Abstract:The list of unauthorized firms was released by the Financial Markets Authority (FMA) to warn the public not to invest due to a lack of necessary authorization to conduct financial transactions or investments.

The Financial Markets Authority (FMA) is the government body in charge of regulating New Zealand's securities markets and financial service providers. Its main objectives are to safeguard consumers while also promoting fair, efficient, and transparent financial markets. The FMA is a separate Crown institution that reports to the Minister of Commerce and Consumer Affairs. It has broad powers and functions, including the authority to register and license financial service providers, undertake financial market monitoring, enforce compliance with laws and regulations, and take enforcement action against persons or organizations that violate the law.

How the FMA protects the public against fraudulent businesses

The Financial Markets Authority (FMA) safeguards the public against fraudulent internet trading brokers by using a number of procedures and technologies to identify and penalize those who participate in it.

One method is to regulate and license financial service companies, such as internet trading brokers. This helps to guarantee that only genuine and trustworthy businesses may function in the market. The FMA also monitors financial markets on a regular basis in order to detect and investigate any fraud or other criminal behavior.

The FMA also maintains a public record of financial service providers on its website, where customers may check to see whether a company is licensed and in good standing with the FMA. Furthermore, FMA published warnings against unlicensed entities known as “scammers” on their websites and via other public announcements.

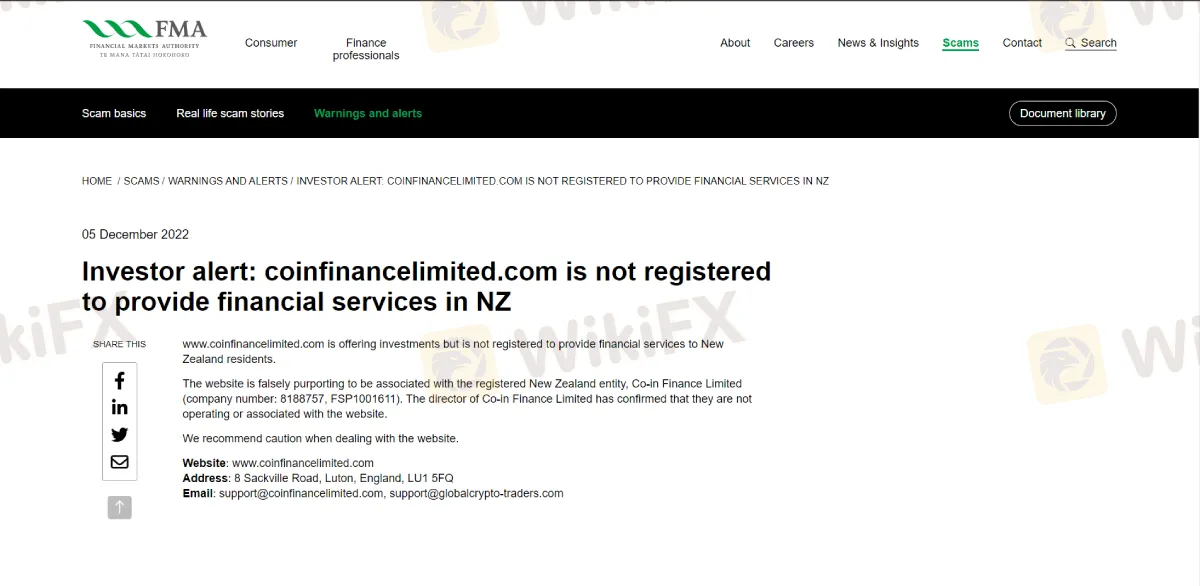

The following is a list of fraudulent businesses that have been banned by the FMA for the whole month of December:

REO FUNDS NZ LIMITED

MACQUARIE

KRYPTO SECURITY

BAY EXCHANGE

CTRLEX

IKICI

COIN FINANCE LIMITED

The FMA together with WikiFX also urges customers to report any unusual behavior or suspected fraud to them so that necessary action may be taken. They also operate public education initiatives to teach customers how to spot and avoid fraudulent online trading brokers, as well as how to protect themselves from fraud.

It is crucial to highlight that the FMA has a role in safeguarding the public, but it is not a guarantee. Consumers should also do their own research and due diligence before investing with any financial service providers.

Stay tuned for more lists of fraudulent firms.

Download and install the WikiFX App from the download link below to stay updated on the latest news, even on the go. You can also download the app from the App Store or Google Play Store.

Download link: https://www.wikifx.com/en/download.html