SogoTrade Fined $75K Amid Compliance Failures

FINRA fines SogoTrade $75,000 for market access control failures as TopFX advances synthetic indices trading and 24/7 multi-asset solutions.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

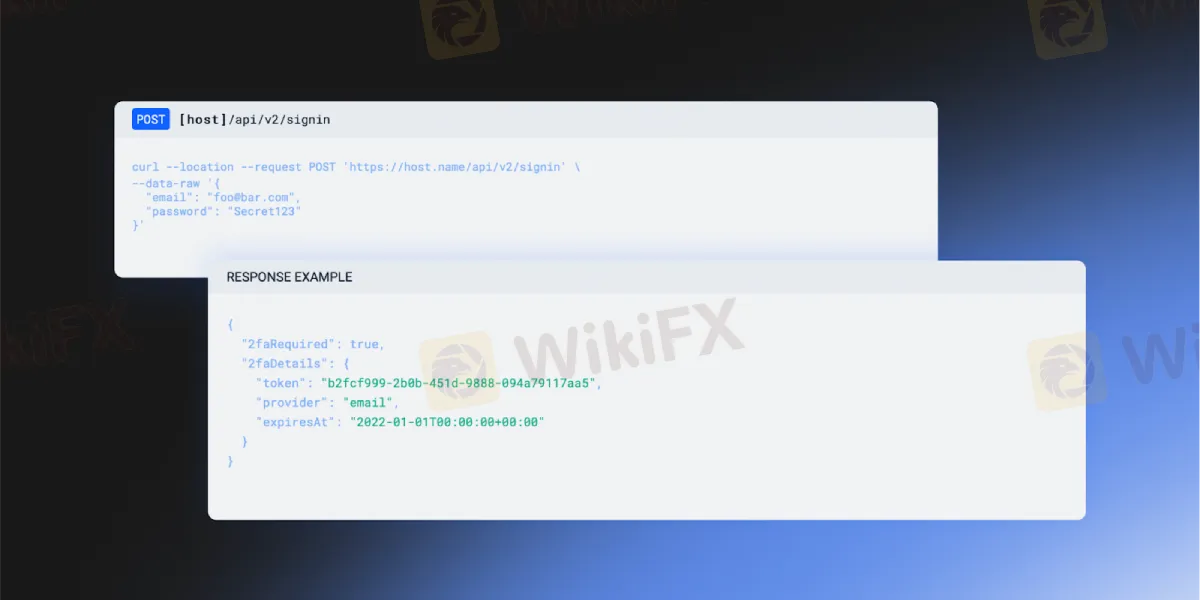

Abstract:B2Broker has announced the release of its new REST API, allowing customers to use B2Broker's products and services for their own commercial operations.

B2Broker has announced the release of its new REST API, allowing customers to use B2Broker's products and services for their own commercial operations.

Customers may utilize HTTP methods to add, read, update, and delete resources using the REST API. This is a huge accomplishment for the firm since it enables our clients to provide their consumers with a wider range of options and choices. This, we think, will result in enhanced consumer pleasure and loyalty.

B2Broker retains its position as the industry leader in providing cutting-edge Forex solutions with its newest update. We appreciate your ongoing support.

API for Back Office

Customers may utilize back-office API methods to get information about their users, accounts, and operations. This data may be utilized for both analytical and operational purposes.

Understanding how customers interact with the firm's products and services will be aided by the data obtained via this API.

This would greatly benefit companies since they will have a thorough understanding of their consumer base and will be able to target those customers more precisely with their marketing efforts.

Overall, this data will assist organizations in making more informed strategic choices and allocating their resources more effectively. Finally, the back-office API will assist organizations in improving their bottom line.

API for the Front-Office

The B2Core API methods help users by allowing them to interface with the Trader's Room or Front-Office API.

You can do much more with Front-Office APIs than just authenticate users, integrate your product's interface features into other platforms, and process transactions.

Front-Office APIs empower and enhance your product, making it more appealing to your customers.

You may use the Front-Office APIs to add new features and functions to your product, as well as make it more engaging and immersive.

You may also utilize it to provide your customers with a more smooth and more coherent experience. If you want to boost client happiness and loyalty, the Front-Office API is a tool you should think about using.

To summarize

We are thrilled to finally be able to make the B2Core API available to the public, and we will continue to develop its capabilities and features. We at B2Broker are always working to improve so that your experience with our products is the best it can be.

We aim to provide our clients with the tools they need to design the most efficient and user-friendly experience possible. As a result, the B2Core API's first release is merely the beginning.

We will continue to improve this API to meet and surpass your expectations. We believe that with this release, our users will find it easier to modify current applications and create new ones.

So, whether you're a Forex, cryptocurrency, or CFD broker, you can now utilize the B2Core API to grow your company. Crypto exchanges, converters, and other financial companies will benefit from the B2Core API as well.

Stay tuned for additional changes as we want everyone to be able to use this API. Please email us if you have any queries or comments.

About B2Broker

B2Broker is a worldwide supplier of Forex, CFDs, and cryptocurrency liquidity and technology. The firm provides a variety of options for companies looking to develop or grow financial trading activities. B2Broker provides comprehensive brokerage solutions for Forex, CFD, and cryptocurrency firms in addition to liquidity. Prospective customers may get the product offering by clicking here. B2Broker does not provide financial services; instead, it focuses on corporate and institutional clientele.

More of B2Broker

B2Broker LTD is a registered company in the United Kingdom of Great Britain and Ireland with the company number 10562809. The company is worldwide in scope. The firm has offices in three countries and a global footprint. The firm serves as a prime broker, giving enterprises and institutions access to worldwide liquidity pools.

Check out more of B2Broker on the WikiFX dealer page: https://www.wikifx.com/en/dealer/1951524925.html

About WikiFX

WikiFX is a search engine for worldwide corporate financial information. Its primary duty is to search for basic information, regulatory licenses, the credit assessment, platform identification, and other services for the participating foreign currency trading firms.

There are about 39,000 brokers listed on the marketplace, both licensed and unregistered. WikiFX's staff has been working hard with 30 financial regulators from across the world to guarantee that the information supplied is accurate and up-to-date.

Stay tuned for more Broker News.

Download the WikiFX App from the App Store or Google Play Store to access the news on the go.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

FINRA fines SogoTrade $75,000 for market access control failures as TopFX advances synthetic indices trading and 24/7 multi-asset solutions.

A WikiFX review of Zeven Global reveals the absence of regulatory licensing, a low safety rating, and potential risks to investor protection.

As the new year begins, WikiFX extends our sincere gratitude to traders worldwide, our industry partners, and all users who have consistently supported us.

Dear Forex Traders, When choosing a forex broker, have you ever faced these dilemmas? Dozens of broker advertisements, but unsure which one is truly reliable? Online reviews are either promotional content or outdated/incomplete? Want to learn about real users’ deposit/withdrawal experiences but can’t find firsthand accounts? Now, your experience can help thousands of traders and earn you generous rewards! The campaign is long-term and you can join anytime.