Abstract: ATFX, FXTM, and EightCap are three forex brokers that have excellent reputations in the forex industry. If you are curious about the similarity between these three brokers, you should not miss this article as we will explore them from different perspectives.

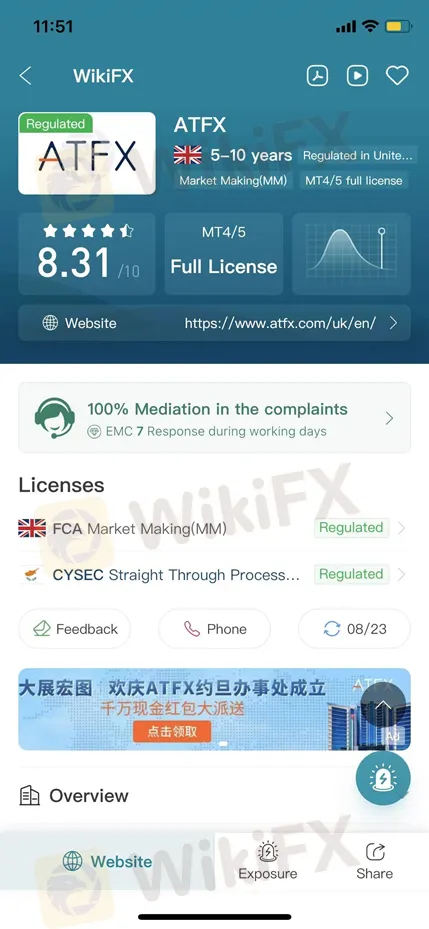

ATFX

ATFX is a co-brand shared by a group of entities including AT Global Markets (UK) Ltd. The company provides users with a hundred kinds of CFDs products including currency pairs, precious metals, energy, stocks, and indices. There are 43 currency pairs, precious metals including spot gold, silver, and futures gold; Energies include British crude oil, US crude oil, and US natural gas; 15 indexes are provided, including multi-national stock market indexes and US dollar indexes; 86 well-known corporate stocks listed in Europe and the United States.

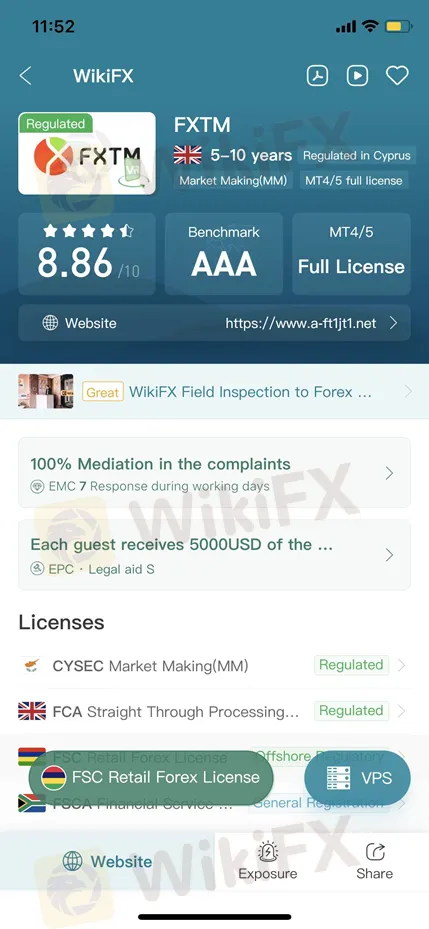

FXTM

Founded in 2011, FXTM is an online forex broker, providing services for its clients globally. FXTM offers over 250 trading products to investors worldwide, covering a wide range of investment instruments such as currency pairs, precious metals, commodity CFDs, index CFDs, equities CFDs, and more.

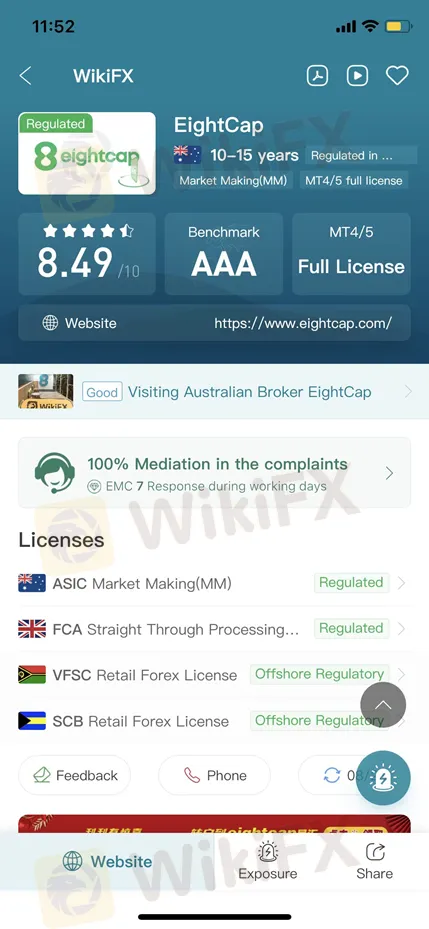

EightCap

Eightcap Group was established in 2009 in Melbourne, Australia's traditional financial center. The company's management team consists of elites who have over 20 years of experience in the forex and financial fields in investment banks and are committed to providing traders with a fair, transparent, and trustworthy trading environment. Eightcap offers mainstream and popular financial instruments in the global financial markets, including forex (42 currency pairs), indices, precious metals (gold, silver), and crude oil.

Regulation

One of the biggest reasons why we consider these three brokers trustworthy is that they are regulated by different regulatory authorities from around the world. Unlike scam brokers, it is not likely for them to take clients money away fraudulently as they are restricted by regulatory authorities.

No exposure on WikiFX

On WikiFX, the Exposure consists of feedback from traders. A bad track record of brokers can be checked via Exposure. WikiFXs Exposure function helps you get feedback from other traders and remind you of the risks before it starts.

The reputation of these brokers has contributed to their unshakeable status in the forex industry. Therefore, there is no exposure related to these brokers found on WikiFX.

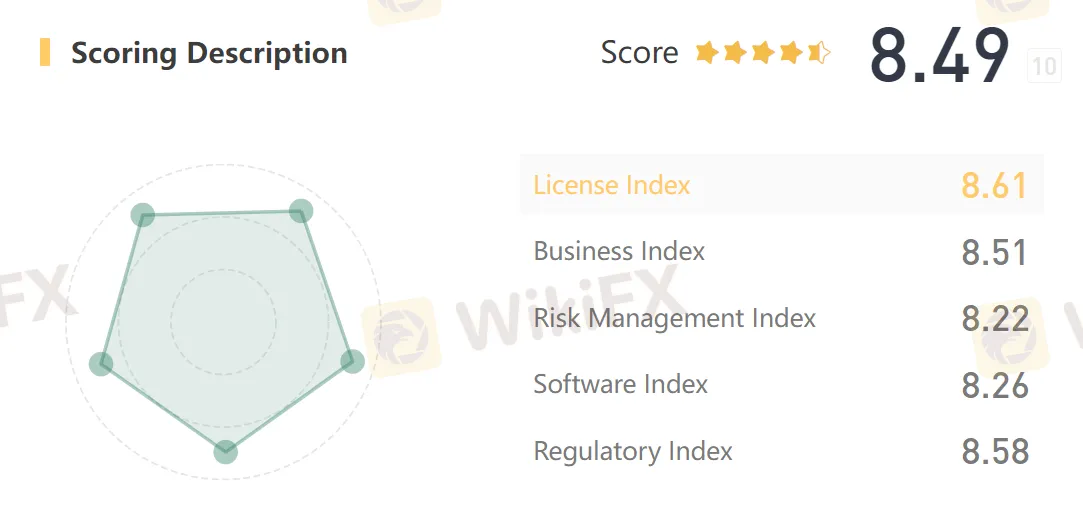

Risk Management

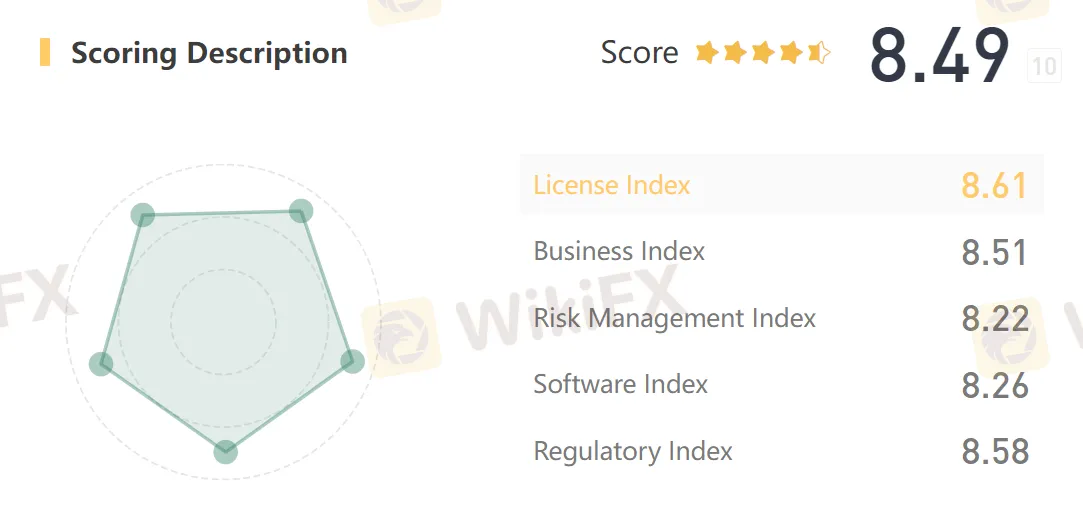

Risk management includes the measurement, assessment, and contingency strategy of risk. Ideally, risk management is a series of prioritized events. ATFX, FXTM, and EightCap have excellent abilities in risk management. This means if some emergencies happen, these brokers have enough capital to solve the problems without harming the interests of customers.

ATFX

FXTM

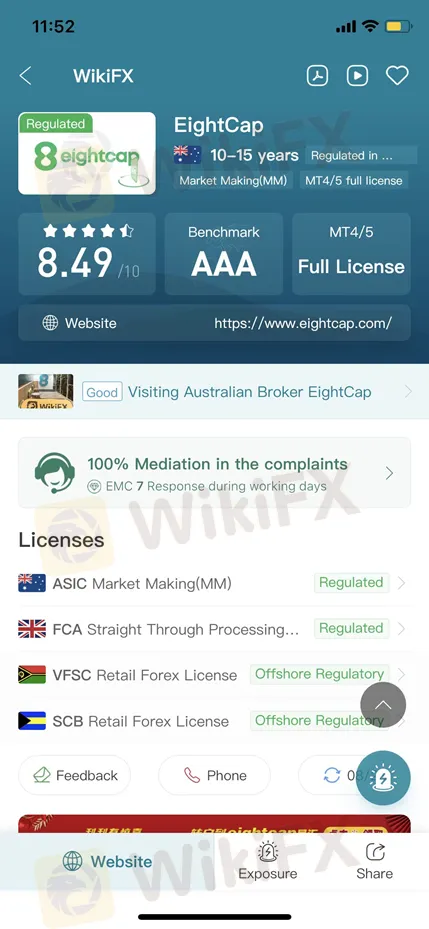

EightCap

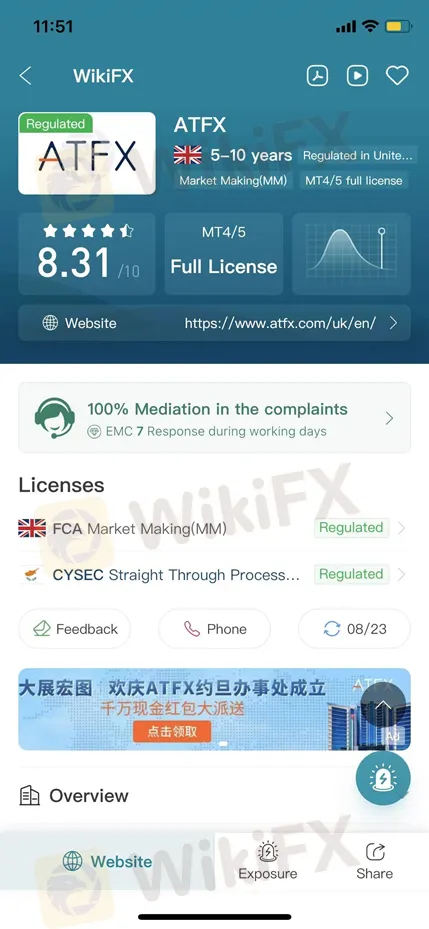

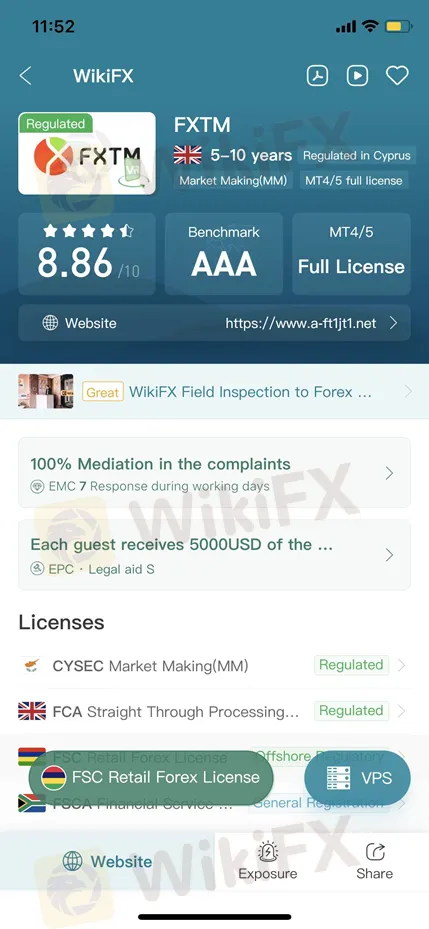

High Score on WikiFX

WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

ATFX, FXTM, and EightCap all have high scores on WikiFX. They all got WikiFX scores of over 8.

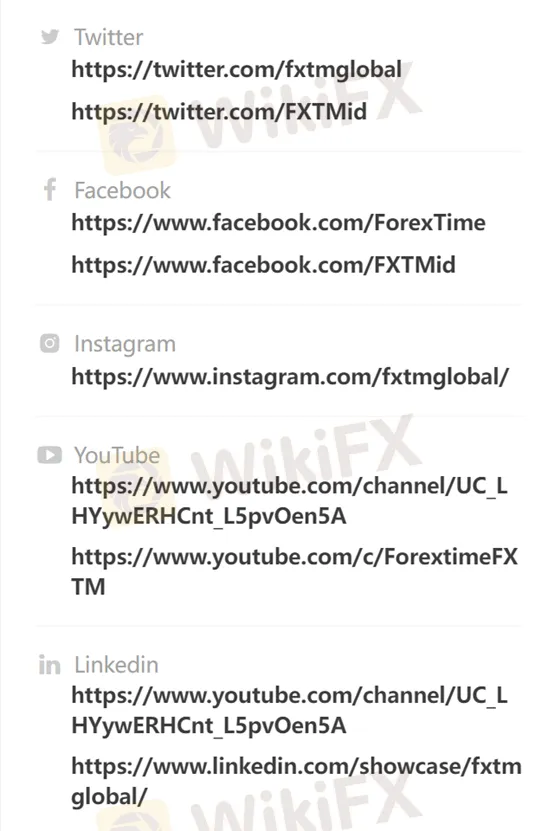

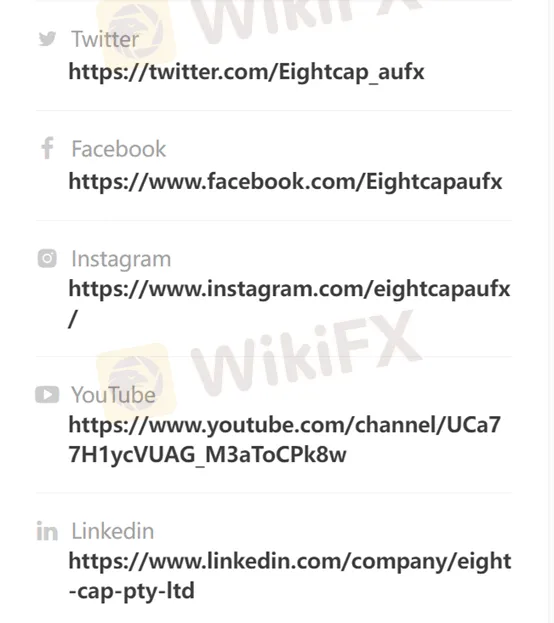

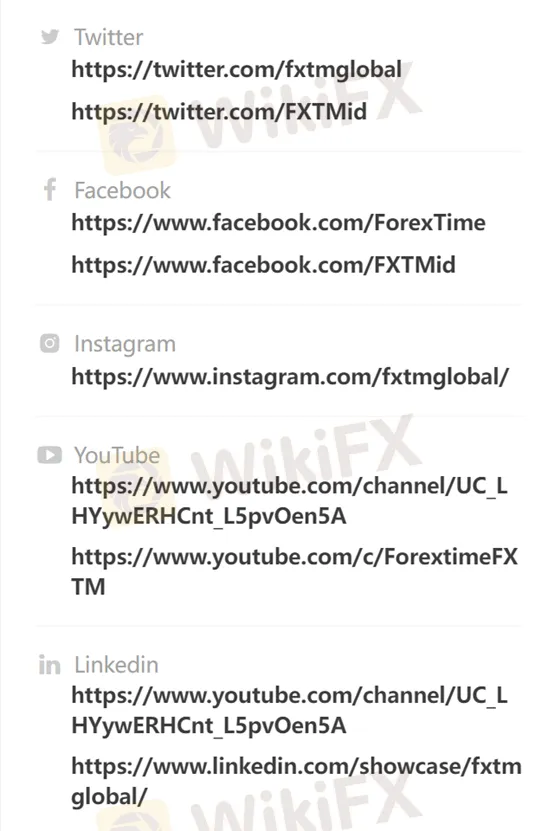

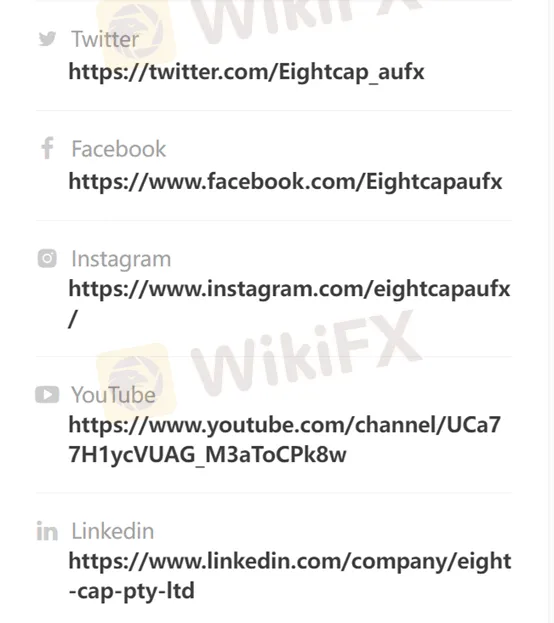

Social medias supported

Good brokers will use the media platform to promote publicity. There is no doubt that ATFX, FXTM, and EightCap all have their own official accounts on different mainstream social media platforms, such as Twitter, Facebook, YouTube, Instagram, and LinkedIn.

ATFX:

FXTM

EightCap

Conclusion

ATFX, FXTM, and EightCap are solid, regulated brokers that have had honorable reputations for a long time. If you want to choose a trustworthy broker to invest in, all of these three are wise choices, although some other brokers are also as good as them.

If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP for free through this link (https://www.wikifx.com/en/download.html). Running well in both the Android system and the IOS system, the WikiFX APP offers you the easiest and most convenient way to seek the brokers you are curious about.