Abstract:On December 13, Canada's provincial and territorial securities regulators, CSA, announced that it is forbidding all Canadian-based cryptocurrency trading companies to provide margin or leveraged trading services to any Canadian clients.

On December 13, Canada's provincial and territorial securities regulators, the Canadian Securities Administrators (CSA), released a statement that it has forbidden all Canadian-based cryptocurrency trading companies to provide margin or leveraged trading services to any Canadian clients. This also applies to foreign platforms offering services to Canadians residing within the country's border.

Furthermore, the CSA requires that Canadian cryptocurrency exchanges keep their custody assets separate from the platform's proprietary company.

Additionally, the CSA considers labelling stablecoins as securities and/or derivatives as it strengthens its oversight of the crypto industry. These refer to those cryptocurrencies pegged to fiat or other fundamentally stable and reliable assets.

eToro's co-founder, Ronen Assia, also sees an evident shift within retailers' preferences on his multi-asset trading platform, wherein individuals are cashing out from cryptocurrencies and opting for securities and bonds.

Therefore, it is sufficient to say that, at the moment, regulators worldwide are striving to strengthen their oversight of this seemingly shaky and risky cryptocurrency industry. In conjunction with this, let us take a look at what exactly CSA does do.

Aiming to enhance, coordinate, and harmonise the regulation of the Canadian capital markets, the Canadian Securities Administrators (CSA) is the umbrella body for Canada's provincial and territorial securities regulators.

It seeks to reach an agreement on policy choices that have an impact on the Canadian capital market and its players. Additionally, it seeks to cooperate in the execution of regulatory initiatives across Canada, such as the evaluation of continuous disclosure and prospectus filings. While provincial or territorial authorities in each jurisdiction address all complaints relating to securities infractions, the CSA coordinates initiatives on a national level. As a result, each regulator may offer a more direct and effective service to the local investors and market participants. Each province or territory also handles its own enforcement of securities laws respectively.

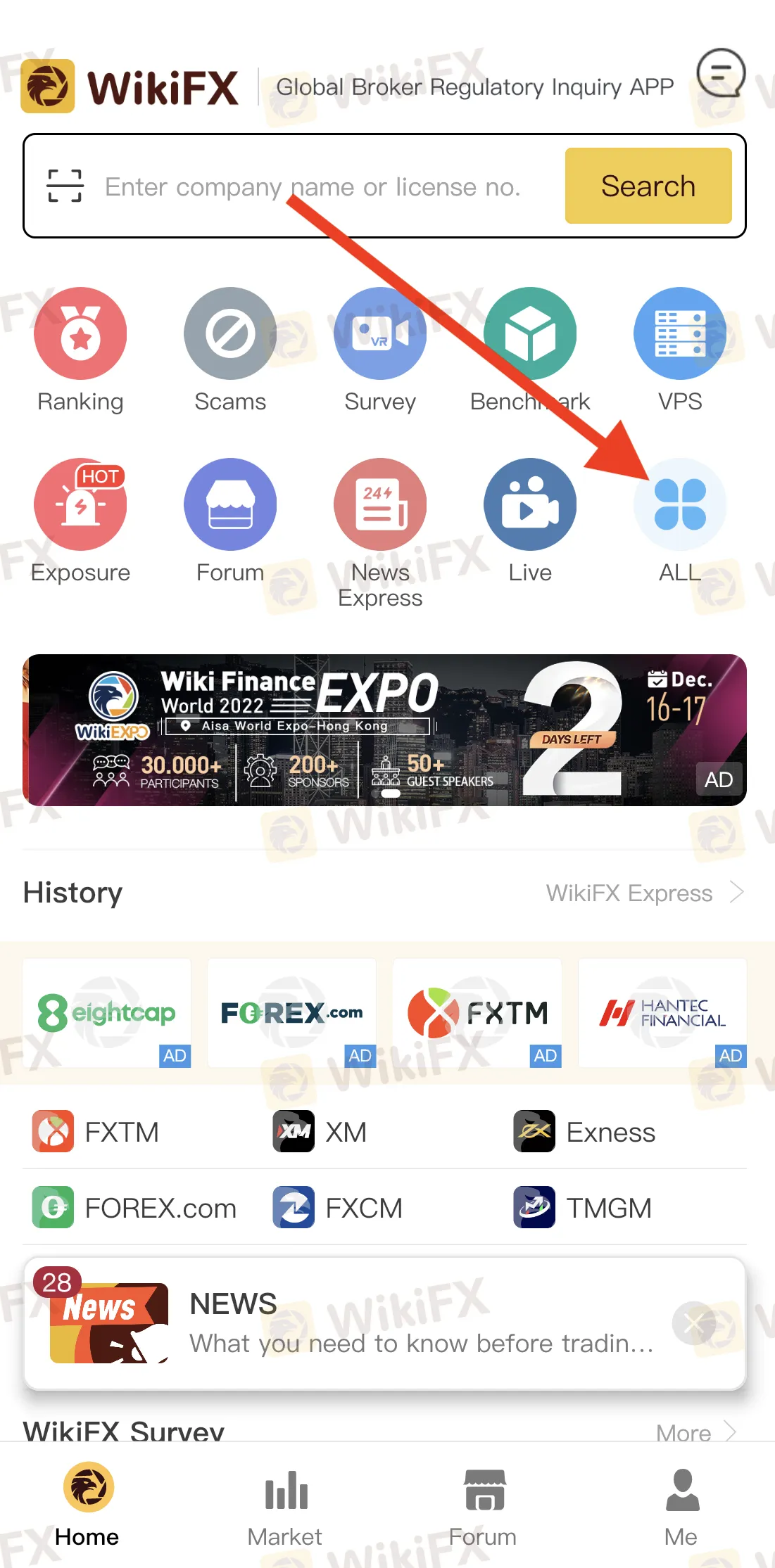

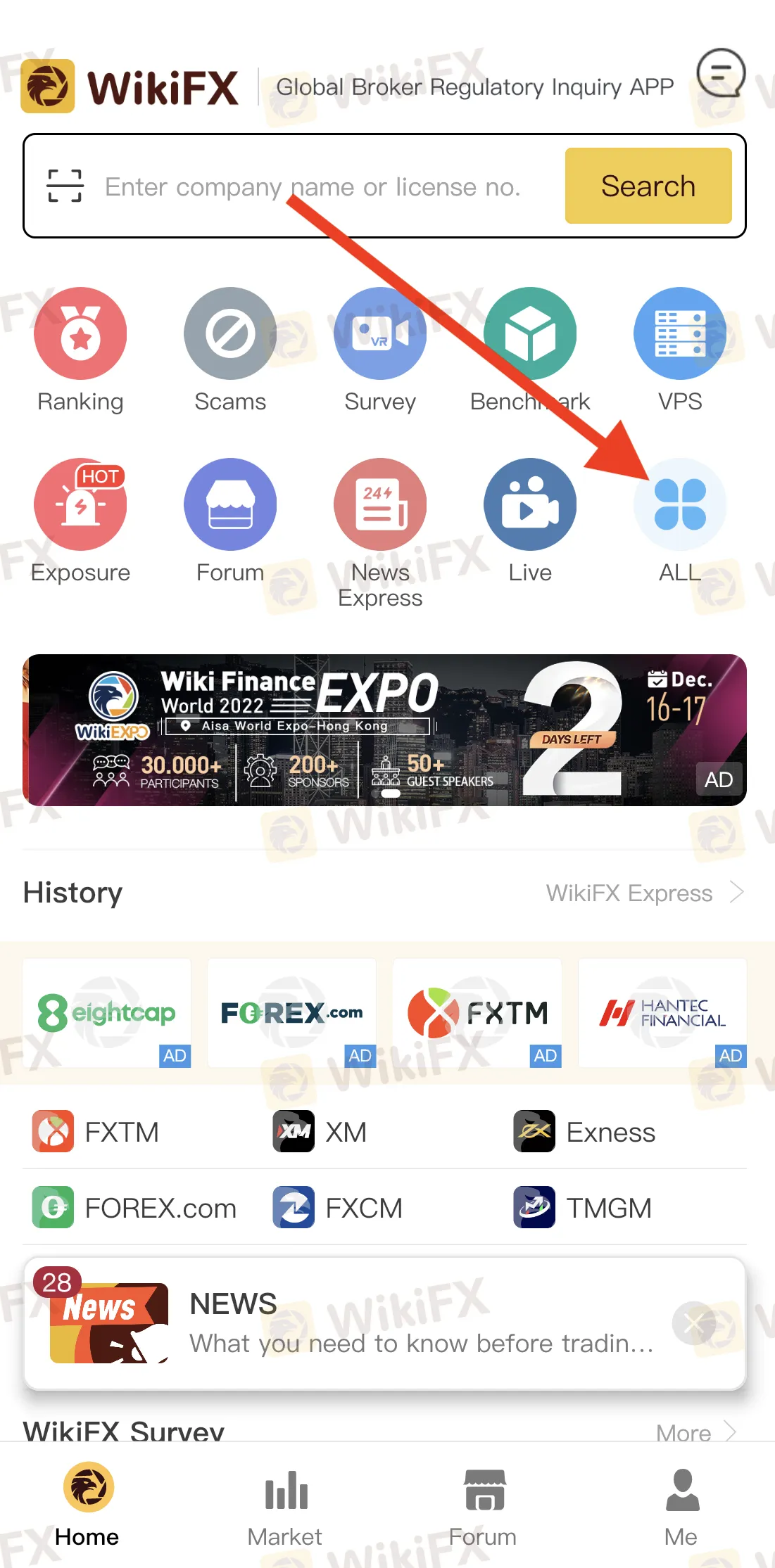

Here's a useful tip to utilise the free WikiFX app to the fullest. There is a function named “Regulatory Disclosure” where you can stay informed about the warnings and sanctions imposed by national regulators throughout the globe on concerning (forex) brokers.

WikiFX is a global forex broker regulatory query platform that holds verified information of over 40,000 forex brokers in collaboration with more than 30 national regulators, including CSA, ASIC, FCA and more.