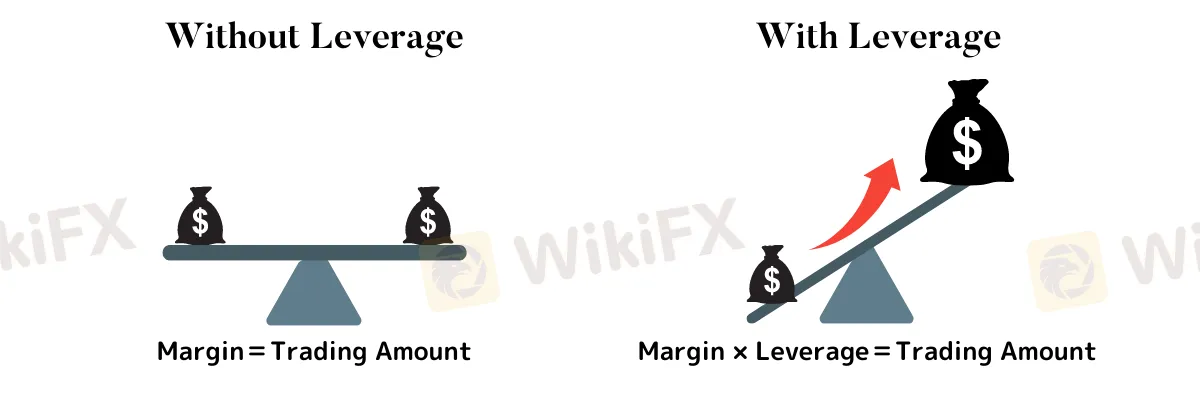

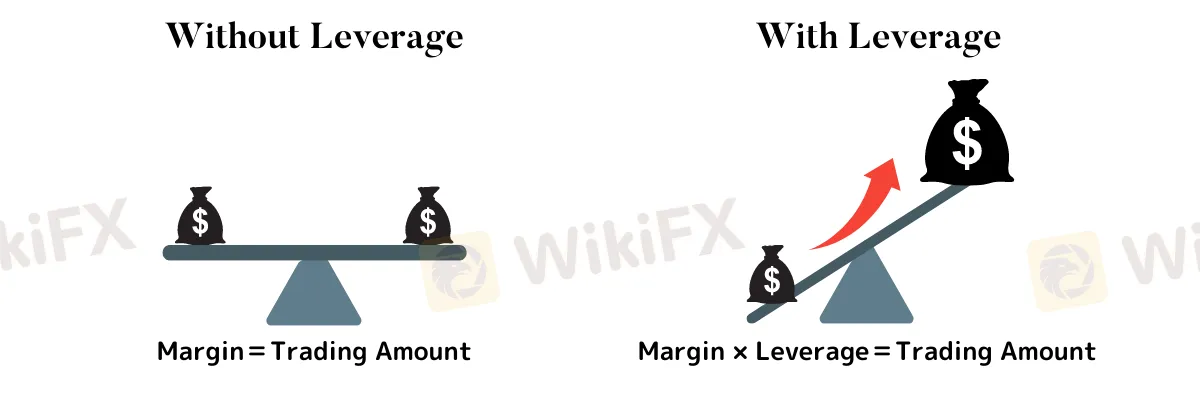

Abstract:Leverage can greatly amplify profits and losses as merchants can control larger positions using less money (margin). Leverage transactions are also called margin transactions.

Leverage will amplify potential gains and losses. For example, if you purchase EUR/USD at 1.0000 without leverage, the price will be zero or you will have to double your investment by moving to 2.0000 to bear the total loss. When trading using a total of 100:1 leverage, 100 times less price fluctuations result in the same profit or loss.

Margin is the capital that traders have to raise to open a new position. It is not a fee or cost, and it will be canceled again when the transaction is terminated. The purpose is to protect brokers from losses. If the traders margin falls below a predefined stop-out percentage due to loss, one or all open positions are automatically closed by the broker. The margin call warning from the broker is a warning message that additional deposits are needed in the transaction account to prevent the shortage of evidence needed to maintain the open position.

How leverage and margin works.

With 100:1 leverage, merchants can open positions 100 times larger than they can without leverage. For example, if the purchase cost of EUR/USDs 0.01 litres is generally $1000 and the broker offers 100:1 leverage, the trader must raise it to $100,000. Of course, merchants can use as little leverage as they want.

Caution: The higher the leverage, the higher the risk. Most experts use very low leverage ratios or do not use them at all and use the appropriate risk ratio per transaction.

For more information on leverage, please read the article on what leverage is and how to use it in Forex.

Use a convenient foreign exchange margin calculator to calculate margin requirements based on transaction size and leverage.