SogoTrade Fined $75K Amid Compliance Failures

FINRA fines SogoTrade $75,000 for market access control failures as TopFX advances synthetic indices trading and 24/7 multi-asset solutions.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Bitcoin Trade Pro is a scam you should avoid, and WikiFX will explain why in the following review.

The currency market, which is filled both opportunities and risks, is unpredictable. While many investors have gained considerable returns after investing in the forex market, those who suffered great losses have learned painful lessons. Today, WikiFX is going to review a forex broker named Bitcoin Trade Pro (bitcointradepro.com) for investors and traders.

First let's search “Bitcoin Trade Pro” on WikiFX APP to take a look at the details page. WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. WikiFX can evaluate the safety and reliability of more than 36,000 global forex brokers. WikiFX gives you a huge advantage while seeking the best forex brokers.

As you can see, based on information given on WikiFX (https://www.wikifx.com/en/dealer/1616759004.html), Bitcoin Trade Pro currently has no valid regulatory license and the score is rather negative - only 0.99/10. WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

WikiFX also paid a visit to the broker‘s website to learn more. On the homepage, we see a claim that behind the brand Bitcoin Trade Pro is a group of companies holding licenses from Cyprus Securities and Exchange Commission (CySEC), Vanuatu Financial Services Commision (VFSC) and South Africa’s Financial Sector Conduct Authority (FSCA):

Experience shows that such information should not be taken on trust. A check of the CySEC database shows that there is no authorized broker with this name and using this domain.

The company listed on the Bitcoin Trade Pro website also cannot be found in the VFSC Register. The registration number shown belongs to a different company, Primus Markets Intl Limited.

When we searched in the FSCA database, we also discovered a company with this license number – but it was not Bitcoin Trade Pro. Moreover, the license issued for that company has expired.

FSCA also issued a warning in June that the Bitcoin Trade Pro is not authorized to provide financial services:

The fact that the broker is fully unlicensed but has tried to fool you into thinking otherwise is a sure sign that we are dealing with a scam!

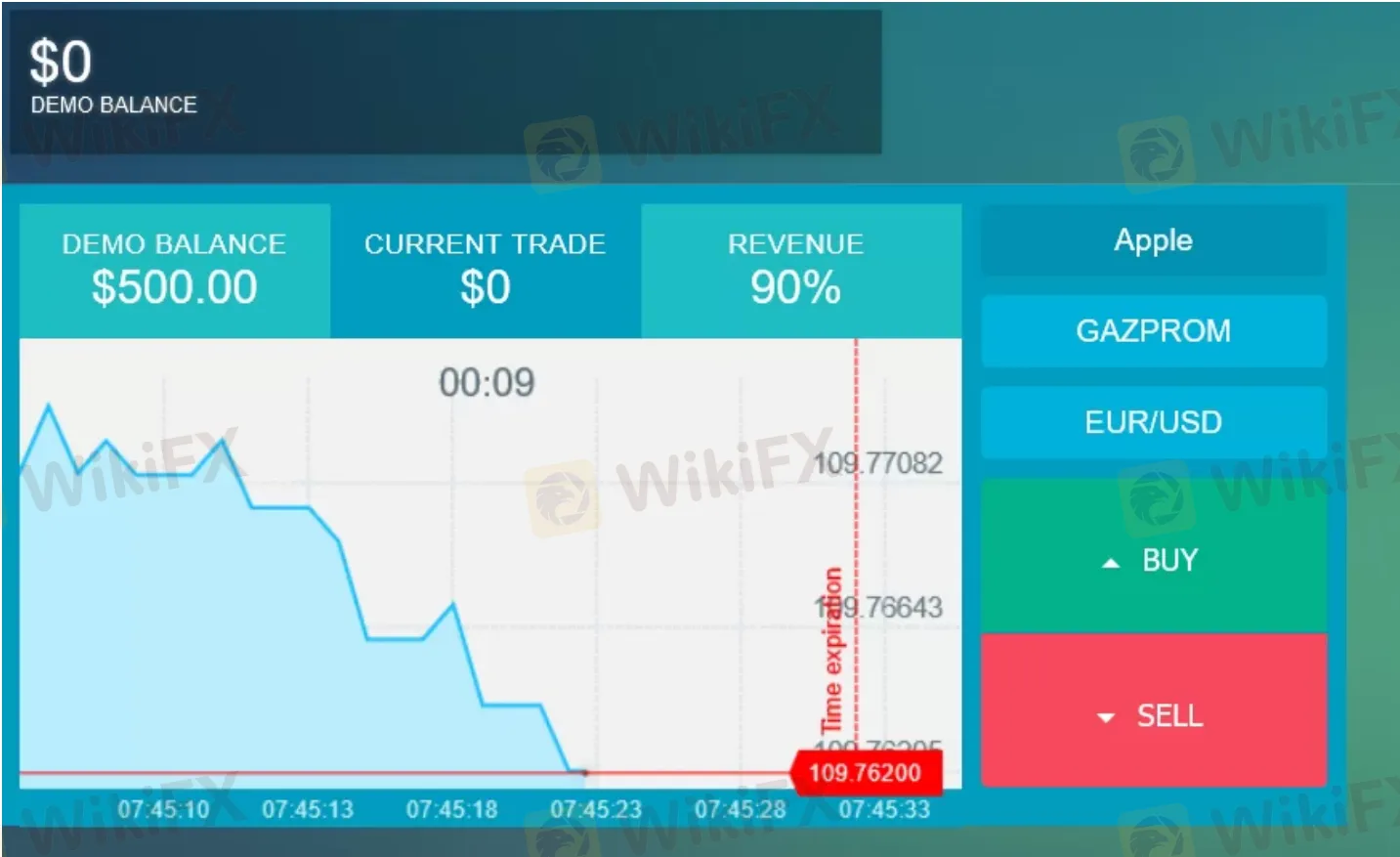

What's more, Bitcoin Trade Pro claims to offer several advanced trading platforms. After signing up for an account it becomes apparent that this is also a lie. In the dashboard, WikiFX only sees simple charts with current Bitcoin prices. There is also a “demo trader” which is a very unconvincing imitation, supposedly allowing simulated trading of Apple and Gazprom shares.

Furthermore, the only deposit option at Bitcoin Trade Pro is Bitcoin. Cryptocurrencies are the payment method of choice for most financial fraudsters. The reason is that these transactions allow for a great degree of anonymity for the fraudsters while preventing the defrauded from requesting a refund.

Given what has been discussed above, it can be concluded that Bitcoin Trade Pro is not trustworthy at all. All traders should be vigilant when investing in a broker. WikiFX keeps track of developments, providing instant updates on individual traders and helping investors avoid unscrupulous brokers. If you want to know whether a broker is safe or not, be sure to open WikiFXs official website (https://www.WikiFX.com/en) or download the WikiFX APP through this link (https://www.wikifx.com/en/download.html) to evaluate the safety and reliability of this broker!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

FINRA fines SogoTrade $75,000 for market access control failures as TopFX advances synthetic indices trading and 24/7 multi-asset solutions.

A WikiFX review of Zeven Global reveals the absence of regulatory licensing, a low safety rating, and potential risks to investor protection.

As the new year begins, WikiFX extends our sincere gratitude to traders worldwide, our industry partners, and all users who have consistently supported us.

Dear Forex Traders, When choosing a forex broker, have you ever faced these dilemmas? Dozens of broker advertisements, but unsure which one is truly reliable? Online reviews are either promotional content or outdated/incomplete? Want to learn about real users’ deposit/withdrawal experiences but can’t find firsthand accounts? Now, your experience can help thousands of traders and earn you generous rewards! The campaign is long-term and you can join anytime.