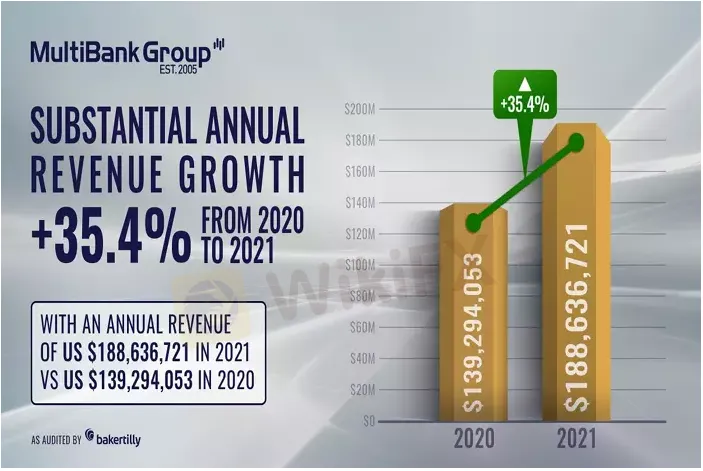

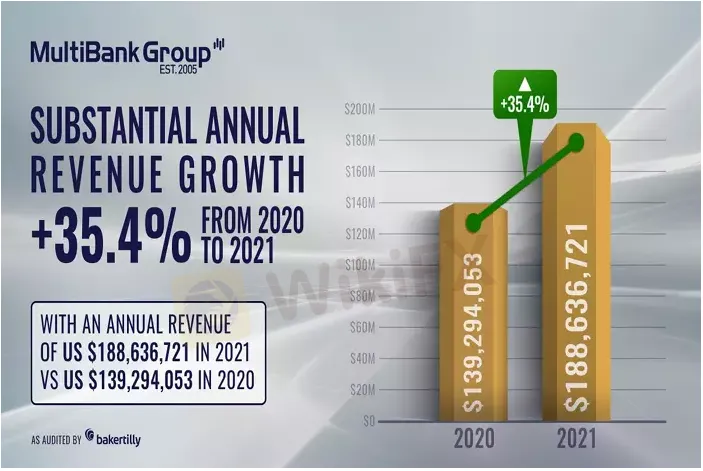

Abstract:With a Daily Turnover of over US$ 12.1 Billion and annual revenue of US$ 189 million.

The award-winning financial services group announced a record turnover of over US$ 12.1 Billion per day, with a record annual revenue of approximately USD $ 189 million in FY 2021. This was an impressive 35.4% increase from 2020s results, marking a record-breaking year for the global giant.

MultiBank Group, established in 2005, has an unparalleled and unblemished regulatory record, with over 11 financial regulators and over 25 branches worldwide.

The Group is strategically focused on developing and investing in advanced trading technologies. Currently, MultiBank Group is in the latest stages of launching a digital assets exchange fully regulated in Australia, which aims to be the worlds first cross-asset ecosystem to bridge the gap between traditional and alternative finance.

Multibank Founder and Chairman Naser Taher, who in 2022 was awarded as one of the 50 Most Influential Financial Figures in Global Financial Markets, further stated:

2021 was a monumental year for MultiBank Group, and I am proud of these record-breaking financial figures. Moreover, I am proud to announce that the number of users on our platforms has surpassed over 1 million by the end of the second quarter of 2022. These results are a testament to our commitment to providing our valued customers with advanced, reliable platforms and first-class customer service provided by our over 600 staff globally.

These achievements give us continued motivation to increase our investment in our technology and regulatory infrastructure for the benefit of traders worldwide in general and our valued clients in particular. We have high hopes for the second half of 2022 and plan to launch further projects which will fortify our position as a global leader in the market.

About MultiBank Group:

MultiBank Group was established in California, USA, in 2005. It boasts a daily trading volume of over US $12.1 billion and services an extensive client base of over 1,000,000 customers across 100 countries. Since its launch, MultiBank Group has evolved into one of the largest online financial derivatives providers worldwide, offering brokerage services and asset management.

The group offers its valued customers award-winning trading platforms, with up to a 500:1 leverage on products including Shares, Commodities, Indices, Digital Assets, Metals, and Foreign Exchange.