Abstract:"One hit and you're gone". This is one controversial aspect of forex trading. How can you determine if a trader or a signal provider is good and consistent? Is winning 9 out of 10 trades profitable enough to be deemed good? If you answered yes to that question, start pondering on this golden question, "what if the last trade could wipe everything off?" In forex trading, it never hurts to consider the worst-case scenario first – after all, that is what most people do not do.

“One hit and you're gone”. This is one controversial aspect of forex trading. How can you determine if a trader or a signal provider is good and consistent? Is winning 9 out of 10 trades profitable enough to be deemed good? If you answered yes to that question, start pondering on this golden question, “what if the last trade could wipe everything off?” In forex trading, it never hurts to consider the worst-case scenario first – after all, that is what most people do not do.

Case 1

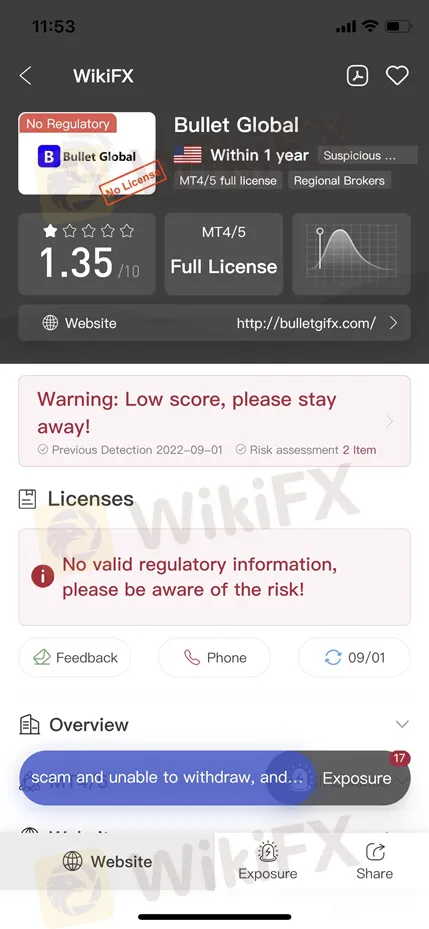

Earl is a client of Bullet Global Investment (BGI) from the Philippines. On 25th July 2022, he started signal trading provided by BGI.

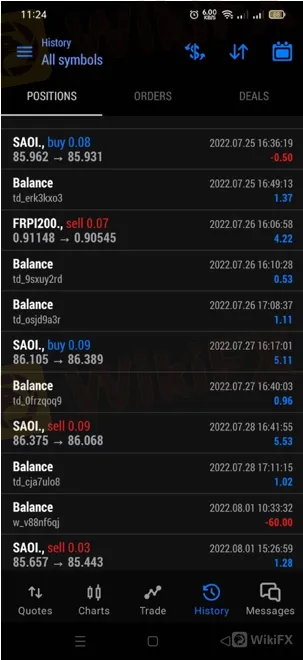

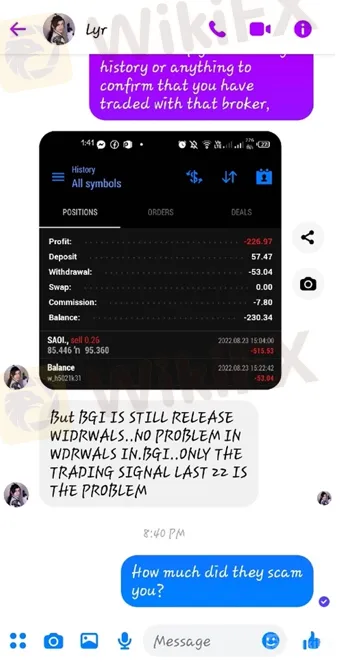

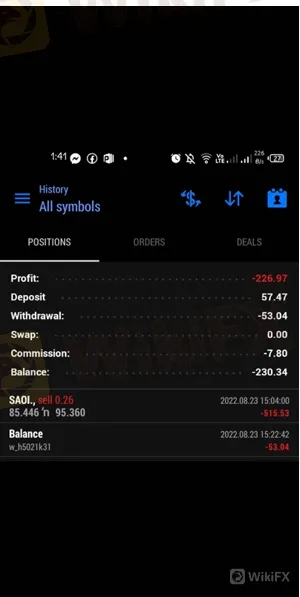

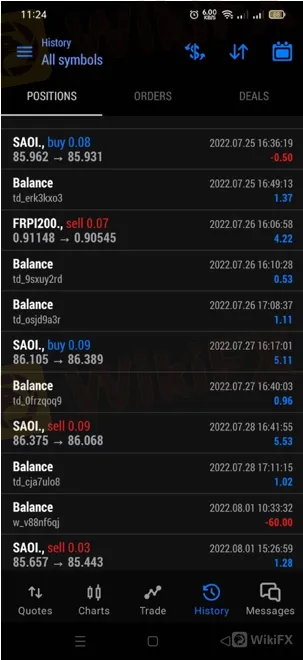

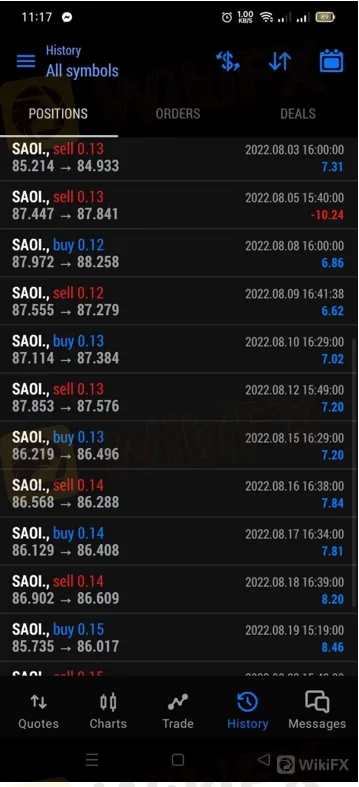

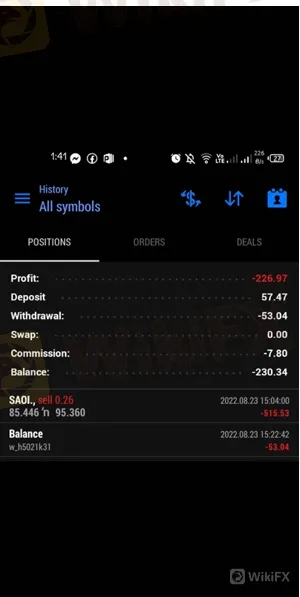

This is a screenshot of his trading account and the performance of BGIs signal towards the end of July 2022.

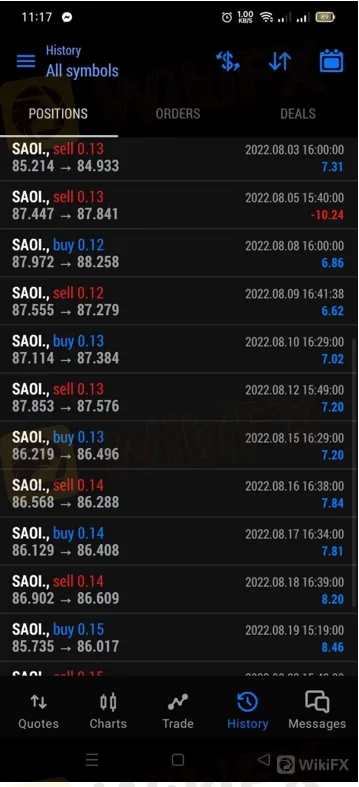

Initially, everything looked fine with the trading signal performing consistently with relatively bigger wins and small losses. From here, it is evident that in August, the trading signal upped its traded lot size while bagging consistent profits.

However, on 23rd August, Earl found that his account was wiped out completely. His accumulated profits for approximately 1 month had disappeared overnight.

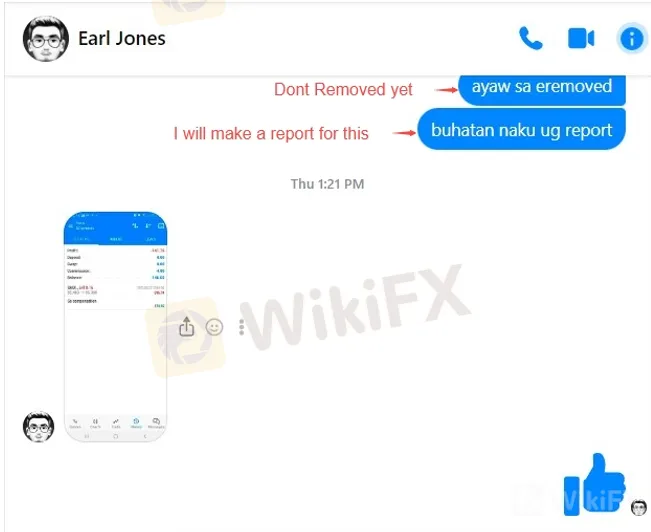

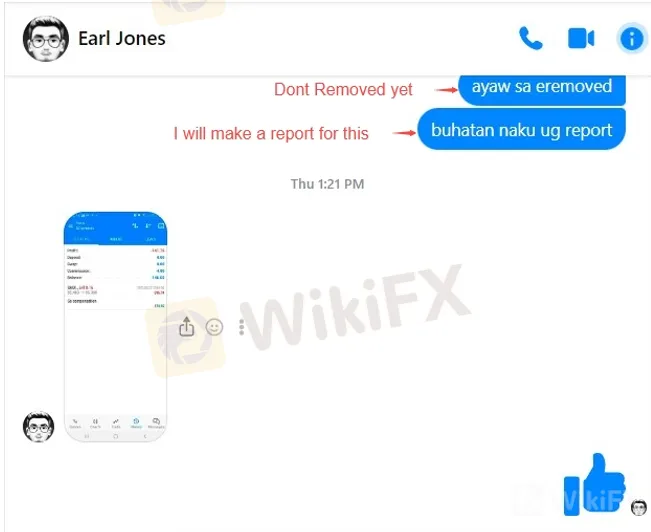

He then reached out to WikiFX for help through our Facebook page because he felt cheated by the signal provided by BGI.

Case 2

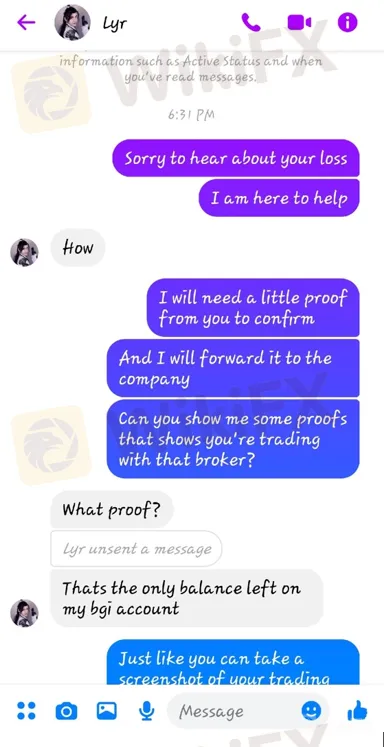

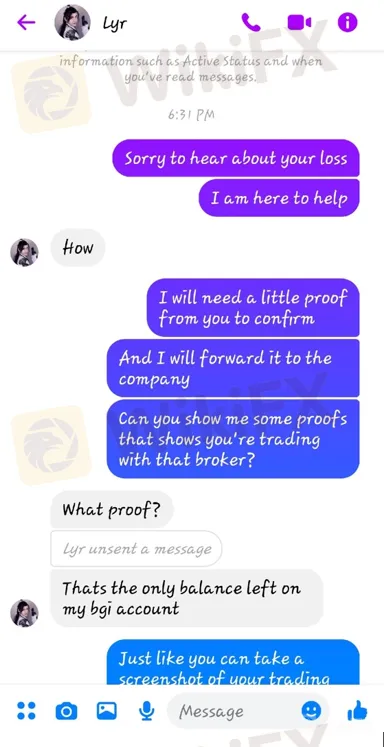

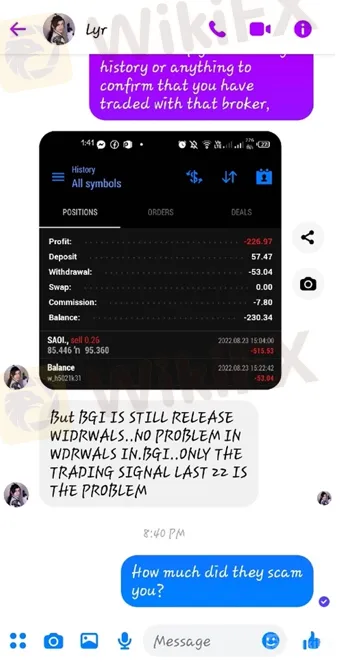

Lyr is another trading client who encountered a similar issue caused by BGI.

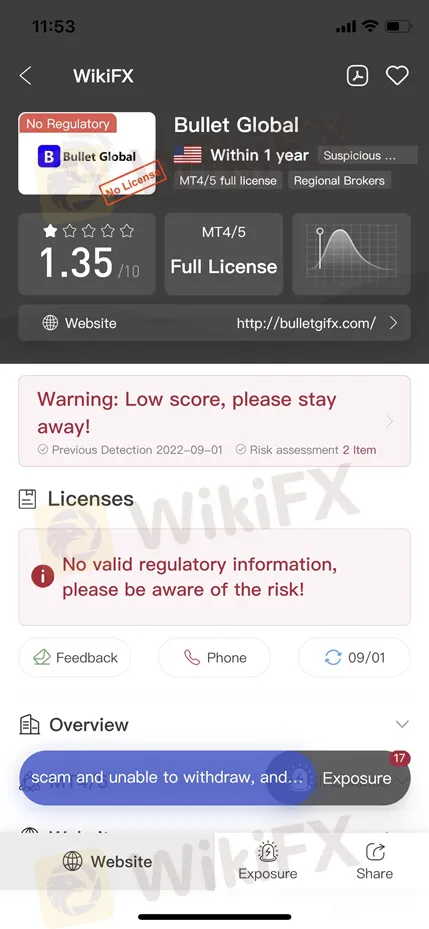

Due to the fact that WikiFX has been receiving several Exposure pieces targeting BGI, we are determined to further investigate this broker in question and the cases reported.

Stay tuned for more information.

If you are another victim of BGI, WikiFX urges you to quickly reach out to us with as much evidence as possible to aid in the investigation process.