UbitMarkets Review 2026: No Regulation, Direct Links to UBIT Coin Scam, and Serious Platform Risks

UbitMarkets review reveals no valid license and direct links to a fraudulent project, raising serious concerns over investor fund safety.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:There are basically two types of accounts in the forex market: institutional trading accounts and retail trading accounts. In this article, we will discuss institutional trading accounts. WikiFX has listed four solid brokers offering institutional trading accounts.

There are basically two types of accounts in the forex market: institutional trading accounts and retail trading accounts. In this article, we will discuss institutional trading accounts. WikiFX has listed four solid brokers offering institutional trading accounts.

What is an Institutional forex trading account?

Institutional trading accounts are not for individuals. Among the institutions, groups, and companies that use these accounts are banks, mutual funds, insurance companies, multinational corporations, pension funds, and hedge funds.

Comparing retail and institutional trading accounts, institutional trading accounts have additional advantages. Their systems can be connected to the real-time data of financial brokers via APIs. In such a completely in-house environment, they are able to execute trades quickly.

Brokers list: Institutional trading accounts

A member of the FTSE 250 since 1974, IG Group is an established financial services provider. Its nearly 50-year experience in leading the market gives it a huge advantage over its competitors. The company has been recognized as a pioneer in its field, having created a whole new type of trading in the year it was founded. It offers more than 400 products and has offices in 20 countries across five continents, serving over 400,000 clients worldwide.

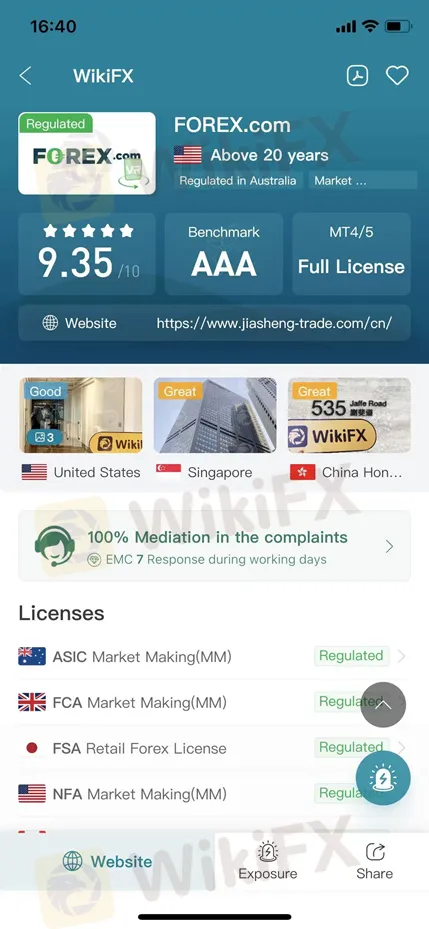

FOREX.com is the leading global retail online trading brand of Gain Capital, owned by NASDAQ-listed StoneX Group Inc. Founded in 1999, this company has developed into a global leader in online trading and operates through its regulated subsidiaries in seven major financial jurisdictions around the world

AvaTrade was established in 2006 in Dublin, the capital of Ireland, co-founded by professionals in the financial field and experts in the e-commerce field. By the end of 2016, AvaTrade had 16 directly-affiliated branches, with branches in five continents around the world, in addition to representative offices in more than 20 countries, and business covering more than 150 countries around the world.

IC Markets is a leading forex broker around the globe, offering various solutions for active traders, day traders, scalpers and more. IC Markets allows its clients access to a massive market with diversified types of trading instruments.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

UbitMarkets review reveals no valid license and direct links to a fraudulent project, raising serious concerns over investor fund safety.

LMAX GROUP review: FCA regulation, WikiFX score 7.51/10, trader complaints, risks, and broker comparison. Is LMAX GROUP safe for traders?

Is withdrawal issue perennial for Phyntex Markets traders like you? Does the Comoros-based forex broker give you numerous excuses to deny you withdrawals? Faced account blocks when raising Phyntex Markets withdrawal queries? Feel that the broker’s customer support service does not exist for you? Many traders have openly expressed frustration on how the broker goes about its business on review platforms. In this Phyntex Markets review article, we have shared multiple complaints against the broker. Keep reading to know the same.

Have you made multiple unsuccessful attempts to withdraw funds from your Tifia forex trading account? Registered successful trades but could not withdraw because of inadequate customer support service? Have you been facing capital losses due to severe slippage on the Tifia login? These issues have become increasingly common for traders here. Many of them have made such allegations on broker review platforms. In this Tifia review article, we have explored some scam allegations. Take a look!