Abstract:Uptos (https://uptos.com/) is a St. Vincent and Grenadines-based offshore brokerage business. Clients may trade tradable assets across numerous financial markets, including FX, equities, indices, commodities, and digital currencies, via the broker.

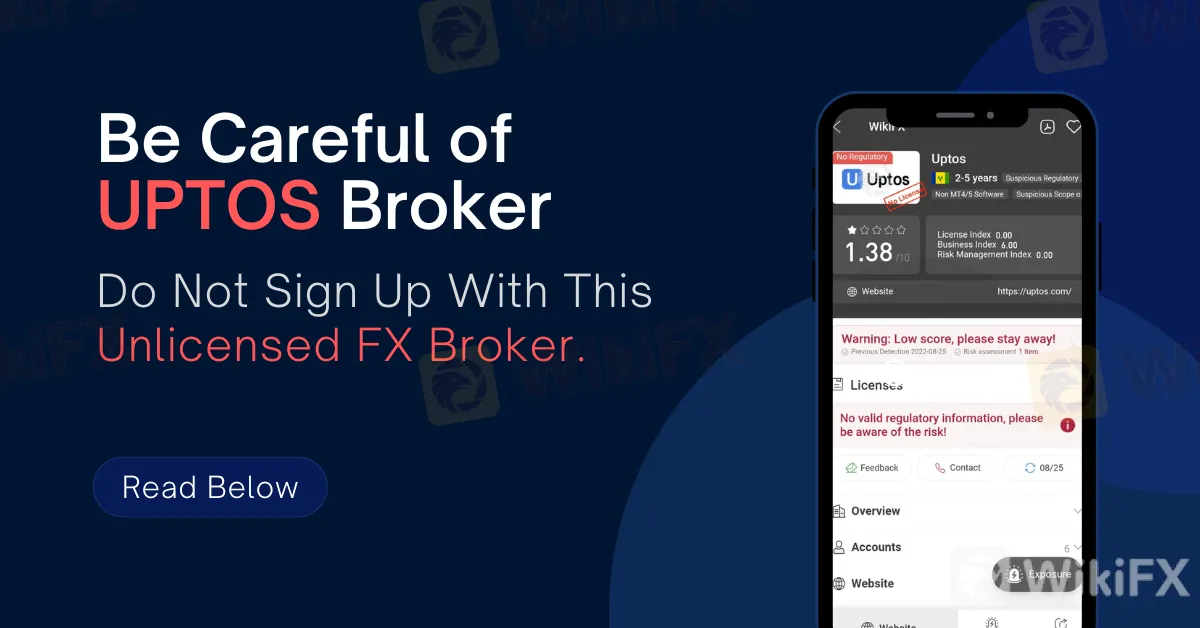

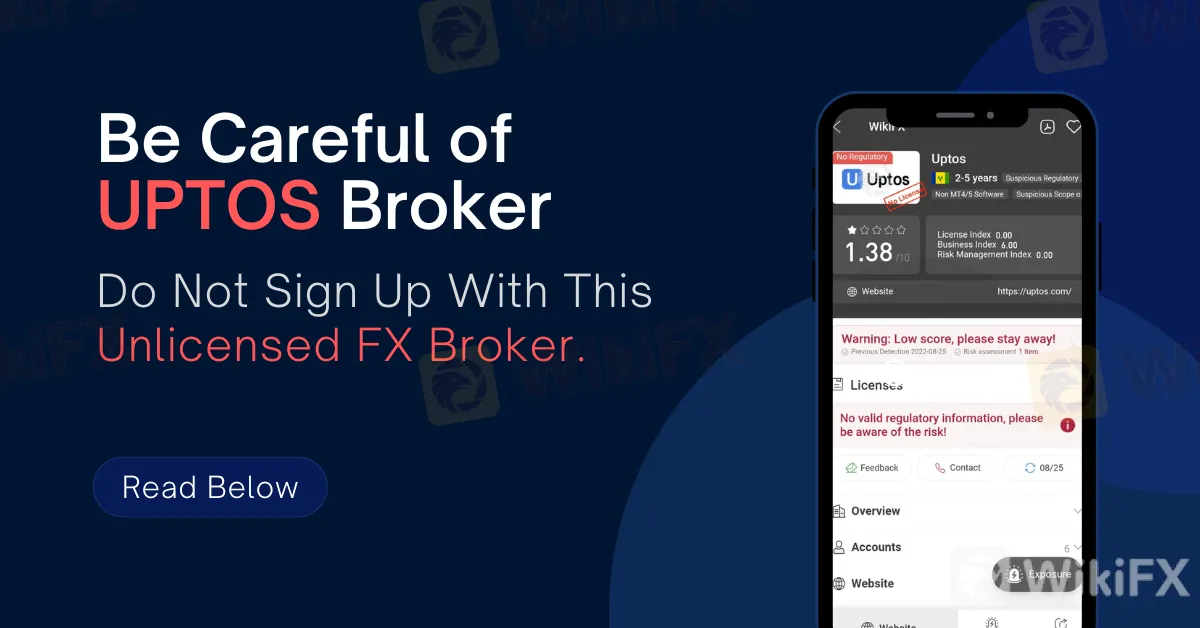

Losses in investment markets are unavoidable. It should not, however, be the consequence of your carelessness, which relates to losing your hard-earned money to scam brokers, which you may prevent by taking steps. Today, we'll look at how shady brokers like UPTOS cheat investors and what you can do to avoid falling into their trap.On the other hand, a trusted program called the WikiFX App assists traders in verifying a broker's regulation without having to visit several websites or read papers. WikiFX was developed to give up-to-date brokerage regulatory information. If you've ever questioned why WikiFX can give correct information to traders, it's because WikiFX has been working diligently with 30 financial regulators to disclose the broker's true position.

The data in the WikiFX database is sourced from legitimate regulatory bodies like the FCA, ASIC, and others. Fairness, impartiality, and facts are also emphasized in the released information. WikiFX does not charge public relations fees, advertising costs, ranking fees, data cleaning fees, or any other unreasonable expenses. WikiFX will do everything possible to keep the database consistent and synchronized with authoritative data sources such as regulatory bodies, but cannot promise that the data will always be up to date.

A Quick Overview of Uptos

Uptos (https://uptos.com/) is a St. Vincent and Grenadines-based offshore brokerage business. Clients may trade tradable assets across numerous financial markets, including FX, equities, indices, commodities, and digital currencies, via the broker. The firm promises to provide dependable trading conditions with its custom-built trading platform, which is accessible via all channels, including Web, Desktop, and Mobile. It also allows for copy swapping.

Is Uptos Regulated?

Nowhere in the world is Uptos controlled. Furthermore, the firm claims to be registered in Saint Vincent and the Grenadines. However, it does not show in the search results on the website of St. Vincent and the Grenadines Financial Services Authority (SVG FSA). Furthermore, the SVG FSA does not regulate or license financial intermediaries that operate in forex and CFD trading. As a result, Uptos is a fraud.

Client Response

Clients seem to be quite dissatisfied with the broker. Almost 60% of investors have condemned the corporation for its unethical business practices.

How do Uptos Take Advantage of Traders?

Uptos organizes the capture of customers. When you initially visit a broker's website, it is difficult to tell it apart from a real platform. Brokers provide appealing trading techniques that attract investors in addition to tempting them to employ automated trading tools for rapid profits.

The corporation has every resource to make you feel it is a reliable partner, from product descriptions and specifications to the promotion of sophisticated trading tools and features and claiming legal compliance.

When you register with the broker, its marketing staff contacts you and encourages you to make a deposit. It poses as your account manager and promises you a successful trading venture.

After receiving your cash, it either encourages you to make further deposits by enticing you with unique offers or persuades you to test its auto-trading option.

According to customers, the auto trading robot initially delivers you lucrative transactions. However, after a time, you begin to lose your position. Furthermore, when you want to withdraw your remaining dollars, the firm drives you insane and refuses to release your money.

How do you prevent unregulated broker like UPTOS?

Before joining up with it, be sure to check its license status. Furthermore, evaluating a broker's reputation using third-party broker review services such as WikiFX App may aid in the identification of a dishonest broker. You may also study customer reviews on various forex or social trading networks to see if a firm is worth investing in.

The WikiFX staff can help traders in retrieving their funds from fraudulent brokers with the help of Financial Authorities. Visit the official WikiFX website at www.wikifx.com and share your negative experience with your broker. You may also contact customer service directly using the information provided below.

Remember that rules do not ensure the security of your cash with the broker. It does, however, safeguard your right to sue the broker if it violates the code of conduct.

You may visit UPTOS dealer page on WikiFX to know more: https://www.wikifx.com/en/dealer/7111162597.html

Keep an eye out for Uptos.

Download the WikiFX App from the App Store or Google Play Store to stay up to date on the newest news.