Abstract:Danske Bank announced a deal with US and Danish authorities in one of the world's worst money-laundering scandals on Tuesday, admitting guilty to bank fraud conspiracy and civil securities fraud and agreeing to pay a total of US$2 billion in penalties.

“The resolutions bring the investigations by US and Danish authorities to a close,” said Martin Blessing, chairman of Danske Bank's Board of Directors. “We sincerely apologize and accept full responsibility for the past's deplorable failures and misbehavior, which have no place at Danske Bank today.”

Danske commissioned an inquiry in 2018, which revealed that a large percentage of the $200 billion that went through its Estonian business from 2007 to 2015 was of dubious origin.

The US Department of Justice (DOJ) accused Danske of tricking US banks about its anti-money laundering procedures and high-risk client base, allowing it to funnel billions of dollars of questionable and illicit payments through the nation's financial system.

The US Securities and Exchange Commission (SEC) has filed a civil securities fraud lawsuit against the bank, accusing it of giving false information to investors, and preventing them from making smart investment choices.

These two cases were resolved with payments to the DOJ of $1.2 billion and the SEC of $178.6 million. The remaining $612.4 million will go to the Danish Special Crime Unit.

The issue was sparked by a former trader at the Estonian division who informed the executive board in Copenhagen of suspicious activity in the office.

An Estonian inquiry eventually revealed how bankers in the branch's international banking division assisted customers in laundering unlawful funds in return for fees and commissions.

The gang of 19 people provided services such as selling offshore corporations, creating bogus contracts and locating proxy directors who were then added to company papers to make it seem more respectable.

The funds were obtained via eight different schemes in Russia, Azerbaijan, Iran, Switzerland, Georgia, and the United States.

Blessing noted that Danske has placed comprehensive control systems in place to avoid such failures in the future.

The whole story may be found at: https://www.justice.gov/opa/pr/danske-bank-pleads-guilty-fraud-us-banks-multi-billion-dollar-scheme-access-us-financial-system

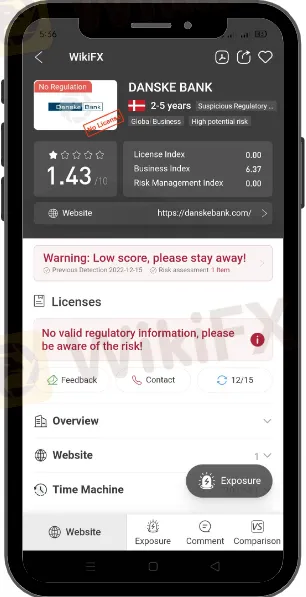

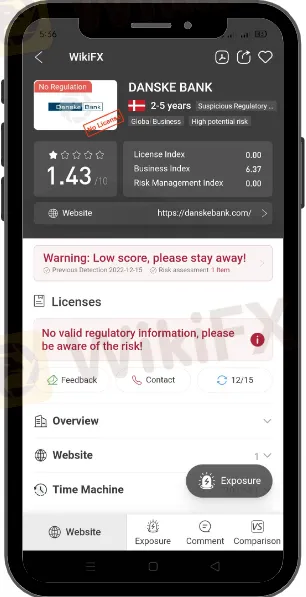

Find out more news about Danske Bank here: https://www.wikifx.com/en/dealer/6451811396.html

You may find the download link below to download and install the WikiApp so you can stay up to date even while you're on the move.

Download link: https://www.wikifx.com/en/download.html