Abstract:FinFX-Pro is an online forex broker rooted in the UK, FinFx-pro is a trusted professional-grade Research and Analysis Company that provides complete solutions for all the segments of the market, ranging from Currency, Commodities, Global Indices, and Individual Stocks. But can this broker make your money safe? In this article, we will look closely at this broker so you can make a wise decision yourself afterward.

About FinFX-Pro

FinFx-Pro is a forex and CFD broker registered in the UK, that provides investors with popular financial instruments, including forex currency pairs, gold, silver, oil, cryptocurrencies, and index CFDs.

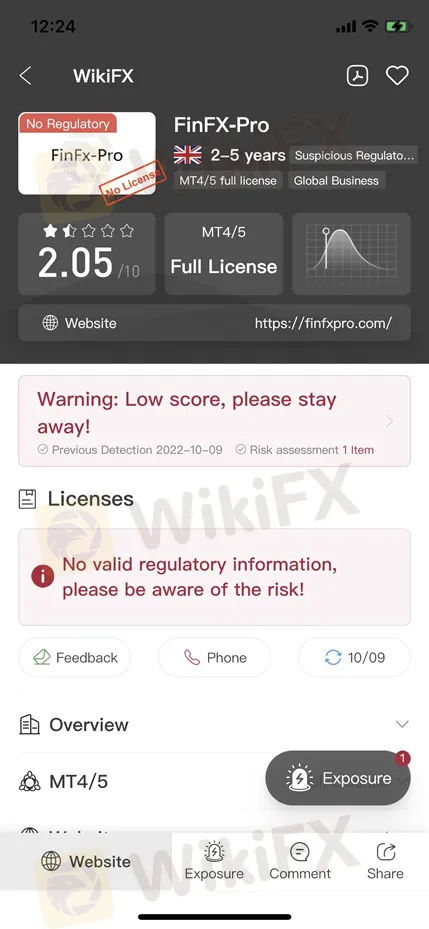

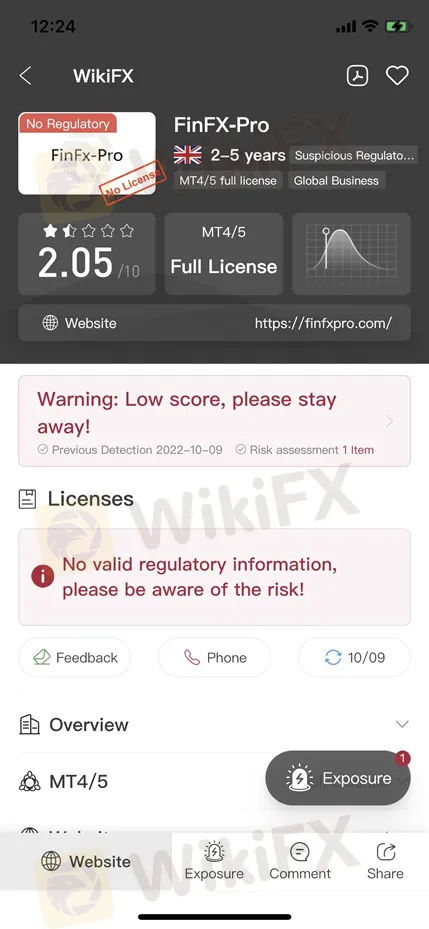

Regulation

FinFx-Pro is an unregulated broker. A regulatory certificate by a well-respected financial authority is probably the most important factor in the forex industry, as this gives credibility to the broker and security to potential traders. Therefore, Traders are advised to get away from any brokers that are not subject to any regulation.

Accounts & Minimum Deposit

There are five different trading accounts available. Micro (minimum deposit of $5), Standard STP (minimum deposit of $100), Pure ECN (minimum deposit of $200), VIP (minimum deposit of $25,000), and Islamic (minimum deposit of $200).

Leverage

When it comes to trading leverage, leverage levels vary depending on trading accounts. The maximum leverage is 1:100 for the VIP account, 1:200 for the Islamic account, and up to 1:400 for the rest of the accounts.

Spreads & Commissions

Standard STP accounts have spreads starting from 0.7 pips and no commissions. Micro accounts have spread starting at 0.2 pips and commissions of $4/standard lot. Pure ECN and VIP accounts have spreads starting at 0 pips, with pure ECN accounts charging $4/standard lot, and VIP accounts have commissions of $2/standard lot. Spreads for Islamic accounts start from 1 pip, and there is no commission.

Trading Platforms

FinFx-Pro offers traders the classic MT4 trading platform, one of the most widely used trading platforms on the market today, with support for algorithmic and automated trading, traders to create their trading programs, in addition to FinFx-Pro MT4 with powerful charting tools and 50 built-in technical indicators for seasoned traders and novice traders.

Exposure

This victim from Paraguay claimed that FinFX-Pro lures him to invest and take his money away fraudulently.

Conclusion

Since FinFX-Pro is an unregulated broker with a low rating, we advise you to avoid this broker as possible as you can. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP to find the most trusted broker for yourself.