Abstract:Vantage Markets' swap-free gold XAU USD trade has received an overwhelming response from clients, saving its traders nearly $1 million in overnight fees in three months of operation.

Vantage extended the swap-free Gold Traders' Day to expand the range of services offered. In response to the overwhelming response from clients, Vantage decided to extend the swap-free service through 2023 and extend it to other digital assets to allow more clients to benefit.

Customers do not pay an overnight fee when trading on all trading accounts, including on the Vantage App, regardless of the size of the transaction. In addition, customers can use the Vantage calculator to calculate their own transaction savings.

Marc Despallieres, Vantage's chief strategy, and trading officer, said: “We have received very positive feedback from our clients and are excited to extend this service to more clients. During extreme market volatility, swap-free trading eliminates the cost of overnight fees for our clients when they choose to use a long-term trading strategy. In addition, it gives clients greater trading flexibility by allowing them to terminate their trades at a point of their choosing, instead of manually terminating trades on a daily basis and focusing on hedging targets.”

What swap-free account is

With a standard account, you are charged or credited swaps or interest on any leveraged positions that you keep open at the end of each trading day. These costs are known as overnight fees or swap fees. The swap-free account is designed to meet the needs of clients who do not wish to be charged or credited this swap or interest.

About Vantage Markets

Founded in 2009, VANTAGE GLOBAL PRIME PTY LTD (short for “Vantage Markets”) is a brokerage firm registered in Australia, offering its clients access to a wide selection of trading instruments. Vantage Markets does not offer services to residents of certain regions such as North Korea, Japan, the United States. WikiFX has given this broker a decent score of 7.48/10.

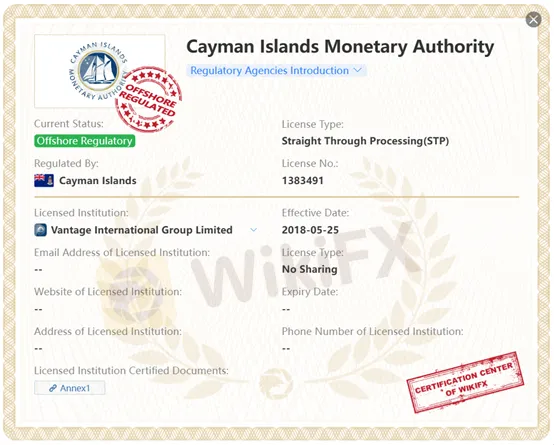

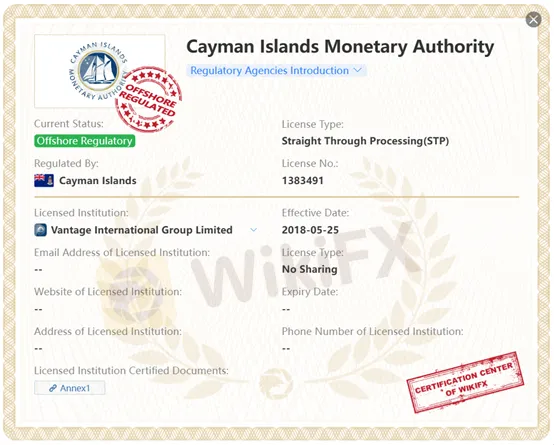

Vantage Markets is a regulated broker. It was authorized and regulated by the Cayman Islands Monetary Authority (CIMA), with Regulatory License Number: 1383491, the Australian Securities and Investments Commission (ASIC), AFSL No. 428901, the Financial Conduct Authority(FCA), with Regulatory License No. 590299.

Click on Vantage Markets' WikiFX page for details