Abstract:Saxo Bank or Saxo Markets as some might know it is a division of the Saxo Group of financial institutions with a trust rating of 99 global, supposedly making them one of the more trusted companies by investors across the world, based on their business model one can easily tell the investors who entrust Saxo Bank with their capital are not small time investors at all, but are they actually as attractive as they appear to be? In the article we look all aspects relating to Saxo Bank, including, investment options, fees and commissions, trading applications and platforms, educational offering, research findings and client reviews.

INVESTMENT OPTIONS ON OFFER WITH SAXO BANK

As a multi-asset broker, Saxo Bank offers investors a huge and I mean huge selection of trading instruments, 40,000 in total to be exact which can only be highly overwhelming, they offer anything from spot fx (current asset price) , fx options (pre-agreed), NFD‘s (non-deliverable), CFD’s (contracts for difference), stocks, stock options, ETF‘s, ETN’s, futures, as well as 33,000 bonds available via phone application.

Crypto is only available through derivatives and not by trading the underlying asset and is not available to traders or brokers based in the United Kingdom.

An impressive but completely impractical amount of trading instruments, this will surely serve very little purpose to any traders strategy.

FEES AND COMMISSIONS

Saxo Bank offers three account tiers, classic, platinum and VIP. As at the time of writing this article their average spread offering stands at 0.9 pips for classic, 0.8 pips for platinum and 0.7 for the VIP account, this is a bit high but in line with market related conditions as compared to other brokers, where industry standards range between 0.1 and 1.2 depending on the asset you are trading. Some traders might find Saxo Banks business model slightly unattractive due to the minimum deposit of $2,000 for the classic account, $200,000 on the platinum and at least $1,000,000 for the VIP account, making this more ideal for larger investors.

SaxoBank is however commission free which somewhat justifies the high spreads on offer and any trader who trades less than 50,000 units per month will be charged a ticket fee of $3 per side. There are other fees that need also be considered so pay careful attention to all fees that could potentially be incurred.

TRADING APPLICATIONS AND PLATFORMS

Saxo Banks offering can be traded on Meta Trader but traders will not be able to enjoy the full range of assets using this platform, this is in an effort to promote their in-house trading platform called SaxoTraderGO, a mobile application for US citizens, I will not go into too much detail here, the features do not stand out nor differ from any other trading application have seen before, their web based offering also does not have much of a wow factor either and still has a long way to go to be weighed against other platforms who provides a quality experience, absolutely free.

As an outsider I was not otherwise impressed with their offering in this regard, the experience does not justify the extremely high minimum deposits or the spreads on offer, the honest truth is that there are much more reasonable products on offer without the kind of financial obligation you would commit to with Saxo Bank.

EDUCATION

As any seasoned, hard boiled trader will tell you, forex education remains the most important ingredient in obtaining the kind of success that the top 5% of traders enjoy.

Saxo Bank seems to offer a wide variety of in-house educational content that strike me as no different then the plethora of educational material splashed all over the internet, what does seem mildly appealing is the fact that traders can filter analysis and educational content by asset class or by a specific analyst that would suit the individuals trading style, again, mildly appealing but also available absolutely risk free on YouTube, a video platform where Saxo Bank are very dormant and lack activity and is reported to fall short of education on this popular platform, to me this shows a lack of transparency, these type of free tutorials allows potential investors valuable insight into what he or she might be investing in, but with Saxo Bank youre either happy or not after making the minimum deposit with little option left if you do in fact have a bad experience.

If your product is as superior as you claim it is, give traders a free taste and your real time results will determine whether they stay or leave.

THE REAL USER EXPERIENCE

I had a hard time coming across reviews of any kind relating to Saxo Bank‘s business conduct, but after some patient and diligent research I was sadly disappointed by what I came across from many users from different backgrounds all experiencing issues in one or more areas after investing with Saxo Bank, I truly thought that although Saxo Bank was average compared to competitors that they would at least be operating with little to no hassles, I mean, they are a bank after all who are regulated in many countries and one would expect a much higher level of professionalism , but according to many investors, this is not the case at all, it’s no wonder its so hard to find any reviews on them, dating back from 2006 through to 2021, the lost of terrible investor experience is long and cover a wide variety of issues, from withdrawals not being honored to being accused of being market makers, with complaints of constant re-quotes, excessive spreads across all pairs, miss management of funds, frozen accounts and the list goes on, one or two investors do share a good experience but the amount of complaints far outweigh the praise… customer service also seems to be a popular complaint, showing that when issues do arise, it is very difficult to find a resolution, only adding to frustration.

CONCLUSION

In conclusion I must share my most honest opinion and say that at first glance, Saxo Bank comes across as the perfect broker, with many different investment options and a name that stands out from the crowd, but looking at existing and past investors have to say, Saxo Bank actually seems to offer a very unpleasant trading experience, trading in its own is already a very hard discipline to master and trading under this kind of duress is not conducive to long term success, some investors even leave their details for potential investors to verify their horrible experience with Saxo Bank, which shows that these past investors are completely honest about their personal experience.

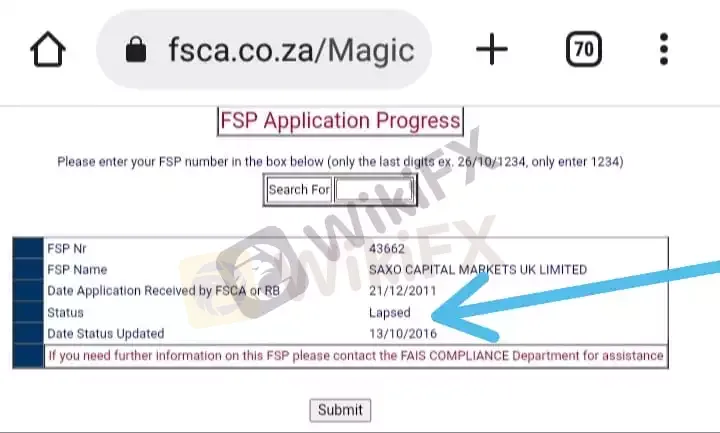

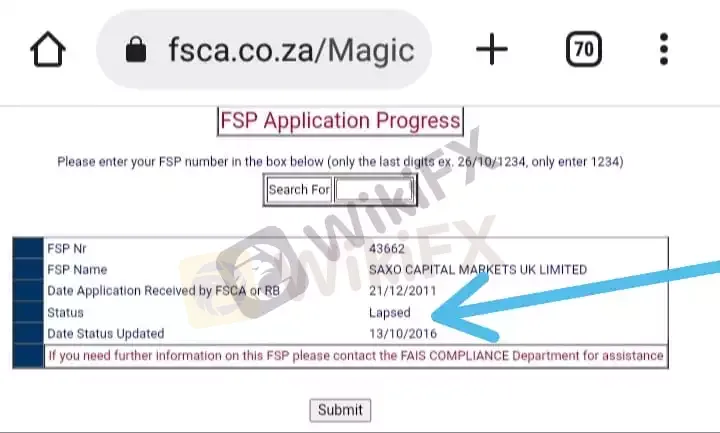

Another notable mention is that Saxo Bank is ranked number 50 in the world on the global brokers list according to forex broker listing based on investor experience, making them a very unattractive choice for investors worldwide, furthermore, they have been recently said to be reviving operations in South Africa, but according to the FSCA their regulation has lapsed in South Africa and have yet to renew their FSP status, their licence have also been revoked in the UAE and other countries, South African investors should note that Saxo Bank is currently not authorized to conduct business in the financial sector.