Abstract:Atom Asset Exchange (AAX) has restricted customer withdrawals on its platform, although the action is not part of a larger restriction on activities after the collapse of FTX.

It comes only days after AAX said on Twitter that they had “no financial exposure to FTX and its affiliates.” Instead, the Hong Kong-based cryptocurrency exchange claimed a third-party partner's malfunction, which led certain customers' balance data to be incorrectly recorded when arranging a system update. As a result, AAX suspended its services to avoid future dangers, while the technical staff manually reviewed and restored the system to assure the correctness of all users' holdings.

Some crypto businesses may be exposed to the troubled FTX.com, either by holding balances on the exchange or through ownership of FTX's native token, FTT, which fell 94% last week. While the scale of the contagion among industry participants is unknown, certain organizations, like insolvent crypto lender Celsius Network and asset management CoinShares, have disclosed their exposure to FTX.

“More significantly, all digital assets on AAX stay intact, with a significant percentage saved in cold wallets, and user money are never exposed to counterparty risk from any financing or venture activity,” the company noted.

AAX anticipates that normal operations will return for all customers within 7-10 days, although its personnel will then manually analyze the withdrawal requests one by one in collaboration with the security, operations, and compliance departments.

“In light of the collapse of one of our industry's top companies last week,” the statement adds, “crypto consumers are understandably worried about the operational and financial viability of centralized digital asset exchanges.”

AAX, which is powered by the London Stock Exchange Group's LSEG Technology, has experienced a 285 percent increase in trade volume since the beginning of the year, jumping from $14.9 billion. According to recent industry sources, institutional cryptocurrency exchange spot trading volume increased to $57.2 billion, making it the biggest exchange by volume after Binance for the first time in its existence.

Meanwhile, CoinGecko gave AAX a Trust Score of 8, indicating that the institutionally oriented platform is now rated as a 3-star Certified Ethereum Professional (CEP) Exchange.

AAX supposedly scored well in areas of liquidity, size, cybersecurity, API coverage, and the availability of a senior leadership team. AAX was also identified as a digital asset exchange that has yet to face security/functional difficulties that might jeopardize a user's investment safety.

About AAX

AAX is a cryptocurrency trading exchange that was founded in early 2018 and successfully debuted in 2019. This exchange was designed with retail traders in mind, while also highlighting the advantages of blockchain technology. AAX's modern digital services and products include futures contracts, interest accounts with high savings interest, and various crypto marketplaces.

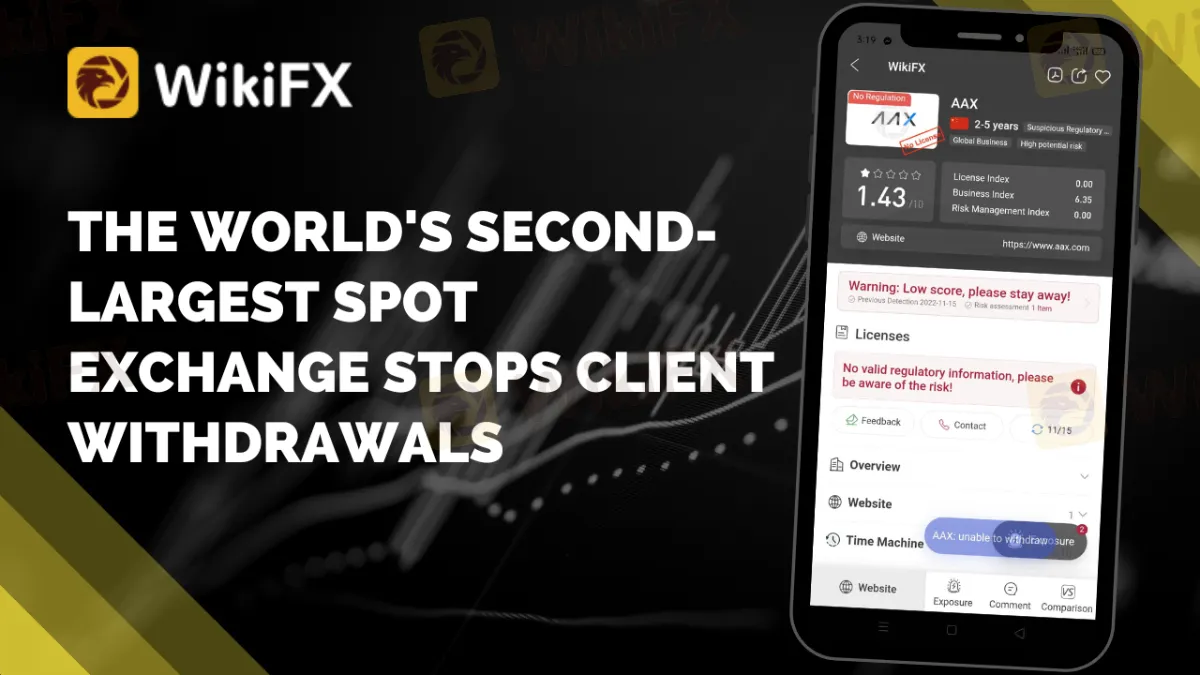

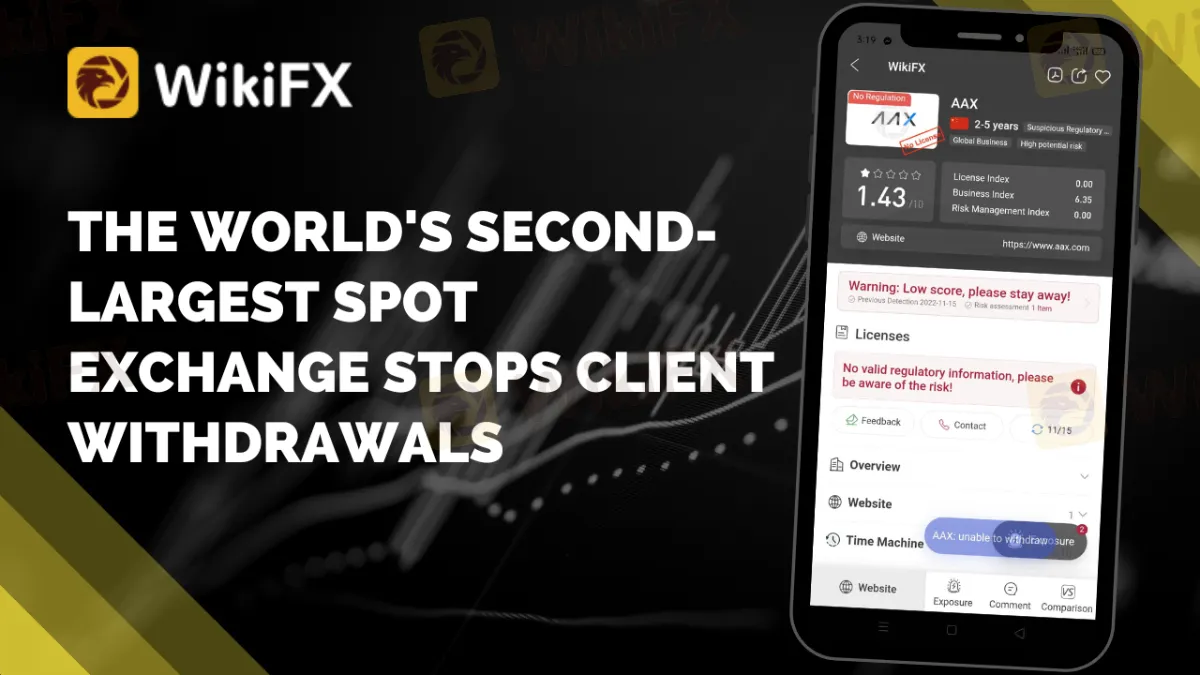

Here's the status of AAX in the WikiFX Platform

Check out more of AAX: https://www.wikifx.com/en/dealer/3801739622.html

Stay tuned for more Forex Broker news.

Download the WikiFX App from the App Store or Google Play Store to stay updated on the latest news.