SogoTrade Fined $75K Amid Compliance Failures

FINRA fines SogoTrade $75,000 for market access control failures as TopFX advances synthetic indices trading and 24/7 multi-asset solutions.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:The Financial Conduct Authority (FCA) has a list of businesses and persons it has identified as possibly operating without its authorization and oversight, or about whom it has concerns for other reasons. The list's purpose is to safeguard consumers and the integrity of the UK financial system by assisting them in avoiding doing business with these companies and persons. It is continuously updated, and customers are recommended to consult it before participating in any financial activities.

FCA stands for Financial Conduct Authority, a regulatory authority in the United Kingdom that monitors financial markets and corporations to ensure they function in a fair, transparent, and consumer-friendly manner. To safeguard customers from financial loss, the FCA offers warnings about possible scams, fraudulent activity, and other dangers. These warnings are available on the FCA's website and are often disseminated via the media and other means to reach a broad audience.

On January 20, 2023, a list of unlicensed brokers was issued.

MONTGOMERY KENT INSURANCE

naslsportline@insurer.com

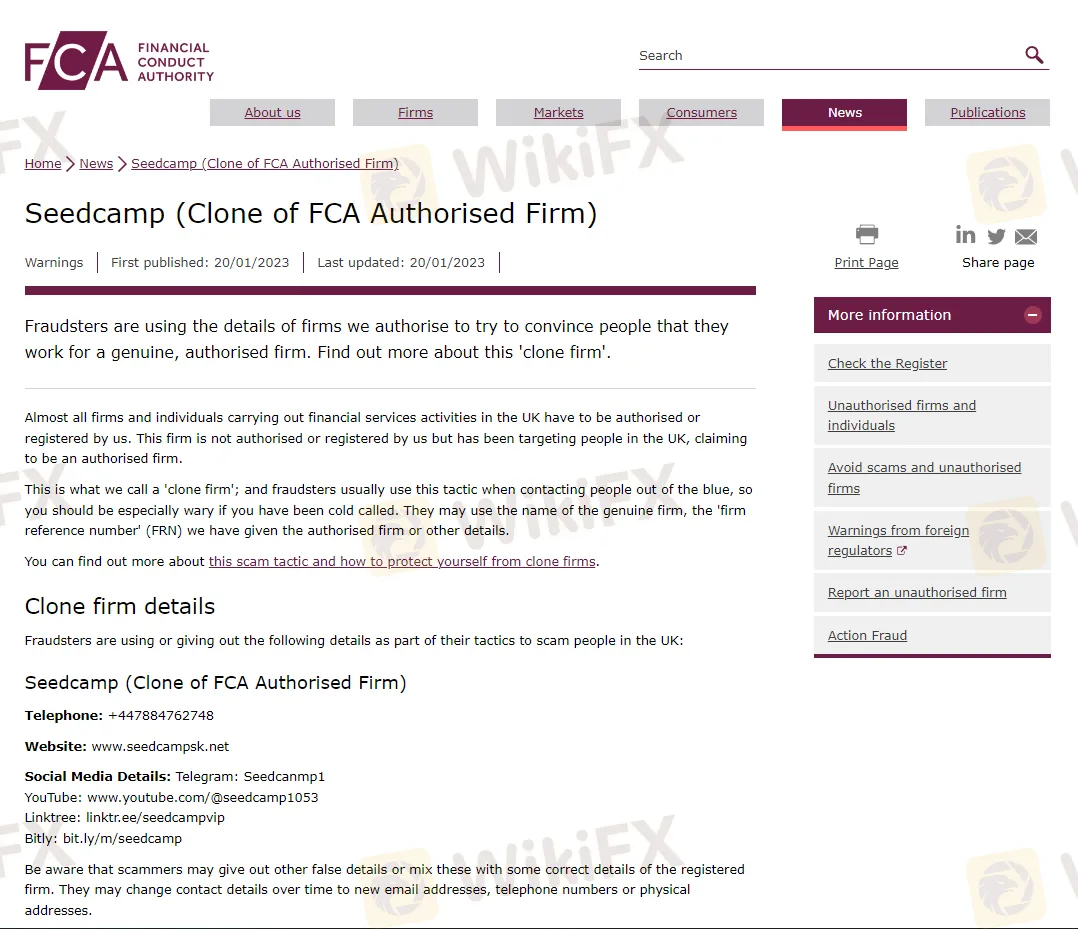

SEEDCAMP

ROIFX

SMART COIN TRADE FX

TRADEBITFINEX

CRYPTO ALPHA FX TRADE

INSTANT TRADES FX

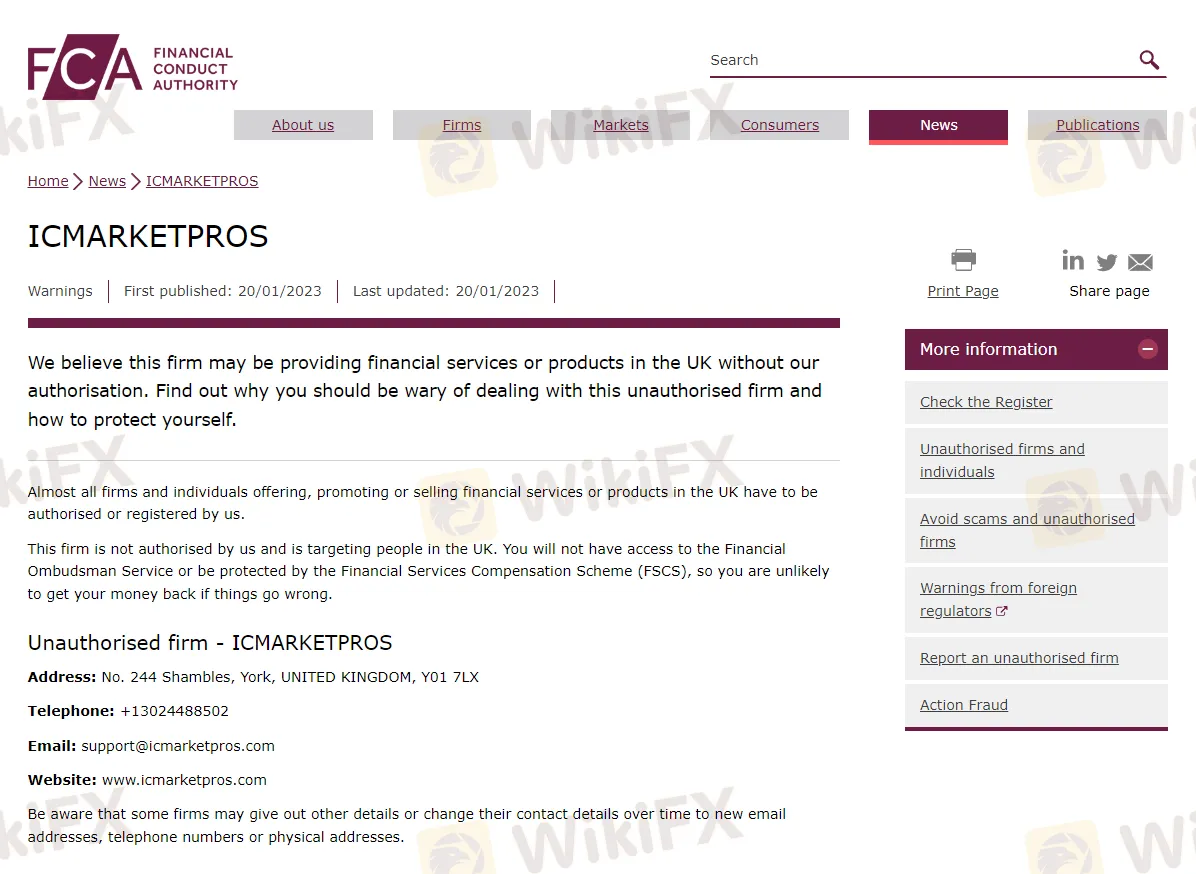

ICMARKETPROS

The FCA's warning lists feature a variety of companies and persons that the FCA has recognized as potentially endangering consumers. These are some examples:

Unauthorized companies: These are firms that have not been approved by the FCA to perform regulated activities in the UK yet continue to provide financial services to customers. Consumers should be especially wary of these companies since they are not subject to FCA inspection and may not be functioning in accordance with legislation.

Fraudulent websites: These are sites classified by the FCA as being used in fraudulent activities such as phishing schemes or impersonating legal businesses. Customers should use caution when providing personal or financial information to these websites.

Clone firms: These are businesses that use the name and contact information of legal businesses to deceive customers into believing they are dealing with a legitimate organization. Consumers should verify the FCA's list of approved businesses to establish the legitimacy of any company with which they are contemplating doing business.

Suspicious investment schemes: These are investment schemes flagged by the FCA as possibly fraudulent or high-risk. Consumers should be cautious of these scams and perform their own research before investing.

Enforcement actions: These are businesses and people that have received FCA enforcement action, such as fines or penalties, for failing to comply with rules. Customers should exercise caution while doing business with these companies and persons.

In addition, the FCA provides consumer warnings and press releases to keep consumers aware of any substantial dangers to consumers and financial markets. It is strongly advised to check the FCA's warning lists and alerts on a frequent basis and to exercise caution before doing business with any entity or person on the list.

Final words

Consumers should be aware of the FCA warning lists and check them on a frequent basis to ensure they are not doing business with organizations or persons who have been warned as possibly fraudulent or acting illegally. The FCA's warning lists, which are available on their website, contain information on unlicensed businesses and persons, as well as firms and individuals against whom the FCA has initiated enforcement action. It's also important to remember that just because a company or person is on the FCA's warning list doesn't always indicate they're doing things unlawfully or fraudulently, so customers should proceed with care and do their own investigation before doing business with them.

Stay tuned for more FCA warning lists of brokers.

You can install the WikiFX App on your mobile phones through the download link below, or from the App Store or Google Play Store.

Download link: https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

FINRA fines SogoTrade $75,000 for market access control failures as TopFX advances synthetic indices trading and 24/7 multi-asset solutions.

A WikiFX review of Zeven Global reveals the absence of regulatory licensing, a low safety rating, and potential risks to investor protection.

As the new year begins, WikiFX extends our sincere gratitude to traders worldwide, our industry partners, and all users who have consistently supported us.

Dear Forex Traders, When choosing a forex broker, have you ever faced these dilemmas? Dozens of broker advertisements, but unsure which one is truly reliable? Online reviews are either promotional content or outdated/incomplete? Want to learn about real users’ deposit/withdrawal experiences but can’t find firsthand accounts? Now, your experience can help thousands of traders and earn you generous rewards! The campaign is long-term and you can join anytime.