Allied Top Review: Scam or Legit Broker?

Allied Top review: Covering regulation, trading platforms, leverage, spreads, deposits, and real trader feedback for informed decisions.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

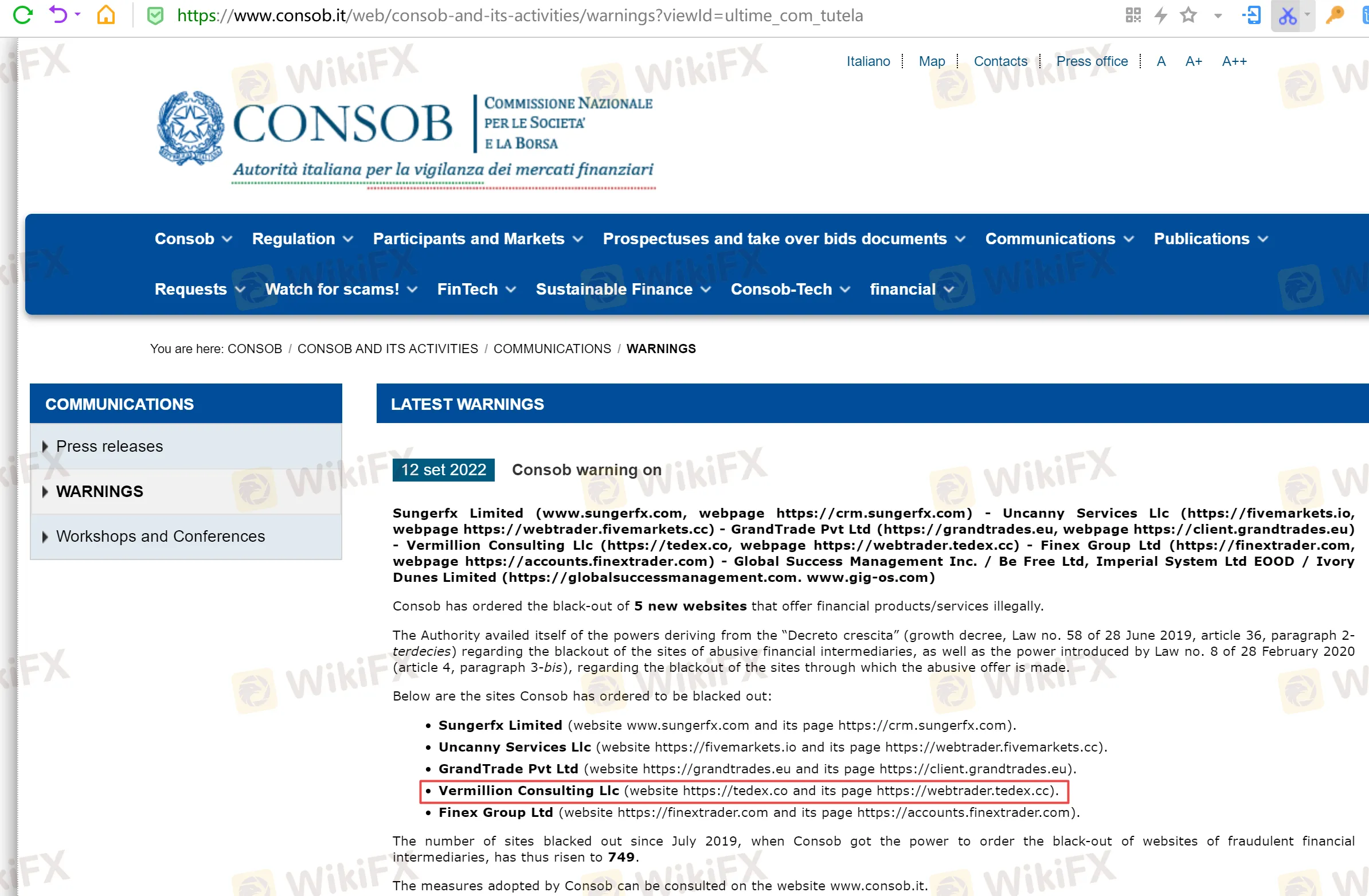

Abstract:The Italian regulator CONSOB issued an official warning against Tedex on September 12th!!!

Investors who are still trading forex at Tedex had better quit trading ASAP!!! Investors who have been deceived by this broker please contact WikiFX to help you recover your funds!!!

So let us start with the most important, the recent warning issued on September 12th against Tedex(tedex.co) by CONSOB – the financial regulator in Italy. Take a look:

“Consob draws investors attention to the importance of adopting the greatest diligence in order to make informed investment choices, adopting common sense behaviors, essential to safeguard their savings: these include, for websites that offer financial services, checking in advance that the operator with whom they are investing is authorized, and, for offers of financial products, that a prospectus has been published”, the warning by the Italian financial authorities reads.

What's more, in April, Tedex was also the subject of a warning issued by the regulatory body of Spain – the CNMV, as you can see from the screenshot below:

It states the company has been offering its services without authorization from the Spanish regulatory body CNMV. Take such warnings seriously – financial authorities usually have very specific reasons for blacklisting brokers.

WikiFX also paid a visit to the broker's official website to learn more. Tedex has been operating from the offshore scam paradise of St. Vincent and the Grenadines, as you can see below:

Tedex is operated byVermillion Consulting LLC, a firm that has registered in SVG because it does not require brokers to be formerly regulated. This has led countless scams to the shores of St. Vincent where they conduct their scams without needing to worry about regulatory pushback!

Furthermore, Tedex only provides a simple web trading platform, which is far less advanced than MT5 and only offers limited functionality!

Tedex offers three account types – Standard, Professional, and Elite. The broker promised extremely attractive spreads on all accounts – starting from 0.13 pips on Standard accounts and as low as 0 pips on Elite accounts. However, the truth was much different – WikiFX got around 3 pips on the benchmark EURUSD pair. This is a huge spread considering that the average you would find throughout the industry is around 1.5 pips.

The maximum leverage we were supposed to get on Standard account was supposed to be up to 1:50 which is already decently high – just consider that UK, EU, and Australian brokers can only offer up to 1:30 to retail clients according to the law. However, when we logged in to the platform, it turned out that we are trading with a leverage of 1:200 and that could not be changed from anywhere in the settings. This is less than great – brokers like Tedex would only mention the bigger profits trading with high leverage could result in and say nothing about the potentially huge losses it could lead to!

According to Terms and Conditions, Tedex included a clause that could result in huge monetary losses for you – namely, a dormant account fee. So after just 60 days, Tedex would charge an inactivity fee 0f 30% of your accounts total balance. The broker also reserves the right to introduce additional charges when they see fit – so who knows what sort of amazing fees will show up only after you have opened an account.

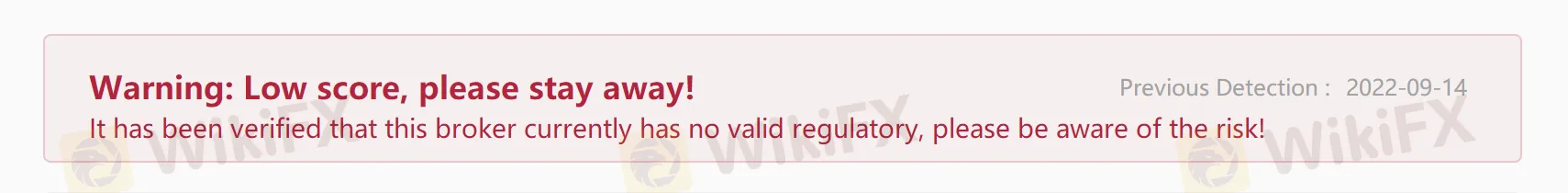

Now let's search “Tedex” on WikiFX APP to find out more about this broker. WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. WikiFX can evaluate the safety and reliability of more than 36,000 global forex brokers. WikiFX gives you a huge advantage while seeking the best forex brokers.

As you can see, based on information given on WikiFX (https://www.wikifx.com/en/dealer/9711886282.html), Tedexcurrently has no valid regulatory license and the score is rather negative - only 1.10/10! WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

Investors are advised to search relevant information on WikiFX APP about the broker you are inclined to trade with before finally deciding whether to make investment or not. Compared with official financial regulators which might lag behind, WikiFX is better at monitoring risks related to certain brokers - the WikiFX compliance and audit team gives a quantitative assessment of the level of broker regulatory through regulatory grading standards, regulatory actual values, regulatory utility models, and regulatory abnormality prediction models. If investors use WikiFX APP before investing in any broker, you will be more likely to avoid unnecessary trouble and thus be prevented from losing money! The importance of being cautious and prudent can never be stressed enough.

In a nutshell, it's not wise to invest in Tedex. The so-called brokerage is actually a scam website, which has already been exposed by the financial authorities in Italy.

WikiFX reminds you that forex scam is everywhere, you'd better check the broker's information and user reviews on WikiFX before investing. You can also expose forex scams on WikiFX. WikiFX will do everything in its power to help you and expose scams, warn others not to be scammed.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Allied Top review: Covering regulation, trading platforms, leverage, spreads, deposits, and real trader feedback for informed decisions.

Global broker STARTRADER refreshes its brand identity, reinforcing trust, growth, and client focus through a modernized visual and strategic repositioning.

FINRA fines SogoTrade $75,000 for market access control failures as TopFX advances synthetic indices trading and 24/7 multi-asset solutions.

A WikiFX review of Zeven Global reveals the absence of regulatory licensing, a low safety rating, and potential risks to investor protection.