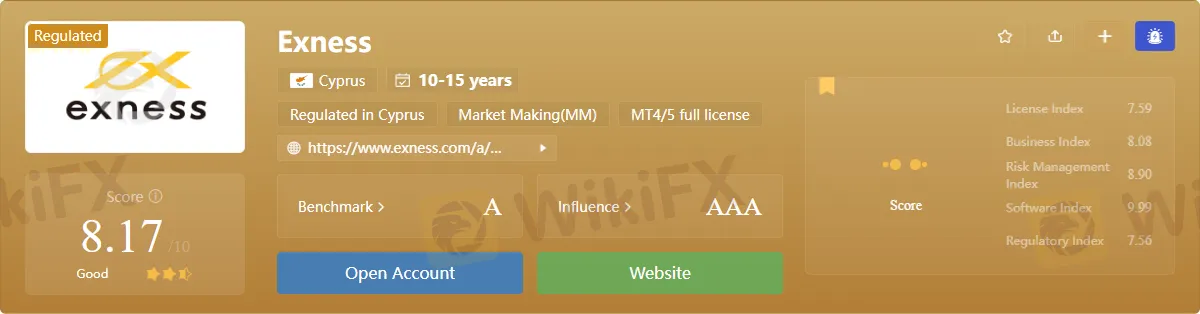

WikiFX top Forex brokers based on their regulation status and reviews

XM

Exness

IC Markets

On the other hand, a country with a low inflation rate typically has a stronger currency. This is because the purchasing power of the currency remains relatively stable over time, which makes it more attractive to investors. In forex trading, traders will look at a country's inflation rate as an indicator of the country's economic health. A high inflation rate may signal that the economy is struggling, while a low inflation rate may indicate that the economy is strong.

Second, inflation affects the monetary policy of a country. Central banks use monetary policy to control inflation and stabilize the economy. When inflation is high, central banks may raise interest rates to reduce the money supply and cool down the economy. This is because high inflation can lead to hyperinflation, which can have devastating effects on the economy. Hyperinflation can lead to a rapid decrease in the value of a currency, which can make it difficult for businesses and consumers to purchase goods and services.

The Impact of Central Bank Interest Rates on Forex Trading

When central banks raise interest rates, it can make a country's currency more attractive to foreign investors. This is because higher interest rates can provide a better return on investment. As a result, the demand for that currency may increase, which can increase its value relative to other currencies. On the other hand, when central banks lower interest rates, it can make a country's currency less attractive to foreign investors. This is because lower interest rates can provide a lower return on investment, which can decrease the demand for that currency and decrease its value relative to other currencies.

In conclusion, inflation plays a critical role in forex trading. It affects the value of a currency in the global market and the monetary policy of a country. Forex traders need to monitor inflation rates to determine the strength of a country's economy and the potential impact on currency values. As a forex trader, it is important to stay up-to-date with the latest news and economic indicators to make informed trading decisions. By understanding the role of inflation in forex trading, traders can develop effective trading strategies that take into account the impact of inflation on currency values.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download link: https://www.wikifx.com/en/download.html?source=fma3