EO Broker Review: Why You Should Avoid It

EOBroker Review shows a low WikiFX score of 1.33/10. No regulation, fake license, and unsafe trading make this broker dangerous.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:In recent years, thanks to public warnings from regulators and increased awareness among general investors, fraudulent brokers are not as easy to get away with as they once were.

A few scammers will steal regulatory information from legitimate brokers and falsely claim to be regulated. But many more scammers, like VRN Capitals, try to obfuscate when asked regulatory-related questions.

No regulatory information found

VRN Capitals shows very attractive trading conditions on its webpage - low spreads, high leverage, and a minimum deposit of even $10. The company also claims that clients' funds are protected by “Solid Regulatory Protection”. But in this dazzling pile of information, only the most important regulatory information for investors can not be found, neither the regulatory number nor the regulator.

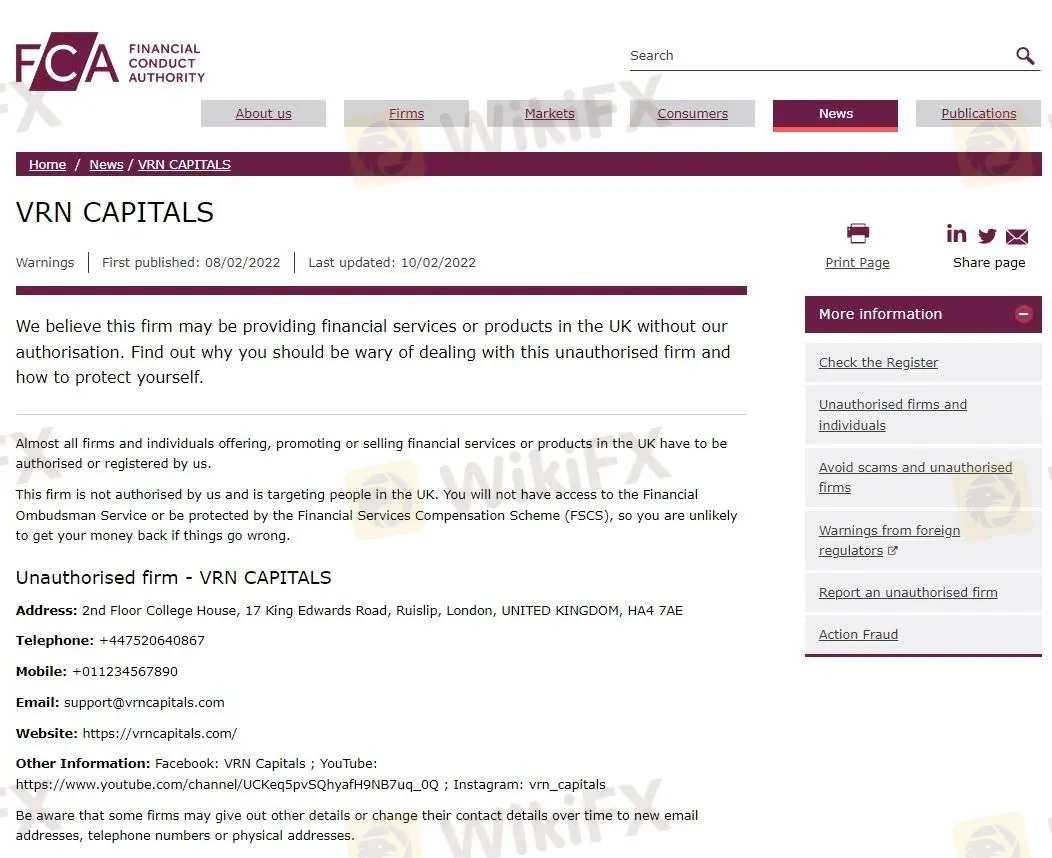

We had no choice but to trace the regulation of the broker through its contact information. The website shows that the company's address is in the UK, and the contact number is also a UK phone number. So we tried to find the license of this company in the FCA. Unfortunately, all we could find was a warning against the company, stating that it provided financial products and financial services to UK citizens without authorization. Obviously, this is not legal.

There are more and more scammers on the market like VRN Capitals, with the attitude of trying to muddle through and never mentioning anything related to regulation. For professionals, this is an obvious red flag, and it is often possible to find the appropriate regulator for a license search through the country where the company is based.

But for the newbies who are distracted from regulation by such a scammer, and, at the same time, are caught by the attractive trading conditions, there is a high risk of falling for it.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

EOBroker Review shows a low WikiFX score of 1.33/10. No regulation, fake license, and unsafe trading make this broker dangerous.

Pocket Broker review highlights user complaints of blocked accounts, rejected withdrawals, and fraudulent practices.

WikiFX Golden Insight Award uniting industry forces to build a safe and healthy forex ecosystem, driving industry innovation and sustainable development, launches a new feature series — “Voices of the Golden Insight Awards Jury.” Through in-depth conversations with distinguished judges, this series explores the evolving landscape of the forex industry and the shared mission to promote innovation, ethics, and sustainability.

WikiFX has launched the “Inside the Elite” Interview Series, featuring outstanding members of the newly formed Elite Committee. During the committee’s first offline gathering in Dubai, we conducted exclusive interviews and gained deeper insights into regional market dynamics and industry developments. Through this series, WikiFX aims to highlight the voices of professionals who are shaping the future of forex trading — from education and compliance to risk control, technology, and trader empowerment.