Abstract:The British regulator FCA issued a warning against One Guaranty Bank on November 2nd!!!

Investors who are still trading forex at One Guaranty Bank had better quit trading ASAP!!! Investors who have been deceived by this broker please contact WikiFX to help you recover your funds!!!

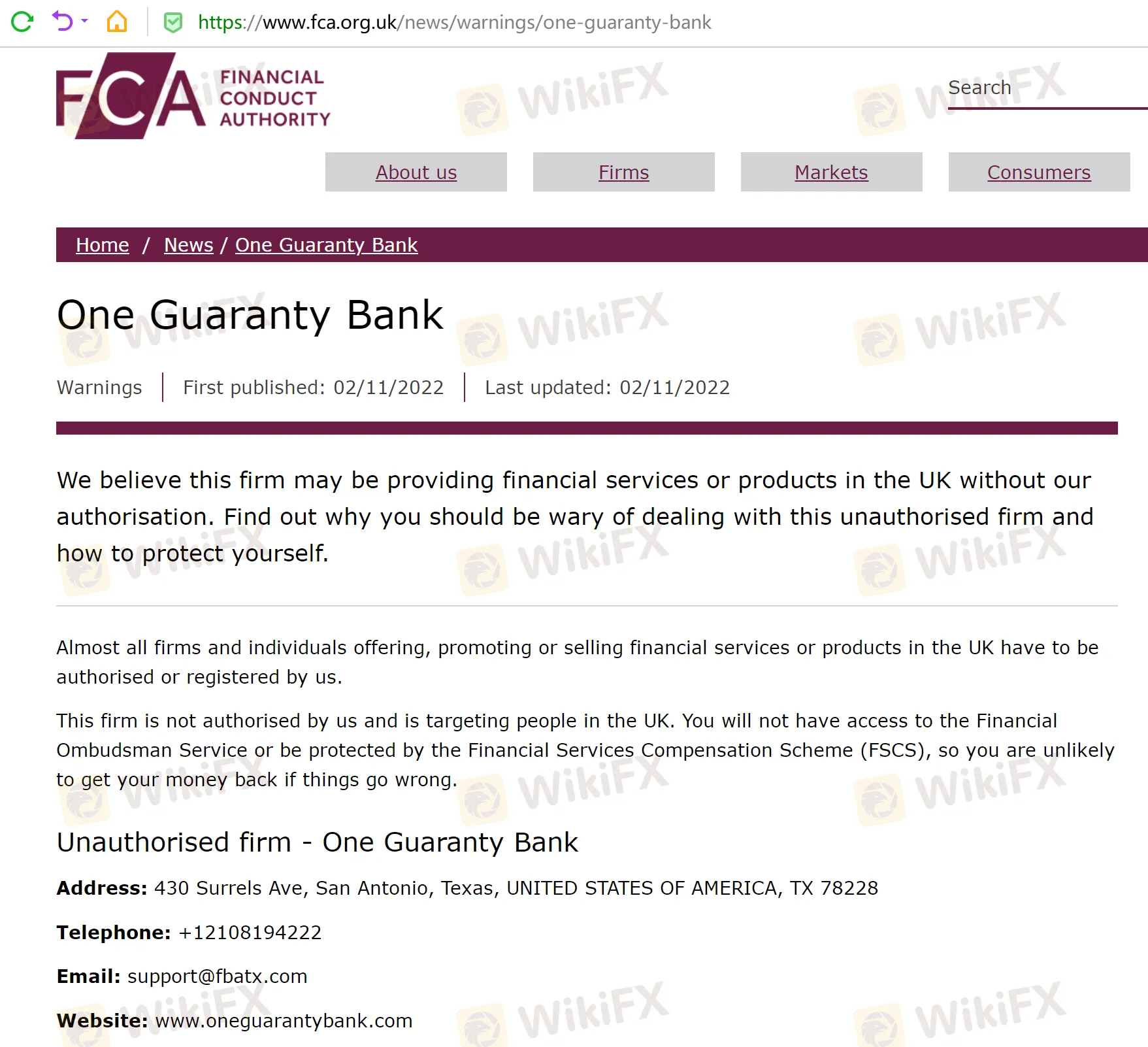

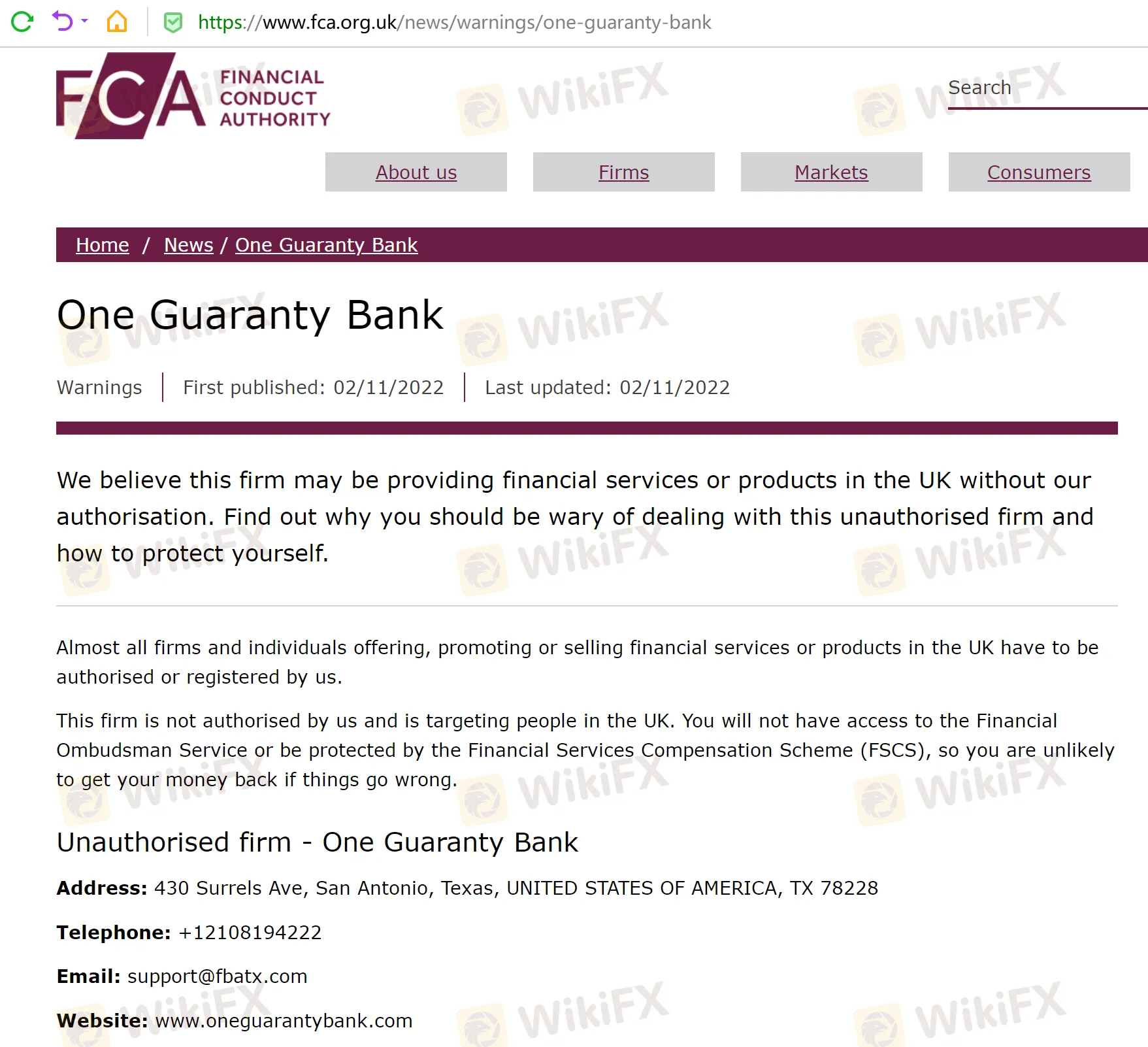

To start with the most essential, you may check the recent warning issued onNovember 2ndby the Financial Conduct Authority (FCA) in the UK against One Guaranty Bankon the screenshot below (source: https://www.fca.org.uk/news/warnings/one-guaranty-bank):

The regulatory body of the United Kingdom, called the FCA regularly issues these warnings, because there are regularly scam brokers on its markets, who try and defraud people. Most of these fraudsters operate from various offshore havens – small countries that do not regulate their Forex markets. Regardless, you need to be very careful when picking who to deal with – otherwise you can end up in serious danger!

WikiFX also made an attempt to visit the broker's official website to learn more. Nevertheless, when we opened it on Google Chrome, we were told that attackers on www.oneguarantybank.com might trick us into doing something dangerous:

WikiFX switched to another web version and successfully opened the brokers website. One Guaranty Bank brazenly claims to be regulated by the Financial Conduct Authority, which is obviously a lie given the FCA warning shown above.

Furthermore, the broker claims to be based in the United States, as you can see from the screenshot below:

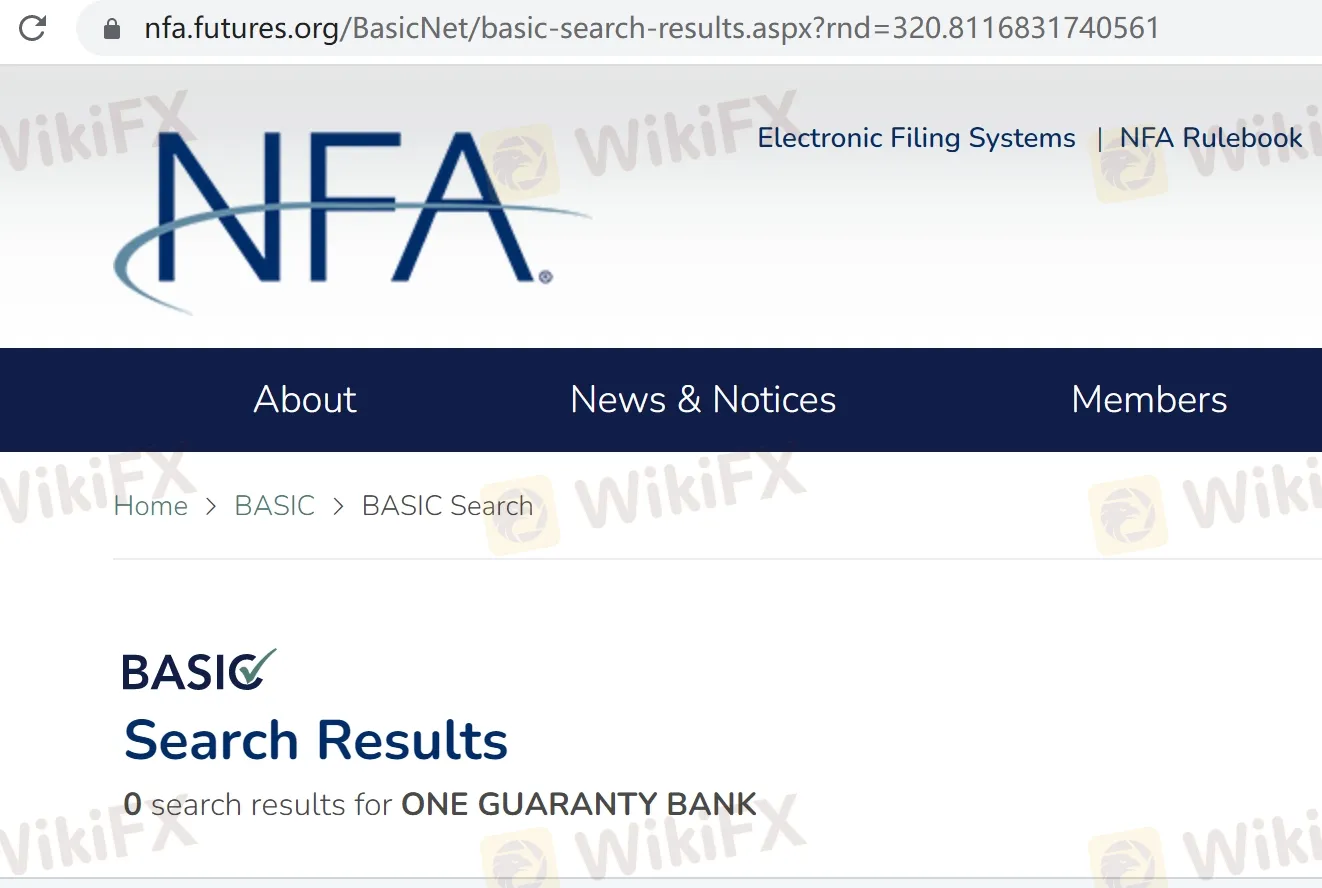

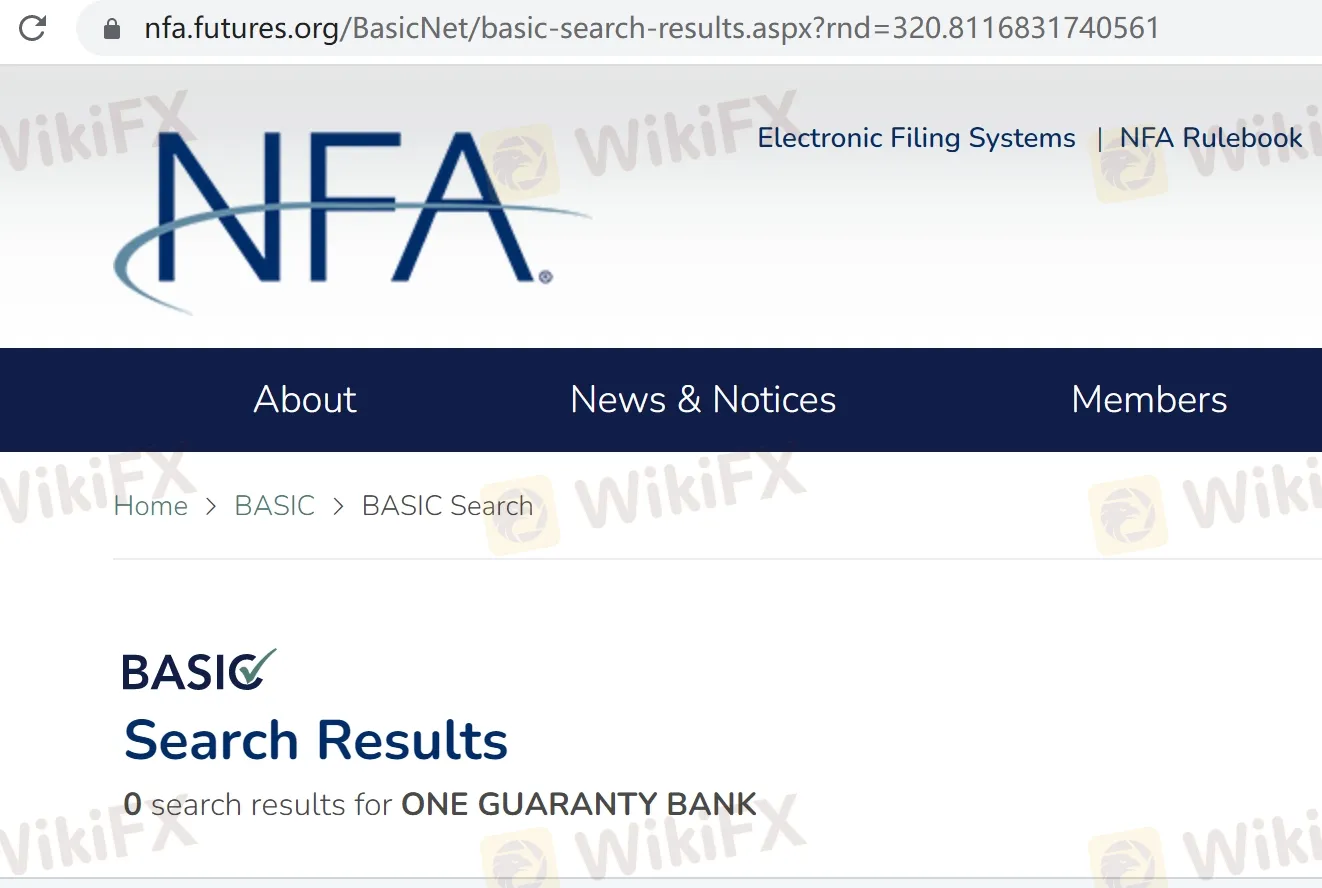

Bear in mind that if “the broker” was truly based in the U.S. it should have also been licensed and authorized as a Futures Commission Merchant (FCM) and a Foreign Exchange Dealer (FED) by the local Commodities Futures Trading Commission (CFTC) in addition to being accepted as a member of the National Futures Association (NFA). And One Guaranty Bank is clearly not regulated there either – WikiFX made the effort and checked the NFAregister but in vain, no company or broker by the name of One Guaranty Bank was listed there.

In a nutshell, it's not wise to invest in One Guaranty Bank. It is yet another broker blacklisted by the British authority FCA. The warning issued by the regulator says it all – the firm is not authorized, and customers who deposit with One Guaranty Bank will have no access to money protection!

WikiFX reminds you that forex scam is everywhere, you'd better check the broker's information and user reviews on WikiFX before investing. You can also expose forex scams on WikiFX. WikiFX will do everything in its power to help you and expose scams, warn others not to be scammed.

WikiFX keeps track of developments, providing instant updates on individual traders and helping investors avoid unscrupulous brokers. If you want to know whether a broker is safe or not, be sure to open WikiFXs official website (https://www.WikiFX.com/en) or download the WikiFX APP through this link (https://www.wikifx.com/en/download.html) to evaluate the safety and reliability of this broker!