Abstract:Peaking inflation, policy changes, geopolitical turmoil, China's covid-19 restrictions, crypto downfall, an energy crisis, and rocking headlined recession fears all contributed to the equity market's meltdown, which fed into rising speculation and comparisons to the Dow Jones crash in 1930 and perhaps felt too familiar to the 2008' recession.

Peaking inflation, policy changes, geopolitical turmoil, China's covid-19 restrictions, crypto downfall, an energy crisis, and rocking headlined recession fears all contributed to the equity market's meltdown, which fed into rising speculation and comparisons to the Dow Jones crash in 1930 and perhaps felt too familiar to the 2008' recession.

Let us begin with the enormous changes in the economy caused by central banks throughout the globe adhering to a more aggressive monetary policy shift by hiking interest rates to combat inflation. Taking away the initial liquidity that they had injected into the market in order to restructure the 2020 pandemic bubble.

Separate from the rest of the globe, The Bank of Japan, despite their perseverance of ultra-easy policy, and I must add with all appreciation, it was mind-boggling to see Japan's inflation not reach 4% (still the highest in four decades at 3.7%), despite the super-easy policy. The yen, on the other hand, suffered and lost its safe-haven status.

A commodity rebound

Meanwhile, inflation in the United States reached 9.1% in June. Inflation in the United Kingdom reached a 41-year high of 11.1%, while Germany reached a decade high of 3.9%.

Aside from policy shifts, spiking inflation, Ukraine-Russia ramifications, interrupted supply chains, and skyrocketing oil costs. That has absorbed me in the year 2022. One would anticipate that this would have led to an increase in haven demand, but this idea has now become overly skewed. Gold, in particular, changed trades after the US dollar fell below the $1600 mark, reaching a familiar low of $1620.

The enormous rise in oil prices was one of the year's most visible topics. As a consequence of Russia's invasion of Ukraine, sanctions were imposed on Russian oil, adding to OPEC+'s decision to limit output, restrict supply and drive up oil prices. Despite the fact that China is the second biggest importer, lengthy lockdowns caused oil prices to swing. Keeping both bulls and bears guessing for the rest of the year.

WTI soared over $125 in early March in anticipation of the Russian oil embargo but is currently battling to stay above $80. Meanwhile, it reached a high of $131 and is now trading at $83. China's demand is expected to recover, but Russian oil caps are expected to remain unchanged, at least in the medium term. Both causes will keep oil prices fluctuating, but recession worries may have the greatest impact on black gold prices.

A soaring dollar

Most currencies were severely devalued in the currency market, particularly against the US dollar.

To begin with, the dollar index's overall performance was pretty excellent, if not triumphant, having reached an absolute high around levels of 115. The greenback, which is now trading at 103, enjoyed its highest surge in 2022, fueled by a hawkish Federal Reserve.

Meanwhile, the British pound has plummeted to fresh lows at 1.03, raising fears that it may go below parity, according to Bloomberg. The relative strength indicator has shown extraordinary volatility from rock bottom to oversold levels. Despite the UK's significant change in terms of governing parties, beginning with Boris Johnson's scandalous leave and an even more startling exit by Liz Truss after just 49 days in office, to eventually Rishi Sunak's turn of events.

With broken economic data, the UK entered an unanticipated recession, wiping out both the pound and the FTSE 100. In addition to the resurfacing Brexit debris, a much-needed emergency central bank intervention. While enduring the consequences of the energy crisis, which rocked the whole economy. The cherry on top, however, was Liz Truss' nonsensical mini-budget of 43 billion pounds, which generated public outrage and a significant increase in borrowing rates. On a more positive note, it's reasonable to say that the UK's sterling found a silver lining towards the end of the year, trading at 1.20.

Equiti markets are on the verge of collapsing.

Equity markets are projected to underperform in the near term as interest rates continue to rise and reach levels over 5%. Major indexes entered a bear market early this year, with reasonable predictions that stocks would significantly underperform in the first half of the year. The S&P 500 has dropped more than 17% this year and is presently trading at $3,795, down from a high of $4,818 in January and up from an annual low of $3,491. Expectations for the S&P 500 remain low, with prominent banks like Morgan Stanley and Wells Fargo warning of further drops in the near future as corporations reduce their profit targets.

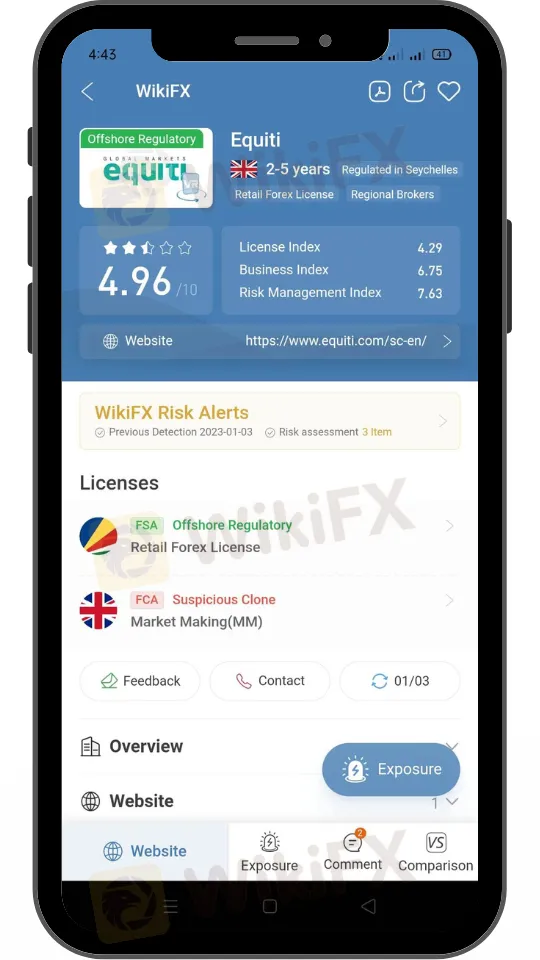

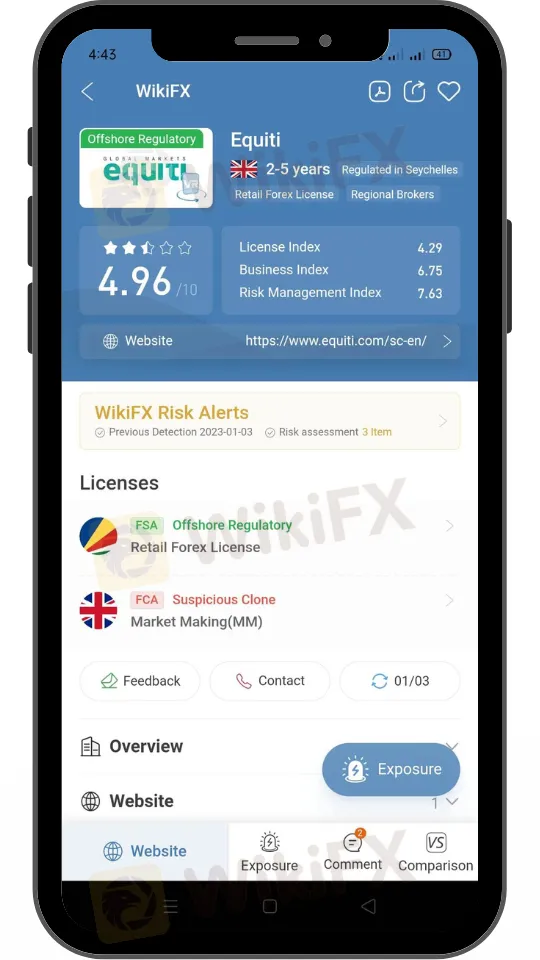

Equiti is a diversified financial services company that offers a range of products and services to clients around the world. The company's offerings include brokerage, asset management, and investment banking. Equiti serves both individual and institutional clients and operates in various countries. It is not clear from your question what specific information you are seeking about Equiti.

Keep an eye out for more Forex market news.

Download and install the WikiFX App from the link below to remain up to speed on the newest news even while you're on the road.

Link to download: https://www.wikifx.com/en/download.html